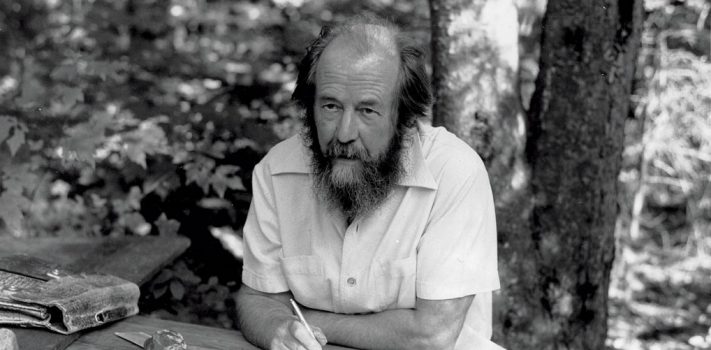

“You only have power over people as long as you don’t take everything away from them. But when you’ve robbed a man of everything he’s no longer in your power—he’s free again.” – Aleksander Solzhenitsyn, from The First Circle, 1968, Chapter 17

- Ad LifeSaver 20K JerryCan Water PurifierThe best water jerrycan you can buy on the market! Mention Survivalblog for a Free Filter ($130 Value)

- Ad Civil Defense ManualClick Here --> The Civil Defense Manual... The A to Z of survival. Looks what's in it... https://civildefensemanual.com/whats-in-the-civil-defense-manual/

Preparedness Notes for Tuesday — May 13, 2025

On May 13, 1916, the Lafayette Escadrille, an American aviation unit under French command comprised of volunteers to fight for France, saw its first combat at the Battle of Verdun.

—

May 13th is also the birthday of firearms engineer Theodor Koch (born 1905, died 1976.) Koch, along with Edmund Heckler and Alex Seidel salvaged tooling from the bombed-out Mauser factory at Oberndorf, and with it founded Heckler und Koch.

—

We are pleased to welcome our newest text advertiser, the Stakeholder Prepping Podcast. Fascinating stuff with some expert advice. Listen in! – JWR

—

SurvivalBlog Writing Contest

Today we present another entry for Round 118 of the SurvivalBlog non-fiction writing contest. The prizes for this round include:

First Prize:

- The photovoltaic power specialists at Quantum Harvest LLC are providing a store-wide 10% off coupon. Depending on the model chosen, this could be worth more than $2,000.

- A Gunsite Academy Three Day Course Certificate. This can be used for any of their one, two, or three-day course (a $1,095 value),

- A Peak Refuel “Wasatch Pack” variety of 60 servings of premium freeze-dried breakfasts and dinners in individual meal pouches — a whopping 21,970 calories, all made and packaged in the USA — courtesy of Ready Made Resources (a $350 value),

- American Gunsmithing Institute (AGI) is providing a $300 certificate good towards any of their DVD training courses. Their course catalog now includes their latest Survival Gunsmithing course.

- HSM Ammunition in Montana is providing a $350 gift certificate. The certificate can be used for any of their products.

Second Prize:

- A SIRT STIC AR-15/M4 Laser Training Package, courtesy of Next Level Training, that has a combined retail value of $679

- Two 1,000-foot spools of full mil-spec U.S.-made 750 paracord (in-stock colors only) from TOUGHGRID.com (a $287 value).

- Two sets of The Civil Defense Manual, (in two volumes) — a $193 value — kindly donated by the author, Jack Lawson.

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun. There is no paperwork required for delivery of pre-1899 guns into most states, making them the last bastion of gun purchasing privacy!

Third Prize:

- A Berkey Light water filter, courtesy of USA Berkey Filters (a $305 value),

- 3Vgear.com is providing an ultimate bug-out bag bundle that includes their 3-day Paratus Bag, a Posse EDC Sling Pack, and a Velox II Tactical Backpack. This prize package has a $289 retail value.

- A $200 credit from Military Surplus LLC that can be applied to purchase and/or shipping costs for any of their in-stock merchandise, including full mil-spec ammo cans, Rothco clothing and field gear, backpacks, optics, compact solar panels, first aid kits, and more.

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun.

—

More than $950,000 worth of prizes have been awarded since we started running this contest. Round 118 ends on May 31st, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging. In 2023, we polled blog readers, asking for suggested article topics. Please refer to that poll if you haven’t yet chosen an article topic.

