Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at The Federal Reserve’s current repo market intervention. (See the Economy & Finance section.)

Economy & Finance:

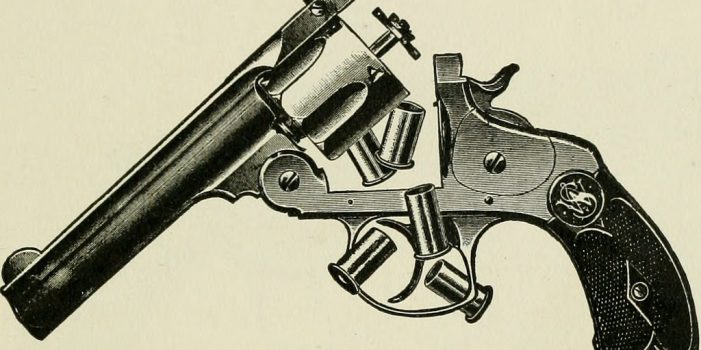

The Federal Reserve’s new repo market intervention–the so-called “Not QE”–now has them consistently buying $60 billion in Treasury bills every month. This is essentially a desperation move to prevent short term interest rates from rising. But inevitably this is like trying to stop a rising tide. It is a futile effort. The rising rates are symptomatic of a much larger problem: Sovereign debt that is so enormous that it can never be re-paid. The Fed’s “Not QE” shenanigans cannot go on forever. At some point interest rates will rise, and there will be either be sovereign debt defaults (unlikely) or there will be mass inflation. Be prepared or the latter, folks. It is wise to diversify into compact liquid tangibles. Think: Silver. Gold. Guns. Lots of guns. Old guns. New guns. Guns without paperwork.

o o o

New Google Checking Accounts Threaten to Shake Up Banking Industry

o o o

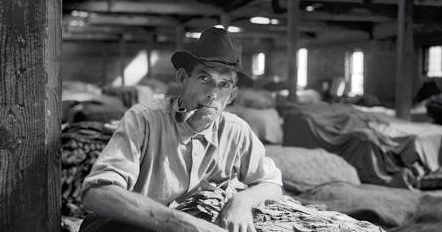

Farm bankruptcies increase nationwide, report says

o o o

At Wolf Street: Negative Interest Rates Bite: Bundesbank Warns of Risks to Financial Stability, Moody’s Downgrades Outlook for German Banks

o o o