Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at some practical tangibles to invest in. (See the Tangibles Investing section.)

Precious Metals:

Gold and silver sell off when U.S. Treasury yield spikes above 1.5%

o o o

Gold prices drop below $1,700 as Jerome Powell dismisses rising inflation and bond yields

Economy & Finance:

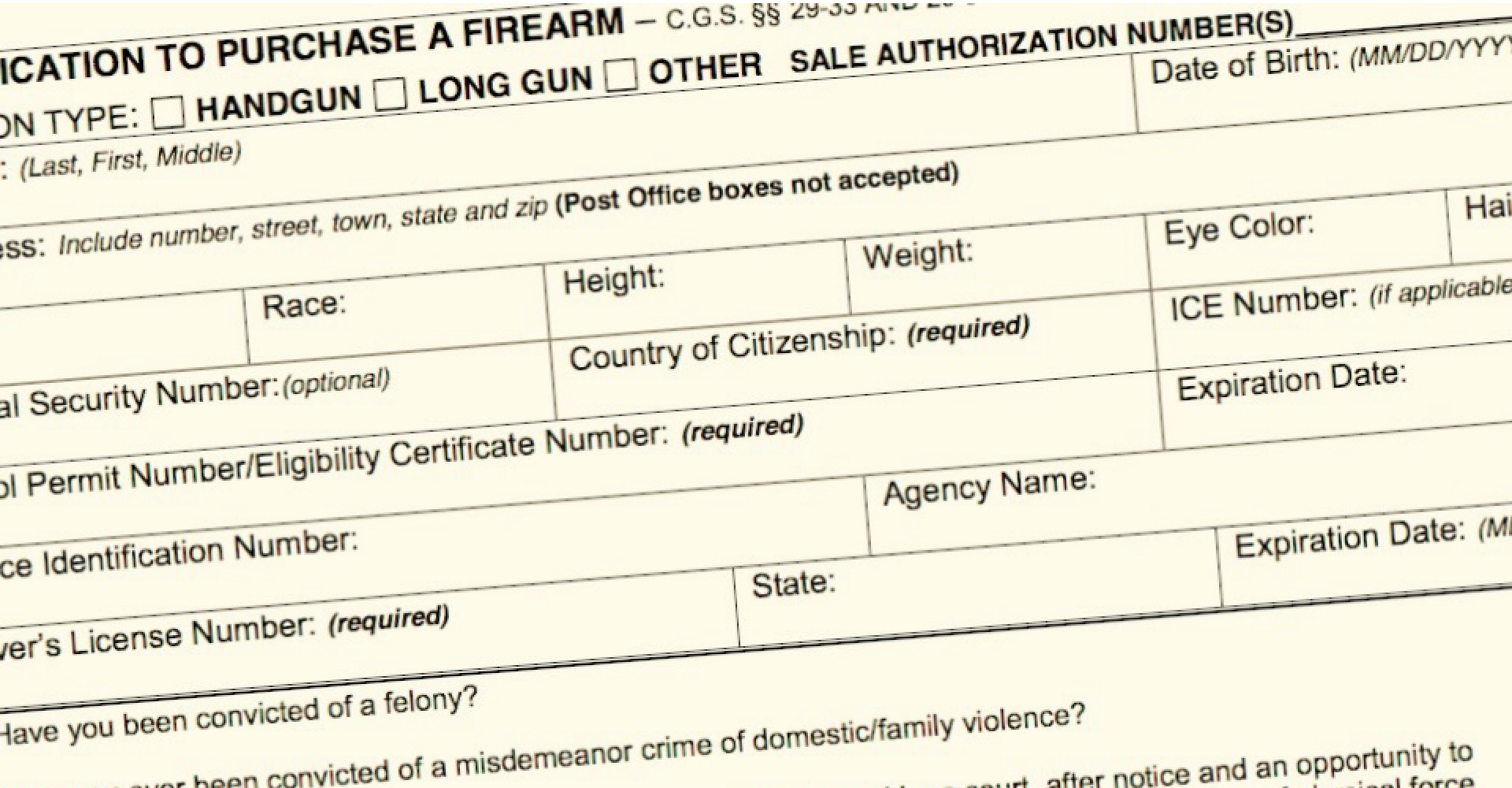

Beige Book Escalates Inflation Warning: Sees Most Prices Rising “Moderately”, Some “Notably”. JWR’s Comments: With a recent additional $1.9 trillion in pork barrel stimulus and bailouts, and another $3 trillion in “Green Energy” Federal spending planned by the Dem-wits, the market movers can clearly see inflation approaching. If their schemes are neacted, we’ll see a $33 trillion national debt, by the end of 2021! Plan and invest accordingly. Get out of Dollars, and into tangibles — with an emphasis on the kind that go “bang.”

o o o

Another at Zero Hedge: Deutsche Bank: Central Banks Simply Can’t Afford Higher Rates With Global Debt So High

o o o

“An Eye-Popping Decline” – US Mall Values Crash By A Record 60% In 2020

o o o

At Wolf Street: Movie Theater Business Isn’t Going Back to Normal: Disney CEO