May 5th is the birthday of Pat Frank (1908-1964). This was the pen name of newspaper journalist Harry Hart Frank. His novel Alas, Babylon is a survivalist classic. His personal life was marred by alcoholism, but his writing is admired and still surprisingly popular, today. (Alas, Babylon is still in print, after more than 50 years!) As an homage to Pat Frank, one of the settings in my novel Expatriates is Mt. Dora, Florida, which was fictionalized by Pat Frank as “Fort Repose” in Alas, Babylon.

- Ad California Legal Rifles & Pistols!WBT makes all popular rifles compliant for your restrictive state. Choose from a wide range of top brands made compliant for your state.

- Ad Survival RealtyFind your secure and sustainable home. The leading marketplace for rural, remote, and off-grid properties worldwide. Affordable ads. No commissions are charged!

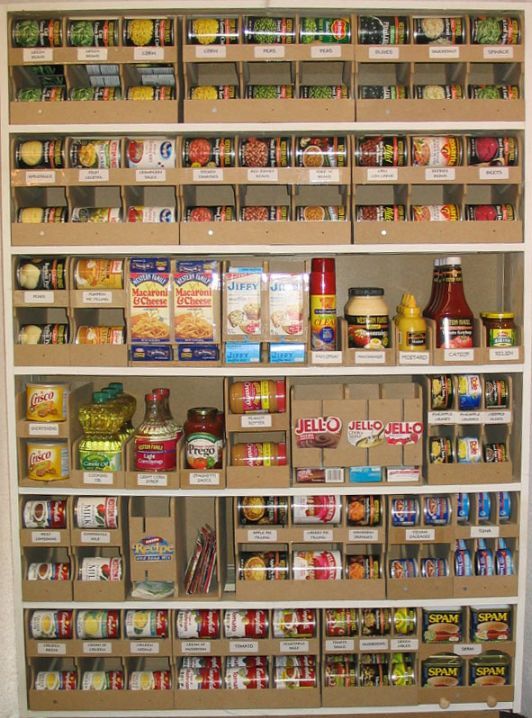

Learning Food Storage From Hard Experience, by PitbullRN

We all have our stories on how and why we got in to prepping. Mine began about seven years ago after reading One Second After, a 2009 novel by American writer William R. Forstchen. (I highly recommend this book, if you haven’t had the chance to read it!) It is about how life changes for a small western North Carolina town following the collapse of the grid due to an EMP. As a nurse who lives in Western North Carolina, this book interested me not only for the setting, but how people with chronic illnesses would suffer and die if cut off from their medication. I also lived through Hurricane Hugo as a newlywed without electricity for two weeks and remember the difficulties back then. I will never forget running a hose from a neighbor’s house to enable us to flush our toilets, since we had no power for our well pump!

I have been a Christian all my life, with a particular interest in the interpretation of the Book of Revelation and the end of times. Not to be morbid, but the older I became, the less sense the world made to me. I began to see the trajectory of our country and modern times was away from, not toward, our Father in Heaven. Fearing for my family, and truly wanting to be able to continue to care for the sick in hard times, I decided to become a prepper. This was not without repeated rolled eyes from my husband and children. My sister even commented to my mother that she thought it was a big mistake to put all the time, effort, and money into something that would never be needed. Fortunately for me, I had a cousin who has the same fears and beliefs. We combined efforts and shared our learning of new information, along with helpful web sites to school us along the way.

I learned how to “put up” or can foods. I bought the pressure cooker and the famous Ball Blue Book of Canning and Preserving. I dedicated one day a week to canning. An immediate benefit was that I found I could can things like stew, chicken pot pie filling, and chili which would help me put dinner on the table quickly after working a twelve-hour shift at the hospital. Soon I had amassed an impressive stockpile of canned entrees, soups and sauces. I went to farmers markets at the end of the summer, when tomatoes are abundant, to buy bulk quantities of tomatoes to can my own pasta sauce and tomatoes. This is so I won’t have to buy canned tomatoes any longer (more on that debacle later).Continue reading“Learning Food Storage From Hard Experience, by PitbullRN”

- Ad USA Berkey Water Filters - Start Drinking Purified Water Today!#1 Trusted Gravity Water Purification System! Start Drinking Purified Water now with a Berkey water filtration system. Find systems, replacement filters, parts and more here.

