Welcome to SurvivalBlog’s Precious Metals Month in Review, where we take a look at “the month that was” in precious metals. Each month, we cover gold’s performance and silver’s performance and examine the factors that affected the metal prices.

WHAT DID GOLD AND SILVER DO IN APRIL?

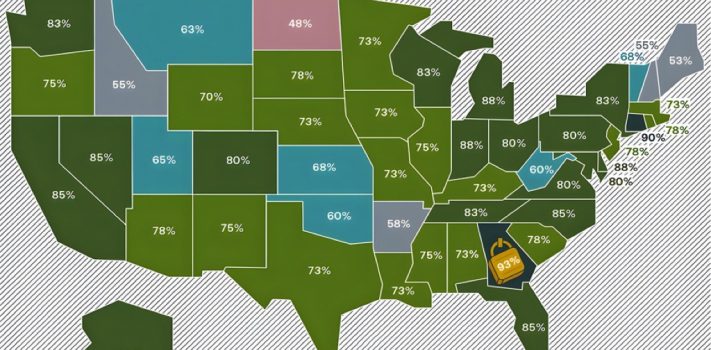

The prices of gold and silver diverged from one another during April. Their price ratio (GSR) is still at a five-year high above 100:1.

Both metals started the month off slowly. After two uneventful days, on Thursday, April 3rd gold slid 0.8% and silver tumbled $2.07 lower (-6.1%). Friday, April 4th was an even sharper decline as silver lost another $2.26 and gold fell 2.5% on the day to $3,037 per troy ounce.

The next week brought the first signs of the divergence that later became a trend. Spot gold tanked 1.8% lower on Monday, April 7th, yet somehow silver gained 45 cents to stay a hair above the $30/oz mark. All of the metals (including platinum, palladium, and copper) jumped higher on Wednesday, April 9th. Gold rallied nearly $100 on three consecutive days between the 9th and 11th, and spot silver saw two days that it rose over $1 during that stretch.

Wednesday, April 16th was the most volatile day of the month: the gold price surged 3.3%, yet silver added a modest 40 cents. This wasn’t gold’s peak yet; after trading sideways for a few days, the yellow metal gained another 2.8% to a new record high above $3,420/oz on Monday, April 21st. (Silver rose just 15 cents the same day.) When gold corrected 2.65% lower on Wednesday, April 23rd, silver was actually up nearly $1.10. This divergent price behavior between the two metals isn’t unheard of, but it’s nonetheless curious how many times it showed up recently.Continue reading“April, 2025 in Precious Metals, by Everett Millman”