Here are the latest items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on investing in odd silver coins. (See the Tangibles Investing section, near the end of this column.)

Stocks:

The tumble in the U.S. stock markets (down 10% since January 26, 2018) is partly attributable to the business cycle, and partly attributable to the Fed raising interest rates. (Ironically, the Fed Governors claim that they are “forced to raise rates” because higher inflation is emerging. But they are the ones who created the inflation!) With even higher interest rates forecast for the rest of 2018 and 2019, it is safe to assume that the equities markets will continue to get pounded.

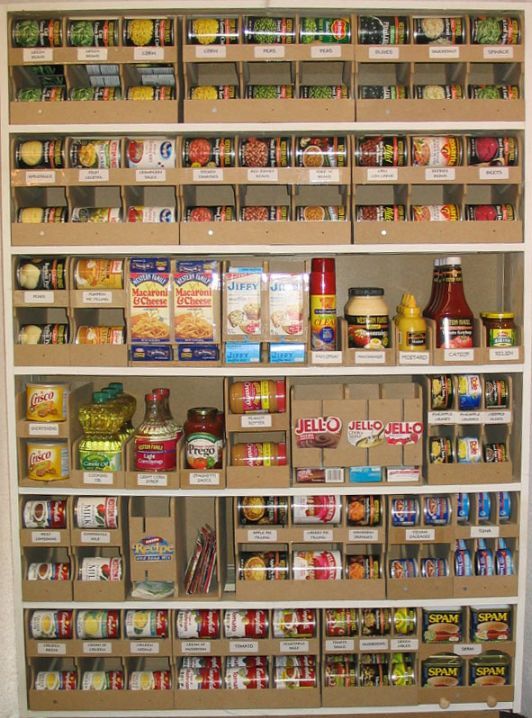

My advice is to minimize your exposure to stocks and mutual funds. Panic now, and beat the rush. For those of you who are enrolled in pension plans: good luck. Odds are that your pension fund managers have heavily invested in stocks. But if you are in a 401(k) plan or an IRA, then it is probably not too late to transition to a self-directed IRA. I suggest that you make that a silver-backed IRA. (IRAs backed by U.S. Mint Silver Eagles are allowable.) Ideally, you should hold that IRA silver at home. With silver now under $16.50 per Troy ounce, it is a sound, affordable alternative to stocks!

Going Cashless:

Commander Zero recently posted some astute observations in his Notes From The Bunker blog: Cashless society. JWR’s Comments: Those of us who share concerns about the advent of a cashless society should plan ahead. It is wise to start forging relationships with those who willing to serve as intermediaries for us, to make food and fuel purchases and to make tax payments for us. It is also crucial to invest heavily in silver coins, so that we’ll have something truly valued available for barter. Silver coins fill all of the requirements for a day-to-day barter money: They are fairly compact, durable, fungible, divisible, easily recognizable, and almost uniformly desirable.