- Ad LifeSaver 20K JerryCan Water PurifierThe best water jerrycan you can buy on the market! Mention Survivalblog for a Free Filter ($130 Value)

SurvivalBlog’s News From The American Redoubt

This weekly column features news stories and event announcements from around the American Redoubt region. (Idaho, Montana, eastern Oregon, eastern Washington, and Wyoming.) Much of the region is also more commonly known as The Inland Northwest. We also mention companies of interest to preppers and survivalists that are located in the American Redoubt region. Today, we focus on another Grizzly bear attack. (See the Wyoming section.)

Region-Wide

In The Wall Street Journal: ‘Safe’ Becomes Rural Tourism Pitch to a Distancing Public. Here is a pericope:

“We’ve all been feeling a little empty. And alone,” a video for Travel Wyoming says, opening with a shot of Devils Tower national monument that cuts to rivers, meadows, the Teton Range and more of the state’s varied scenery. “It’s going to be a while before things get back to normal. But maybe a little more emptiness is what we need.”

Over at my #1 Son’s site: Find a Home in the American Redoubt

o o o

In case you missed seeing this tabloid newspaper series on the Redoubt movement back in 2018, I just found that it has been put all in one big downloadable file, over at ISSUU. Yes, there is some liberal bias in the article series, but it is still informative.

Idaho

Southern Idahoans Share Photos of a Powerful Thunderstorm

o o o

Lori Vallow Daybell to remain in jail on $1 million bail

o o o

I heard about an off-road Transit Van customizing shop in Post Falls, Idaho that does some amazing work: VanCompass. And here is a video that shows their crew at work: The best Van Life off-road lift kit install

Continue reading“SurvivalBlog’s News From The American Redoubt”

- Ad SIEGE belts: The essential go-anywhere GRAY MAN accessory. Solid 5.5 to 7 oz of persuasive power has saved many. Revered "Thousand-Year Buckles" with stunning hand-crafted finishes. Never go out/travel without one. Complements CCW. Lear more...SIEGE STOVES: prepare for the great outdoors with the ultimate portable survival stove. SIEGE BELTS have saved many: NEW: Use code "SBLOG" at checkout for $20 off any belt!

- Ad STRATEGIC RELOCATION REALTYFOR SALE: Self-sustaining Rural Property situated meticulously in serene locales distant from densely populated sanctuary cities. Remember…HISTORY Favors the PREPARED!

The Editors’ Quote of the Day:

“Emergencies have always been used as justifications to curb free speech in the name of keeping secrets, suppressing disloyalty, and aiding the war effort. While extreme measures may now seem warranted and urgent to help halt the contagion, a series of trends afoot pose serious risks for open expression, portending threats that are likely to endure long after the lockdown has lifted.

And many of these measures have less to do with public health than they do with protecting political and institutional reputations, and with trying to retake control of the devastating narrative of a pandemic that has fed on human failures of anticipation, preparation, and mobilization.” – Suzanne Nossel

- Ad Trekker Water Station 1Gal Per MinuteCall us if you have Questions 800-627-3809

- Ad Civil Defense ManualClick Here --> The Civil Defense Manual... The A to Z of survival. Looks what's in it... https://civildefensemanual.com/whats-in-the-civil-defense-manual/

Preparedness Notes for Monday — May 4, 2020

The pandemic hiatus is over! I’m pleased to announce that we’re again taking orders for Elk Creek Company. We now have more than 75 carefully hand-selected Federally exempt (no FFL required) antique cartridge guns available — rifles, pistols, and shotguns. They are all being sold “first come, first served.” We accept payments via credit card, and mail them right to your doorstep or post office box. (Consult your state and local laws, before ordering.)

