Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. This column emphasizes JWR’s “tangibles heavy” investing strategy and contrarian perspective. Today, we look at currencies and precious metals in times of war. (See the Precious Metals section and the Forex & Cryptos section.)

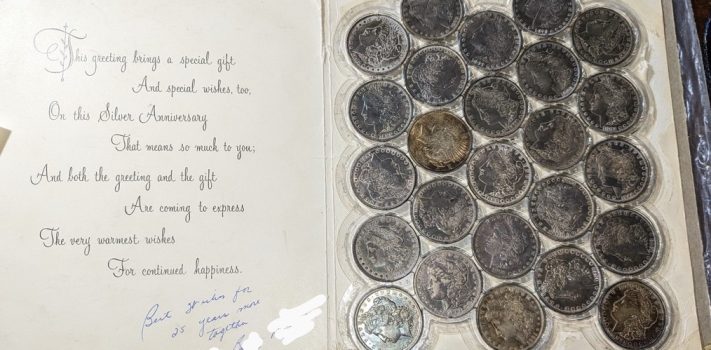

Precious Metals:

Gold spiked versus paper currencies early this week. On Monday, there was an intraday high of $3,417.60 per Troy ounce. But on Tuesday, after an announced (but fragile) ceasefire, spot gold corrected to $3,307.50. By Thursday morning, gold was back up $3,338.40 and silver was at a respectable $36.84. Note how the silver-to-gold ratio is gaining.

Whenever there is a major international crisis, the real worth(lessness) of paper currencies is revealed. Consistently, in crises, there is a well-justifiable “flight to safety” to the precious metals. Gold and silver’s last really big bull market run was in the late 1970s, which was also a time of heightened tension in the Middle East. (Do you remember the lengthy Iran Hostage Crisis?) In U.S. Dollar terms, spot gold was up 22.9% in 1977, 37.1% in 1978, and 126.2% in 1979.

If the truce holds for a week, then I suspect that the precious metals market prices will revert to their status quo ante bellum. Even if there is a successful ceasefire and a true end to the Iran-Israel 12-Day War, I don’t believe that we are anywhere near the end of the current precious metals bull market. – JWR

o o o

In The Financial Times: Germany and Italy pressed to bring $245bn of gold home from US.

o o o

Gary Wagner: Safe-haven assets retreat as ceasefire triggers risk-on market rotation.

Economy & Finance:

Stock market today: Dow, S&P 500, Nasdaq rally to put records back in sight.

o o o

Will the Capital Gains Tax increase to 9.9% cause business to leave Washington state?

o o o

At Zero Hedge: Forget About Iran, the Real Danger to the Markets Is Coming From Japan.

Continue reading“Economics & Investing For Preppers”