- Ad Ready Made Resources, Trijicon Hunter Mk2$2000 off MSRP, Brand New in the case

- Ad Click Here --> Civil Defense ManualNOW BACK IN STOCK How to protect, you, your family, friends and neighborhood in coming times of civil unrest… and much more!

Communications Options for the Common Man – Part 1, by Tunnel Rabbit

We live in uncertain times where tens of millions of foreign invaders comprised largely of military-aged males have recently and in organized fashion crossed our borders. They were assisted by U.S. government-funded NGOs south of the border. We certainly should wonder about their intent. And there are many other significant threats that we should be concerned with particularly as the world is rapidly becoming unstable, both economically and geopolitically.

At some point in the near future, World War 3 will break out and the economy at home will suffer greatly, causing riots in the streets that would further destabilize this country and foment a communist-styled insurrection. With tens of millions of foreigners who have not assimilated, and who are mostly supported by our social welfare system, we are sitting on a ticking time bomb. And there are other plausible scenarios as well. Expect the unexpected, and we will not be disappointed.Continue reading“Communications Options for the Common Man – Part 1, by Tunnel Rabbit”

- Ad Trekker Water Station 1Gal Per MinuteCall us if you have Questions 800-627-3809

- Ad Survival RealtyFind your secure and sustainable home. The leading marketplace for rural, remote, and off-grid properties worldwide. Affordable ads. No commissions are charged!

SurvivalBlog’s News From The American Redoubt

This weekly column features news stories and event announcements from around the American Redoubt region. (Idaho, Montana, eastern Oregon, eastern Washington, and Wyoming.) Much of the region is also more commonly known as The Inland Northwest. We also mention companies located in the American Redoubt region that are of interest to preppers and survivalists. Today, news about a bison goring incident at Yellowstone. (See the Wyoming section.)

Idaho

Idaho Army National Guard’s 116th to transition from armored to mobile combat team.

o o o

Young man arrested with Meridian Police officer’s knee on his neck is found guilty. JWR’s Comment: Watching the video, it is apparent that excessive force was used when the officer lost his temper. He should have been denied Qualified Immunity.

o o o

(Video) Exploring Idaho: A journey beneath the surface.

o o o

‘I refuse to live my life in fear’: Elizabeth Smart addresses recent Wanda Barzee arrest.

Continue reading“SurvivalBlog’s News From The American Redoubt “

- Ad Lessons From the Rhodesian Bush War: A Study in Survival, Rural Defense, and CollapseDrawn from a real guerrilla war, learn what a modern collapse in a rural area might look like. Hard lessons on security, farms, patrols, and attacks from Africa for SHTF.

- Ad California Legal Rifles & Pistols!WBT makes all popular rifles compliant for your restrictive state. Choose from a wide range of top brands made compliant for your state.

The Editors’ Quote of the Day:

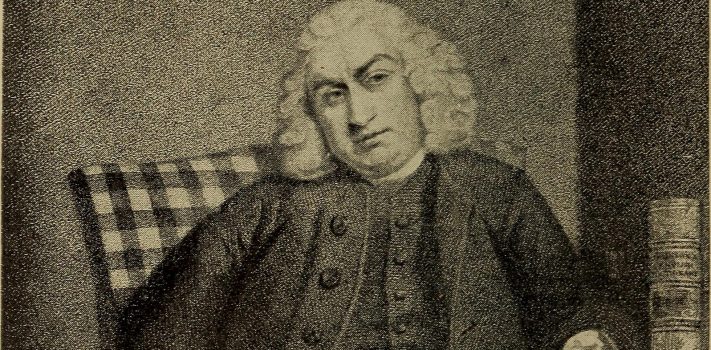

“If a sovereign oppresses his people to a great degree, they will rise and cut off his head. There

is a remedy in human nature against tyranny, that will keep us safe under every form of

government.” – Samuel Jonson

- Ad USA Berkey Water Filters - Start Drinking Purified Water Today!#1 Trusted Gravity Water Purification System! Start Drinking Purified Water now with a Berkey water filtration system. Find systems, replacement filters, parts and more here.

- Ad USA Berkey Water Filters - Start Drinking Purified Water Today!#1 Trusted Gravity Water Purification System! Start Drinking Purified Water now with a Berkey water filtration system. Find systems, replacement filters, parts and more here.