Nearly all of these guns are shootable, and many of them are chambered in modern calibers. For example, take a look at a Winchester Model 1885 Low Wall made in 1887, but now chambered in .22 Hornet, and equipped with modern scope. And we have three Webley Mark I revolvers that were originally in .455 Eley, but that were altered to shoot .45 ACP cartridges. Similarly, we are also offering an antique Colt Single Action Army made in 1882 that was converted to .44 Special!

I should also mention that we’ve also now added just a few recent-production replica guns. These are chambered for obsolete cartridges such as .44 S&W Russian, and .45-90 Winchester. That puts these new guns in the Federally exempt “antique” category. Here is just one example: a Uberti S&W New Model 3 .44 Russian 7″ — Like New, No FFL! (Pictured above.)

One other special note: I’ve put very low sale prices on three percussion (muzzleloader) guns in the non-shootable “wall hanger” category. Take a look.

Since March, gun shows all across America have been cancelled or postponed because of the COVID-19 pandemic. But this is your chance to attend a virtual gun show and buy yourself a great no paperwork gun!

Note that I will be traveling again in the month of June, on a quest to replenish our inventory. We won’t be taking any orders from June 1st to July 1st. So be sure to get your order in soon. Thanks!

—

Today, we present a review written by our Field Gear Editor, Pat Cascio.

- Ad USA Berkey Water Filters - Start Drinking Purified Water Today!#1 Trusted Gravity Water Purification System! Start Drinking Purified Water now with a Berkey water filtration system. Find systems, replacement filters, parts and more here.

- Ad Ready Made Resources, Trijicon Hunter Mk2$2000 off MSRP, Brand New in the case

S&W Model 39-2, by Pat Cascio

I’m still getting some requests from our readers for more review articles on all-metal handguns, and any more, this is getting harder and harder to do. The trend has been, for the past 20+ years are polymer frame handguns. I must admit that, my small collection has fewer and fewer all-metal handguns, and more and more polymer-framed handguns. When the first Glock came out, it was called the Glock17, and even though the magazine capacity was 17-rounds, that’s not why it was called the 17, it was because it was the 17th patent issued to Gaston Glock. Even today, it can be very confusion on the Glock model numbers – guess you need a score card to keep up with all the various model numbers.

The first successful double-action/single-action handgun to be made was the Walther P.38 – and it came out in WW2, unfortunately, the Walther factory fell into the hands of the Nazis and they produced a lot of model P.38s during WW2, and those guns are still commanding big dollars, because of the Nazi markings on them. (Both the pre-war and post-war production guns do not have the Nazi Waffenampt markings.) About 35 years ago, when I lived in Colorado Springs, Colorado, there was a fairly new gun shop in town, which for some strange reason, always had German Lugers and Walther P.38 pistol for sale – and they all had Nazi Waffenampt markings on them. Someone who knew a heck of a lot more than I did, discovered that these two fellows were stamping their pre-war and post-war production guns with Nazi markings, making people believe they were buying Nazi Germany era-produced pistols. In short order, the BATF helped put these two fakers out of business.

Back to the Walther P.38, as I mentioned, was one of the first commercially made pistols that fired from both Double Action and the Single action modes. This meant that you could chamber a round, and de-cock the hammer – after that, the first shot was from the long trigger pull double action mode. All shots after that were in the single action mode – with a much shorter, lighter trigger pull. And, if you were done shooting, you could use the de-cocker to safely lower the hammer, and your next shot would be back to the long double action trigger pull mode. This was something that the Browning Hi-Power lacked. The P.38 de-cocker broke new ground in the gun world. Around 1949 or 1950 – records are conflicting on this — the U.S. Military was in the market for a 9mm Double-Action/Single-Action handgun to replace the grand ol’ Colt Government Model 1911. This is where Smith and Wesson entered into the competition, not that there was any real competition.

