Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today’s focus is on Antique Barometers. (See the Tangibles Investing section.)

Precious Metals:

Wow! On Friday morning, spot gold spiked to near $1,300 USD per Troy ounce: Gold Solidly Up, At Session High, As USDX Hits Daily Low. Gold closed at $1302.60 on Friday. All eyes will be on spot gold, on Monday morning.

o o o

Palladium Is Now The Most Valuable Precious Metal

Global Economy:

Big Exporters are Losing It: US Manufacturing Gains. Germany, Japan, China not so Lucky

o o o

Next, at Wolf Street: Record Defaults by Chinese Companies: Fake “Cash” & Fake Accounting

o o o

As Investors Flee Australia’s Housing Bust, Sales of New Houses Plunge to Record Low. JWR’s Comment: Many markets in the English-speaking world tend to move in harmony. Consider yourself warned.

Stocks:

Michael Bryant, over at Seeking Alpha: Prepare For A Deep Recession And Bear Market

o o o

S&P 500 Earnings Are Still Too High – Here’s Why The Market Will Re-Adjust

o o o

A Fragile Economy:

Reader H.L. sent us this: Government shutdown exposes a harsh truth: Most Americans are unprepared for the next recession

o o o

Uh Oh – Food Stamp Money Will Run Out By The End Of January If The Government Shutdown Lasts That Long. JWR’s Comment: America is always three missed meals away from a riot.

o o o

At Investment Watch: The 27 Cities With a Mortgage Problem. Here is a snippet from Harry Dent: “I would never have thought this many major cities would have 11%-plus mortgages underwater… especially not at the top of a second real estate bubble.”

Cryptos:

Dark Web Hacker Proves Leak of Customer Data From World’s Leading Cryptocurrency Exchanges

o o o

Could This Crypto Ransomware Cripple China’s Bitcoin Mining Industry?

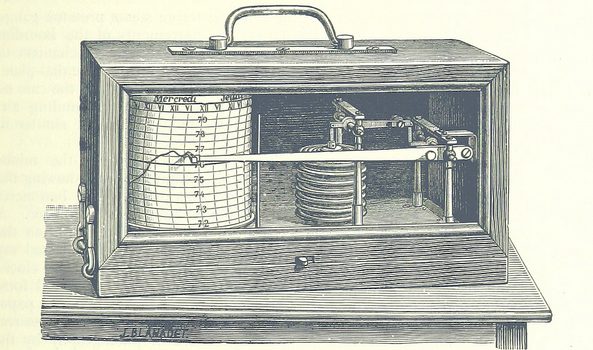

Tangibles Investing (Antique Barometers):

Scientific instruments are an often overlooked niche in the tangibles investing world. Of particular note are antique barometers. They are often sought after because they are both functional and decorative pieces. Preppers look for them because there may come a day when you won’t be able to just click on Weather.com for a detailed forecast. In a world without grid power, the Internet, and the National Weather Service, it will all be up to you.

As with all other scientific instruments, when looking for an antique barometer, condition is everything. It must be fully functional and cosmetically as close to perfect as possible. But on the very low end of the market, if you find a large antique barometer with a broken dial for a giveaway price at a thrift store, then what you’ll be buying is a large sealed container of mercury of as much as 1/2 pound! That can be re-sold for a pretty penny, on eBay or Craigslist. Given the high UPS HazMat fee, it is better to sell it locally, face to face. On wholesale markets, undistilled mercury presently sells for a bit under $9 per pound. But on the consumer/scientific market, distilled mercury is worth $100+ per pound. Just be sure to take the appropriate safety precautions and NEVER spill mercury in your home, or you will be breathing the nerve-damaging vapors for the rest of your life.

Bottom line: You should look for antique barometers that are either as close to perfect as possible, or that are badly broken but still containing an intact cylinder of mercury.

o o o

Reader DSV suggested this AP news story: Political shifts, sales slump cast shadow over gun industry. JWR’s Comment: Buy low and sell high. This is the low, folks. Stack you guns and magazines deep, while they are priced at rock bottom. In just a couple of years the thought of being able to buy a decent AR for $375 will seem like a fantasy.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often get the scoop on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!

A great resource for what is going on in firearms is Tom Gresham’s Gun Talk radio show which is broadcasted on Sundays or by podcast.

It is plumb scarry how many people depend on government for money.

When you factor in government contracts just about everyone is dependent on the government for some of their money. While Amazon certainly sells a lot commercially they also have big government contracts that according to some articles I have read, keep them in the black. Boeing same. Name most any big company, same. When I was an iron worker, the big jobs at the Air Force bases were the big paydays in the region I lived in. And that was small business.

When you factor in the ripple effect, it is quite scary. That framer building residential houses, may be framing up a government worker’s or government contractor’s house. That same framer then goes for beer with some of that money and gives it to the bar owner and server who at first glance have no connection to the government. And it goes on and on.

IMO the whole economy is addicted to government spending and debt. Even those people who think they are not. By and large this is no fault of there own. It just is.

Even in the Redoubt region, take away the BLM, Forestry Service, Army Corps of Engineers, Air Force and even Navy personnel (big contingent at Lake Pend Oreille) and see what happens to the region. Especially since the logging and mining industries are no longer what they were years ago. Will that dairy farm on the edge of town survive? Will the creamery in town that all the dairy farms support even survive. Will the town survive?

Why this scares me is that the trajectory of government debt means that eventually the reset button will be pushed on it. Few politicians are acknowledging it. Rand Paul is the only one I can think of off the top of my head but I am sure there are a few more. And I have not seen one plan that would solve the disaster without just ripping out a big chunk of the economy without giving it time to adapt and replace the government money with private. Bowles Simpson was close but it was dead on arrival. The sequester was helping but it is gone.

It is like a cancer with tentacles reaching out entangling healthy organs. It has to go but ripping it out fast will destroy the health organs and kill the patient. The cancer has to shrink before it can be removed safely. And currently no one is trying to kill it at all.

Re: US manufacturing. Gerald Celente is pretty savvy predicting trends in global financial markets. As Celente stated, ‘The business of China is business. The business of America is war’.

Search for images of the Shanghai shipping port and you will see thousands of CONEX shipping containers full of exports. Even the containers themselves are exports know as ‘1-trippers’. Trust me, Montana is full of them. Search American ports and you’ll see tanks and Humvees.

Australia hasn’t had a recession in 25 years. Seems all those natural resources sold to China have been paying off. China is now slowing. Australia may be more tied to China than English speaking economies.

How far do we go until we see some kind of fracturing in china? Seems like when you control every aspect of an economy you can tell everyone its noon but when you look out your window its pitch black. How long can that last?