Preparedness Notes for Monday — May 12, 2025

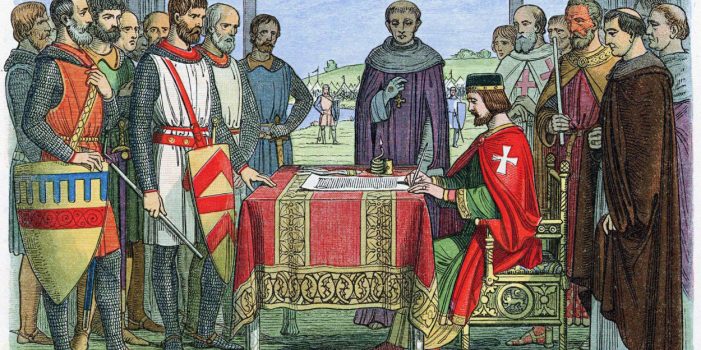

On May 12, 1215, English barons served an ultimatum on King John. This eventually led to the creation and signing of the Magna Carta. (Pictured.)

—

On May 12, 1921 a lengthy solar storm began, dubbed The Great Geomagnetic Storm of May 1921.

—

And on May 12, 1926, the Airship Norge became the first vessel to fly over North Pole, led by Norwegian explorer Roald Amundsen and piloted by the craft’s Italian designer Umberto Nobile.

—

The Sale Ends Tonight! The special 10-day sale on all the Elk Creek Company percussion gun inventory ends tonight at Midnight, Eastern Time. Most of these are revolvers for which cartridge conversion cylinders are readily available. This includes a group of minty Ruger Old Army revolvers (now just five left) that I’ve not yet photographed. Many of those are “Pre-Warning” vintage. We also have special pricing on all of our blackpowder hunting rifles. Most of those are .50 caliber rifles in the quite practical Hawken configuration. Take a look at our Percussion category.

—

We need a few more entries for Round 118 of the SurvivalBlog non-fiction writing contest. More than $950,000 worth of prizes have been awarded since we started running this contest. Round 118 ends on May 31st, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging. In 2023, we polled blog readers, asking for suggested article topics. Please refer to that poll if you haven’t yet chosen an article topic.

- Ad SIEGE belts: The essential go-anywhere GRAY MAN accessory. Solid 5.5-7 oz of persuasive power has saved many on their daily routines & travels. Revered "Thousand-Year Buckles" with stunning hand-crafted finishes. Complements CCW. Lear more..SIEGE STOVES: the ultimate high-performance portable survival stove. SIEGE BELTS: Use code "SBLOG" at checkout for $20 off any belt & be ready! Gifts that will last lifetimes.

- Ad STRATEGIC RELOCATION REALTYFOR SALE: Self-sustaining Rural Property situated meticulously in serene locales distant from densely populated sanctuary cities. Remember…HISTORY Favors the PREPARED!

ALPS Evolution Merino 150 Long Sleeve Shirt, by Thomas Christianson

Made of 100% superfine Merino wool, the ALPS Evolution 150 long-sleeve shirt is the most comfortable woolen garment in my wardrobe. It is also one of the most versatile garments that I own. The fabric is thin and breathable enough to be worn in summer, when it can provide 50+ UPF of protection from the sun. When used with a number of other layers in cooler weather, the shirt helps to hold body heat in while allowing moisture to escape.

The fabric from which the shirt is made is naturally odor resistant and dries quickly after washing. Its “riverstone” color blends well with natural backgrounds, making it well suited for pursuits that benefit from low visibility such as waterfowl hunting or bird watching.

With a price at the time of this writing of $59.99 at https://alpsmountaineering.com , the shirt is not inexpensive, but it represents a good value for the money. There is also a short sleeve version of the shirt available for $49.99. Sadly, as i discovered, they are made in mainland China.Continue reading“ALPS Evolution Merino 150 Long Sleeve Shirt, by Thomas Christianson”

Recipe of the Week: Zesty Corn-From-The-Cob

The following recipe for Zesty Corn-From-The-Cob is from SurvivalBlog reader F.C..

Ingredients

- Sweet Cob Corn, Boiled

- Olive Oil

- Lime Juice

- Red Onion or Walla Walla Sweet Onion, Chopped

- Cilantro, Chopped

- Hot Sauce (Optional)

- Black Pepper, Ground Optional)

Directions

Just cut the kernels off of boiled sweet corn, then toss them with a light coat of olive oil, lime juice, some chopped cilantro, some chopped Red or Walla Walla Sweet onion, and optionally add a dash of hot sauce and/or a light sprinkle of black pepper. Make all of the ingredient proportions suit your taste.

SERVING

Serve it hot or cold.