S&W came up with the Model 39, and it was a single stack 8-round 9mm pistol, with an Aluminum frame and it weighted in at about 28-ounces. This was ground-breaking at the time, a full-sized 9mm handgun, that was lightweight, and it fired the 9mm round – wow! In 1954 the military again expressed interest in the S&W Model 39. But by today’s standards, it was rather rough around the edges. At some later point, the military decided to stick with the 1911. In 1955, S&W released the Model 39 for public sales, and it really didn’t take off — at least not right away.

- Ad Click Here --> Civil Defense ManualNOW BACK IN STOCK How to protect, you, your family, friends and neighborhood in coming times of civil unrest… and much more!

- Add Your Link Here

Recipe of the Week: Braized Beef Brisket

The following Braized Beef Brisket recipe is from The New Butterick Cook Book, by Flora Rose, co-head of the School of Home Economics at Cornell University. It was published in 1924. A professional scan of that 724-page out-of-copyright book will be one of the bonus items in the next edition of the waterproof SurvivalBlog Archive USB stick. This 15th Anniversary Edition USB stick should be available for sale in the third week of January, 2021.

Ingredients

- 2 to 3 pounds brisket, or round of beef

- Drippings

- 2 tablespoons Butter or Butter substitute

- 1 chopped onion

- 1 chopped carrot

- 1 tablespoon chopped parsley

- 1/2 cup diced celery

- 1 cup canned tomatoes

- Salt and paprika, to taste

Directions

Cut the meat into cubes; brown in hot frying-pan with drippings.

Stir the meat so it will cook quickly and not lose its juices. Tender cuts can be cooked whole.

Remove the pieces to a closely covered kettle that can be used either on top of the range or in the oven.

Rinse the pan with a quarter cup of boiling water to save all browned bits, and pour this over the meat.

Cover tightly and cook slowly for two hours.

For the sauce, melt butter or butter substitute and brown the onion, and carrot in it. Add parsley, celery and tomatoes. Heat thoroughly. Add seasonings. Pour the sauce over the meat and continue cooking for another hour.

SERVING

Serve with side dishes of steamed asparagus, green beans, challah bread or rolls, butternut squash, or sweet potatoes.

—

Do you have a favorite recipe that would be of interest to SurvivalBlog readers? In this weekly recipe column we place emphasis on recipes that use long term storage foods, recipes for wild game, dutch oven and slow cooker recipes, and any that use home garden produce. If you have any favorite recipes, then please send them via e-mail. Thanks!

Economics & Investing For Preppers

Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at the shift in interest toward rural real estate. (See the Tangibles Investing section.)

Precious Metals:

o o o

What Caused The New York Vs. London Gold Price Spread And Why It Persists

Economy & Finance:

CNN reports: Americans are hoarding cash: Savings rate hits its highest level since 1981

o o o

Week 6 of the Collapse of the U.S. Labor Market

o o o

Video: 2020 HYPER-BUBBLE – Will it Meltdown, or Meltup? Mike Maloney

o o o

Here is one of the articles that Maloney mentioned: SUVs Get Parked in the Sea, Revealing Scope of U.S. Auto Market Glut

o o o

European Banks Reveal Scale & Complexity of Crisis. Shares Hammered Back to 1987 Level

The Editors’ Quote of the Day:

“Every collectivist revolution rides in on a Trojan horse of “emergency”. It was the tactic of Lenin, Hitler, and Mussolini. In the collectivist sweep over a dozen minor countries of Europe, it was the cry of men striving to get on horseback. And “emergency” became the justification of the subsequent steps. This technique of creating emergency is the greatest achievement that demagoguery attains.” – President Herbert Hoover

Preparedness Notes for Sunday — May 3, 2020

May 3rd, 1952 was the birthday of Pastor Chuck Baldwin. He has done yeoman service in promoting the American Redoubt movement.

