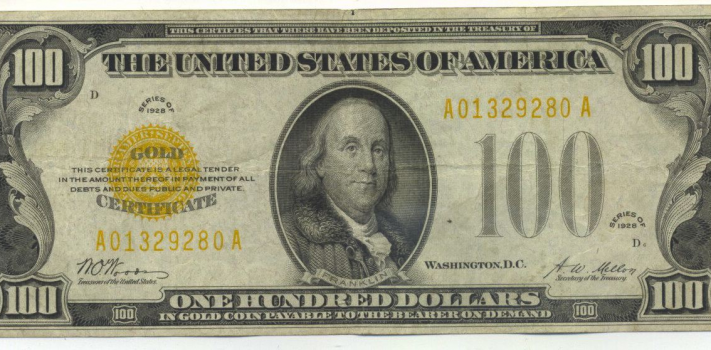

Editor’s Introductory Note: This analysis was published by our friend Hub Moolman on January 20th, 2026. There is a wide range of opinion amongst precious metals market analysts on where the top might be for silver, in the current cycle. I personally expect to see a top somewhere between $125 and $195 per ounce. The bull market will probably be stopped by the combined force of legislation, executive orders, central bank intervention, and radically increased margin requirements by the metals exchanges. Presently, Asian silver buyers are unperturbed by the recent COMEX and LBMA trading rules changes. But when it comes, the PRC government’s draconian intervention will surely have a profound effect. I urge SurvivalBlog readers to cover their costs by gradually divesting as this spike continues. Anyone who bought their silver at below $31 per ounce should have already divested 20% or more of their stack, and put the proceeds into other tangibles. I must also reiterate: Always maintain a core holding of small silver coins (nothing larger than 1 ounce) to be able to barter for necessities. That should be at least 30% of your silver stack.

—

Even at close to $100 an ounce today, silver is still a must-buy. Here is why:

1. Silver vs The Quantity of US Dollars

Buying silver today with US dollars is a lot like buying silver in 1972. Below is a chart that shows the silver price relative to the monetary base (currency in circulation plus reserve balances):

When buying an ounce of silver today, you are using the same amount of US dollars relative to the total amount issued (according to the FED) as you would have circa 1972.Continue reading“Why Silver Continues To Be A Must-Buy, by Hubert Moolman”