—

Do you have a well-tested recipe that would be of interest to SurvivalBlog readers? In this weekly recipe column, we place emphasis on recipes that use long-term storage foods, recipes for wild game, dutch oven recipes, slow cooker recipes, and any recipes that use home garden produce. If you have any favorite recipes, then please send them via e-mail. Thanks!

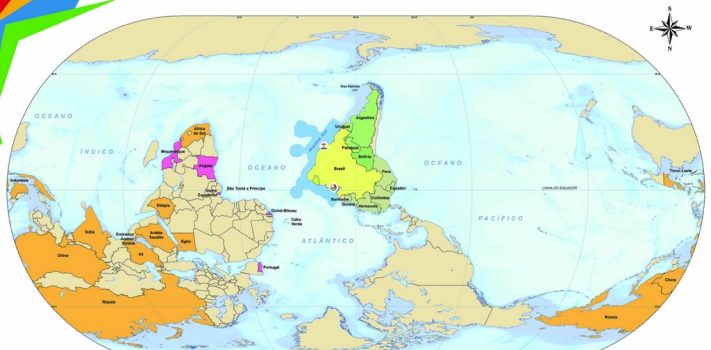

SurvivalBlog Graphic of the Week

Today’s graphic: A world map, as issued by the government of Brazil. (Graphic courtesy of Reddit.)

The thumbnail below is click-expandable.

—

Please send your graphics or graphics links to JWR. (Either via e-mail or via our Contact form.) Any graphics that you send must either be your own creation or uncopyrighted.

The Editors’ Quote of the Day:

“It is a popular delusion that the government wastes vast amounts of money through inefficiency and sloth. Enormous effort and elaborate planning are required to waste this much money.” – P.J. O’Rourke

Preparedness Notes for Sunday — May 11, 2025

On May 11, 1310, Fifty-four members of the Knights Templar were burned at the stake in France after being declared heretics.

—

May 11, 1752: The first US fire insurance policy was issued, in Philadelphia.

—

Just One Day Left! The special 10-day sale on all the Elk Creek Company percussion gun inventory ends tomorrow night. Most of these are revolvers for which cartridge conversion cylinders are readily available. This includes a group of five minty Ruger Old Army revolvers that I’ve not yet photographed. Many of those are “Pre-Warning” vintage. We also have special pricing on all of our blackpowder hunting rifles. Most of those are .50 caliber rifles in the quite practical Hawken configuration. Take a look at our Percussion category.

—

Today, with permission, we are re-posting a recent piece from the excellent Rural Revolution blog. The blog’s Editrix is Patrice Lewis. You may recognize her name from her novels, or from her nonfiction book “The Simplicity Primer: 365 Ideas for Making Life more Livable“, or from her many columns written in her 17 years with WorldNetDaily.

—

We are in need of entries for Round 118 of the SurvivalBlog non-fiction writing contest. More than $950,000 worth of prizes have been awarded since we started running this contest. Round 118 ends on May 31st, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging. In 2023, we polled blog readers, asking for suggested article topics. Please refer to that poll if you haven’t yet chosen an article topic.

Field Fencing: Subdividing the Pasture, by Patrice Lewis

Editor’s Introductory Note: This article is a guest post by our long-time friend and fellow blogger, Patrice Lewis. After first living in Oregon (from 1992 to 2003), Don and Patrice Lewis bought a ranch south of Coeur d’Alene, Idaho, and genuinely pursued a self-sufficient lifestyle. After their lovely homeschooled daughters both reached the “up and out” age, they moved again. This time it was to an undisclosed location elsewhere in North Idaho, ostensibly to slow down and lead a more sedate life. But, as irrepressible gardeners and dairy cattle ranchers, they’ve found themselves busier than ever. I highly recommend bookmarking the Rural Revolution blog, and delving through its extensive archives, which date back to 2009. – JWR

—

A task we’ve been wanting to accomplish since getting the cows is to subdivide the larger pasture. With fairly small acreage compared to our last place, it’s important that we don’t let anything get overgrazed, and having subdivided pastures allows us to rotate the animals frequently.