—

SurvivalBlog Writing Contest

Today we present another entry for Round 88 of the SurvivalBlog non-fiction writing contest. The prizes for this round include:

First Prize:

- A gift certificate from Quantum Harvest LLC (up to a $2,200 value) good for 12% off the purchase of any of their sun-tracking models, and 10% off the purchase price of any of their other models.

- A Gunsite Academy Three Day Course Certificate. This can be used for any one, two, or three day course (a $1,095 value),

- A course certificate from onPoint Tactical for the prize winner’s choice of three-day civilian courses, excluding those restricted for military or government teams. Three day onPoint courses normally cost $795,

- DRD Tactical is providing a 5.56 NATO QD Billet upper. These have hammer forged, chrome-lined barrels and a hard case, to go with your own AR lower. It will allow any standard AR-type rifle to have a quick change barrel. This can be assembled in less than one minute without the use of any tools. It also provides a compact carry capability in a hard case or in 3-day pack (an $1,100 value),

- Two cases of Mountain House freeze-dried assorted entrees in #10 cans, courtesy of Ready Made Resources (a $350 value),

- A $250 gift certificate good for any product from Sunflower Ammo,

- American Gunsmithing Institute (AGI) is providing a $300 certificate good towards any of their DVD training courses.

Second Prize:

- A Front Sight Lifetime Diamond Membership, providing lifetime free training at any Front Sight Nevada course, with no limit on repeating classes. This prize is courtesy of a SurvivalBlog reader who prefers to be anonymous.

- A Glock form factor SIRT laser training pistol and a SIRT AR-15/M4 Laser Training Bolt, courtesy of Next Level Training, which have a combined retail value of $589,

- A Three-Day Deluxe Emergency Kit from Emergency Essentials (a $190 value),

- Two 1,000-foot spools of full mil-spec U.S.-made 750 paracord (in-stock colors only) from www.TOUGHGRID.com (a $240 value).

- An assortment of products along with a one hour consultation on health and wellness from Pruitt’s Tree Resin (a $265 value).

Third Prize:

- Three sets each of made-in-USA regular and wide-mouth reusable canning lids. (This is a total of 300 lids and 600 gaskets.) This prize is courtesy of Harvest Guard (a $270 value)

- A Royal Berkey water filter, courtesy of Directive 21 (a $275 value),

- Naturally Cozy is donating a “Prepper Pack” Menstrual Kit. This kit contains 18 pads and it comes vacuum sealed for long term storage or slips easily into a bugout bag. The value of this kit is $220.

- Two Super Survival Pack seed collections, a $150 value, courtesy of Seed for Security, LLC,

- A transferable $100 purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun. There is no paperwork required for delivery of pre-1899 guns into most states, making them the last bastion of firearms purchasing privacy!

Round 88 ends on May 31st, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how to” skills for survival have an advantage in the judging.

Home Water Storage on a Budget, by KC Seven

There is really no reason why one can’t store a considerable amount of water. If you have access to food grade containers and some potable water from the tap or better, a modest water filter, then one can store copious amounts of water. It just takes a little time.

We are retired and living that “fixed income” lifestyle. Fortunately, we learned to prepare at a fairly early age and spent a little time to store important tools and supplies when we could afford to do so. Then, later in our careers, we found ourselves acquiring a broader array of tools and supplies, most in duplicate and triplicate. We often reflect on how God has been so good to us and continues to bless us in our leaner years. But we do have to discipline ourselves with respect our budget. If you are like us, limited on funds, then you may find this useful.

Living on a lake and having acquired filtration tools I thought little of going down to lake to draw water. Okay, although we’re 70 feet away, we are a couple hundred feet in elevation higher. That makes a direct hike unlikely and leaves us a half mile walk using a gentler grade. Now that I am old and a little crippled with age, the grade that I would need to scale is getting less desirable. In fact I think that in tough times I could succumb to the challenge.

