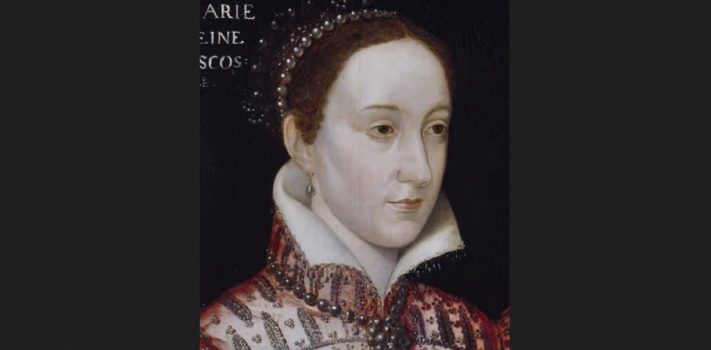

On August 19, 1561, Mary Queen of Scots arrived in Leith, Scotland to assume the throne after spending 13 years in France.

—

August 19th is the birthday of Philo Taylor Farnsworth (1906-1971). Farnsworth was an American inventor who is best known for his image pickup device that formed the basis for the fully functional and complete all-electronic television system. Among his many other inventions was the Farnsworth-Hirsch fusor, a small nuclear fusion device that remains a viable source of neutrons. At his death, he held over 300 patents, mostly in radio and television.

—

Today’s feature article is by SurvivalBlog’s founder, James Wesley, Rawles (JWR).

—

We need entries for Round 120 of the SurvivalBlog non-fiction writing contest. More than $960,000 worth of prizes have been awarded since we started running this contest. Round 120 ends on September 30th, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging. In 2023, we polled blog readers, asking for suggested article topics. Please refer to that poll if you haven’t yet chosen an article topic.