With that in mind, we gathered everything we needed. Thankfully, we weren’t faced with anything nearly as complex and difficult as fencing in the sacrifice pasture. In fact, we could bring all the heavy items (T-posts, roll of [woven wire field] fencing, T-post pounders, etc.) in the bucket of the tractor. We unloaded everything and got ready to run a string.Continue reading“Field Fencing: Subdividing the Pasture, by Patrice Lewis”

With that in mind, we gathered everything we needed. Thankfully, we weren’t faced with anything nearly as complex and difficult as fencing in the sacrifice pasture. In fact, we could bring all the heavy items (T-posts, roll of [woven wire field] fencing, T-post pounders, etc.) in the bucket of the tractor. We unloaded everything and got ready to run a string.Continue reading“Field Fencing: Subdividing the Pasture, by Patrice Lewis”

JWR’s Meme Of The Week:

The latest meme created by JWR:

Meme Text:

Dr. Stephen Hawking’s Visit to Epstein’s Island Has Prompted The Creation Of A New Legal Term: Nerdacious Moral Derpitude

Some Related Links:

- What Unsealed Jeffrey Epstein Documents Say About Stephen Hawking.

- Legal Defintion of Moral Turpitude.

- Pam Bondi dismisses claim Epstein info is missing and defends delays in releasing files

- Pam Bondi Changes Her Tune After Covert Recording.

Notes From JWR: Do you have a meme idea? Just e-mail me the concept, and I’ll try to assemble it. And if it is posted then I’ll give you credit. Thanks!

Permission to repost memes that I’ve created is granted, provided that credit to SurvivalBlog.com is included.

The Editors’ Quote of the Day:

“Brethren, my heart’s desire and prayer to God for Israel is, that they might be saved.

For I bear them record that they have a zeal of God, but not according to knowledge.

For they being ignorant of God’s righteousness, and going about to establish their own righteousness, have not submitted themselves unto the righteousness of God.

For Christ is the end of the law for righteousness to every one that believeth.

For Moses describeth the righteousness which is of the law, That the man which doeth those things shall live by them.

But the righteousness which is of faith speaketh on this wise, Say not in thine heart, Who shall ascend into heaven? (that is, to bring Christ down from above:)

Or, Who shall descend into the deep? (that is, to bring up Christ again from the dead.)

But what saith it? The word is nigh thee, even in thy mouth, and in thy heart: that is, the word of faith, which we preach;

That if thou shalt confess with thy mouth the Lord Jesus, and shalt believe in thine heart that God hath raised him from the dead, thou shalt be saved.” – Romans 10:1-9 (KJV)

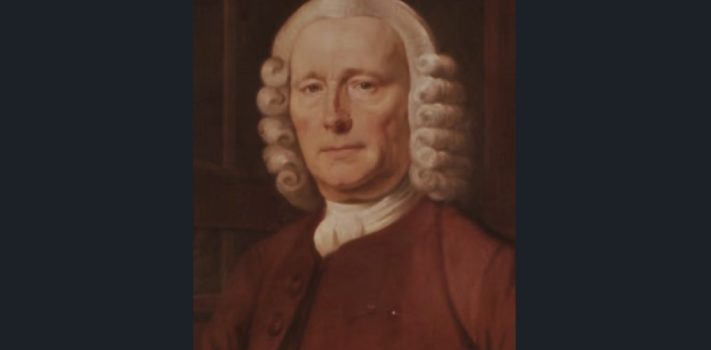

Preparedness Notes for Saturday — May 10, 2025

On May 10, 1765, per the British Longitude Act, clockmaker John Harrison was awarded £10,000 for the invention of a practical naval longitude clock. Latitude calculations had been made for hundreds of years with sextants, but the Longitude Problem was finally solved only by Harrison’s invention of a precision clock that could keep accurate time for many months. This ushered in the era of relatively precise modern maritime navigation.

—

May 10th is the birthday of the late Col. Jeff Cooper (born 1920, died September 25, 2006).

—

May 10th is also the birthday of the late Janis Pinups (born 1925, died 15 June 2007). He was one of the last of the active Forest Brothers anti-communist resistance fighters. He came out of hiding, after five decades, to obtain a Latvian passport in 1994, after the collapse of eastern European communism. (He was never issued any communist government identity papers and by necessity lived as a nonexistent ghost during the entire Soviet occupation of Latvia.) The history of the Forest Brothers movement certainly deserves more recognition.

—

Today’s feature article is a guest piece by global affairs analyst Brandon Smith, the publisher of the highly-recommended Alt-Market.us blog.

—

We are in need of a few more entries to have a full roster for Round 118 of the SurvivalBlog non-fiction writing contest. More than $950,000 worth of prizes have been awarded since we started running this contest. Round 118 ends on May 31st, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging. In 2023, we polled blog readers, asking for suggested article topics. Please refer to that poll if you haven’t yet chosen an article topic.