Some types of Schumer Hits The Fan (SHTF) events for which we would be planning might leave us with contaminated water or a disabled municipal water supply. So, for what reason would I store water, except the obvious for human consumption? With absence of abundant water (and for several other reasons) could come a spike in bacterial infection and viral spread as a result of a lack of human or societal hygiene. A topic on everyone’s mind during the COVID-19 panic. Not to mention a dozen other day-to-day uses. Just think about what you are using water for every time you go to a faucet. It’s not hard to imagine a dozen uses for this precious resource.Continue reading“Home Water Storage on a Budget, by KC Seven”

The Survivalist’s Odds ‘n Sods

SurvivalBlog presents another edition of The Survivalist’s Odds ‘n Sods— a collection of news bits and pieces that are relevant to the modern survivalist and prepper from “JWR”. Our goal is to educate our readers, to help them to recognize emerging threats and to be better prepared for both disasters and negative societal trends. You can’t mitigate a risk if you haven’t first identified a risk. Today, we look at understaffing and reduced production at meat packing plants.

Will Democrats Who Flee Cities Take City Values with Them?

The latest from commentator Bill Whittle: Political Pandemic: Will Democrats Who Flee Cities Take City Values with Them?

New Yorkers Who’ve Fled and Vow to Never Return

Over at The New York Post: Meet the New Yorkers who fled coronavirus in the city – and vow to never return. JWR’s Comment: I suppose that I need to add the term “The Platinum Horde” to my lexicon. 🙂

Meat Packing Plants Suffer Lower Production Rates

As Meat Plants Slow, U.S. to Help Cull Livestock

A.K. sent this: As meat plants slow, U.S. will help growers kill livestock. A snippet:

“The National Pork Board held a webinar on Sunday that discussed step by step “emergency depopulation and disposal” of hogs.

Producers have warned since mid-March of a potentially ruinous backup on the farm of cattle and hogs because of a slowdown at slaughter plants. Hog farmers may be in the worse situation because hogs typically reach slaughter weight of around 250 pounds in five or six months from birth and cannot easily be held from market.”

The Editors’ Quote of the Day:

“I therefore, the prisoner of the Lord, beseech you that ye walk worthy of the vocation wherewith ye are called,

With all lowliness and meekness, with longsuffering, forbearing one another in love;

Endeavouring to keep the unity of the Spirit in the bond of peace.

There is one body, and one Spirit, even as ye are called in one hope of your calling;

One Lord, one faith, one baptism,

One God and Father of all, who is above all, and through all, and in you all.

But unto every one of us is given grace according to the measure of the gift of Christ.

Wherefore he saith, When he ascended up on high, he led captivity captive, and gave gifts unto men.

(Now that he ascended, what is it but that he also descended first into the lower parts of the earth?

He that descended is the same also that ascended up far above all heavens, that he might fill all things.)

And he gave some, apostles; and some, prophets; and some, evangelists; and some, pastors and teachers;

For the perfecting of the saints, for the work of the ministry, for the edifying of the body of Christ:

Till we all come in the unity of the faith, and of the knowledge of the Son of God, unto a perfect man, unto the measure of the stature of the fulness of Christ:

That we henceforth be no more children, tossed to and fro, and carried about with every wind of doctrine, by the sleight of men, and cunning craftiness, whereby they lie in wait to deceive;

But speaking the truth in love, may grow up into him in all things, which is the head, even Christ…” – Ephesians 4: 1-5 (KJV)

Preparedness Notes for Saturday — May 2, 2020

On May 2, 1945, the Soviet Union announced the fall of Berlin and the Allies announced the surrender of Nazi troops in Italy and parts of Austria. This is a famous photograph taken by Yevgeny Khaldei.

—

SurvivalBlog Writing Contest

Today we present another entry for Round 88 of the SurvivalBlog non-fiction writing contest. The prizes for this round include:

First Prize:

- A gift certificate from Quantum Harvest LLC (up to a $2,200 value) good for 12% off the purchase of any of their sun-tracking models, and 10% off the purchase price of any of their other models.

- A Gunsite Academy Three Day Course Certificate. This can be used for any one, two, or three day course (a $1,095 value),

- A course certificate from onPoint Tactical for the prize winner’s choice of three-day civilian courses, excluding those restricted for military or government teams. Three day onPoint courses normally cost $795,

- DRD Tactical is providing a 5.56 NATO QD Billet upper. These have hammer forged, chrome-lined barrels and a hard case, to go with your own AR lower. It will allow any standard AR-type rifle to have a quick change barrel. This can be assembled in less than one minute without the use of any tools. It also provides a compact carry capability in a hard case or in 3-day pack (an $1,100 value),

- Two cases of Mountain House freeze-dried assorted entrees in #10 cans, courtesy of Ready Made Resources (a $350 value),

- A $250 gift certificate good for any product from Sunflower Ammo,

- American Gunsmithing Institute (AGI) is providing a $300 certificate good towards any of their DVD training courses.

Second Prize:

- A Front Sight Lifetime Diamond Membership, providing lifetime free training at any Front Sight Nevada course, with no limit on repeating classes. This prize is courtesy of a SurvivalBlog reader who prefers to be anonymous.

- A Glock form factor SIRT laser training pistol and a SIRT AR-15/M4 Laser Training Bolt, courtesy of Next Level Training, which have a combined retail value of $589,

- A Three-Day Deluxe Emergency Kit from Emergency Essentials (a $190 value),

- Two 1,000-foot spools of full mil-spec U.S.-made 750 paracord (in-stock colors only) from www.TOUGHGRID.com (a $240 value).

- An assortment of products along with a one hour consultation on health and wellness from Pruitt’s Tree Resin (a $265 value).

Third Prize:

- Three sets each of made-in-USA regular and wide-mouth reusable canning lids. (This is a total of 300 lids and 600 gaskets.) This prize is courtesy of Harvest Guard (a $270 value)

- A Royal Berkey water filter, courtesy of Directive 21 (a $275 value),

- Naturally Cozy is donating a “Prepper Pack” Menstrual Kit. This kit contains 18 pads and it comes vacuum sealed for long term storage or slips easily into a bugout bag. The value of this kit is $220.

- Two Super Survival Pack seed collections, a $150 value, courtesy of Seed for Security, LLC,

- A transferable $100 purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun. There is no paperwork required for delivery of pre-1899 guns into most states, making them the last bastion of firearms purchasing privacy!

Round 88 ends on May 31st, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how to” skills for survival have an advantage in the judging.

Wu Flu Versus Spanish Flu, by Steve Coffman

I’ve long been unhappy with the way COVID-19 and the Spanish Flu of 1918 have been compared. Obviously it is a short hand way to compare quarantine and stay at home measures of today with 1918, as opposed to the lethal nature of the sickness. For the record, the Spanish Flu was a far more terrifying and deadly disease than the Coronavirus.

On the subject of quarantine though, there are reasonable comparisons but only to an extent. While the Spanish Flu shut down many places, it did not cause the same crippling economic impact that we are seeing from Coronavirus. You see folks, there was a little thing called The Great War which was just wrapping up.

The United States had gone onto a total war economy footing soon after getting fed up with unrestricted submarine warfare killing our neutral sailors and sinking our neutral shipping. That means the entire economy from agriculture to manufacturing was geared towards exactly one thing – and that thing was war.

Because the United States was almost totally untouched by the war in Europe, we had a massive advantage in manufacturing and food producing capabilities. As a food-exporting nation, we were in a prime position to not only feed our population and our army, but to also prop up our allies who had already tended to import food from us. The demands of war only made US food and manufacturing exports that much more crucial.

To say there were labor shortages would be an understatement. As in WWII, the First World War saw extensive use of women, children, and teenagers in various industries including agriculture in order to boost the work force. Early tractors and other mechanized improvements helped ease the strain on farmers, but total war meant total employment and then some.Continue reading“Wu Flu Versus Spanish Flu, by Steve Coffman”