“And I do think that I’m in a unique situation because I was having the conversations with people that were going out and committing crimes. And so, I understood what was kind of pushing them there. And so, I do want people to know that, just because someone has committed a crime, it doesn’t make them a criminal.” – Rep. Jasmine Crockett, Democrat of Texas

- Ad Ready Made Resources, Trijicon Hunter Mk2$2000 off MSRP, Brand New in the case

- Ad STRATEGIC RELOCATION REALTYFOR SALE: Self-sustaining Rural Property situated meticulously in serene locales distant from densely populated sanctuary cities. Remember…HISTORY Favors the PREPARED!

Preparedness Notes for Sunday — September 28, 2025

On September 28, 1779, Samuel Huntington was elected President of the Continental Congress, succeeding John Jay. Huntington was a self-educated man who became an attorney and statesman. The following is a fair use excerpt from the Descendants of Signers of the Declaration of Independence DSDI website:

“Samuel Huntington was born in the town of Scotland, Windham County, Connecticut on July 5, 1731, the 4th of ten children, and second son of Nathaniel Huntington and Mehetable Thurston [Huntington]. Nathaniel was a farmer and clothier at Scotland, and built a home there in 1732 that still stands to this day.

Samuel’s great-grandfather was Simon Huntington, who was born in England and arrived in Boston in 1633. The family settled in Roxbury and subsequently moved to Norwich, Connecticut. Matthew Marvin, a great-grandfather of Samuel Huntington, came to America in the Increase in 1635 and was one of the first settlers of Hartford in 1638.

Young Samuel did not acquire a formal education, except that provided by the “common schools.” At age 16 Samuel was apprenticed to a cooper, although he continued to help his father on the farm. Interested in learning, Samuel borrowed books from the library of the Rev. Ebenezer Devotion and from local lawyers, and began to study history, Latin, and the law. He was admitted to the bar at Windham in 1754 at the age 23, and moved to Norwich, Connecticut to begin his practice.”

—

September 28, 1066: William The Conqueror invaded England, landing at Pevensey Bay, Sussex.

—

Our big inventory reduction sale at Elk Creek Company — with nearly all of our items reduced — is in progress. This is your chance to do some early Christmas or Hanukkah shopping. Or consider it the Pre-1899 part of your tangibles investing strategy. The sale will end on Wednesday, October 1st. Get your order in soon!

—

Today’s feature article is a guest piece by our long-time friend Patrice Lewis of the excellent Rural Revolution blog.

—

Just two days left! We need another article entry for Round 120 of the SurvivalBlog non-fiction writing contest. More than $960,000 worth of prizes have been awarded since we started running this contest. Round 120 ends on September 30th, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging. In 2023, we polled blog readers, asking for suggested article topics. Please refer to that poll if you haven’t yet chosen an article topic.

- Ad USA Berkey Water Filters - Start Drinking Purified Water Today!#1 Trusted Gravity Water Purification System! Start Drinking Purified Water now with a Berkey water filtration system. Find systems, replacement filters, parts and more here.

- Ad Lessons From the Rhodesian Bush War: A Study in Survival, Rural Defense, and CollapseDrawn from a real guerrilla war, learn what a modern collapse in a rural area might look like. Hard lessons on security, farms, patrols, and attacks from Africa for SHTF.

The Other AI: Breeding Maggie, by Patrice Lewis

Editor’s Introductory Note: This guest article was written by our friend and fellow blogger, Patrice Lewis. Her entertaining and informative Rural Revolution blog has been published several times a week since 2009. We highly recommend bookmarking it. – JWR

—

Last year, we bred Maggie, our Jersey heifer, to a neighbor’s young Angus bull.

It was a convenient arrangement, and little Stormy was the product of that breeding.

But our neighbors no longer have that little bull, so we were trying to figure out how to get Maggie bred this year. After some discussion, we decided to use AI (Artificial Insemination; it had the “AI” abbreviation decades before computers were a thing).Continue reading“The Other AI: Breeding Maggie, by Patrice Lewis”

- Ad Survival RealtyFind your secure and sustainable home. The leading marketplace for rural, remote, and off-grid properties worldwide. Affordable ads. No commissions are charged!

- Ad California Legal Rifles & Pistols!WBT makes all popular rifles compliant for your restrictive state. Choose from a wide range of top brands made compliant for your state.

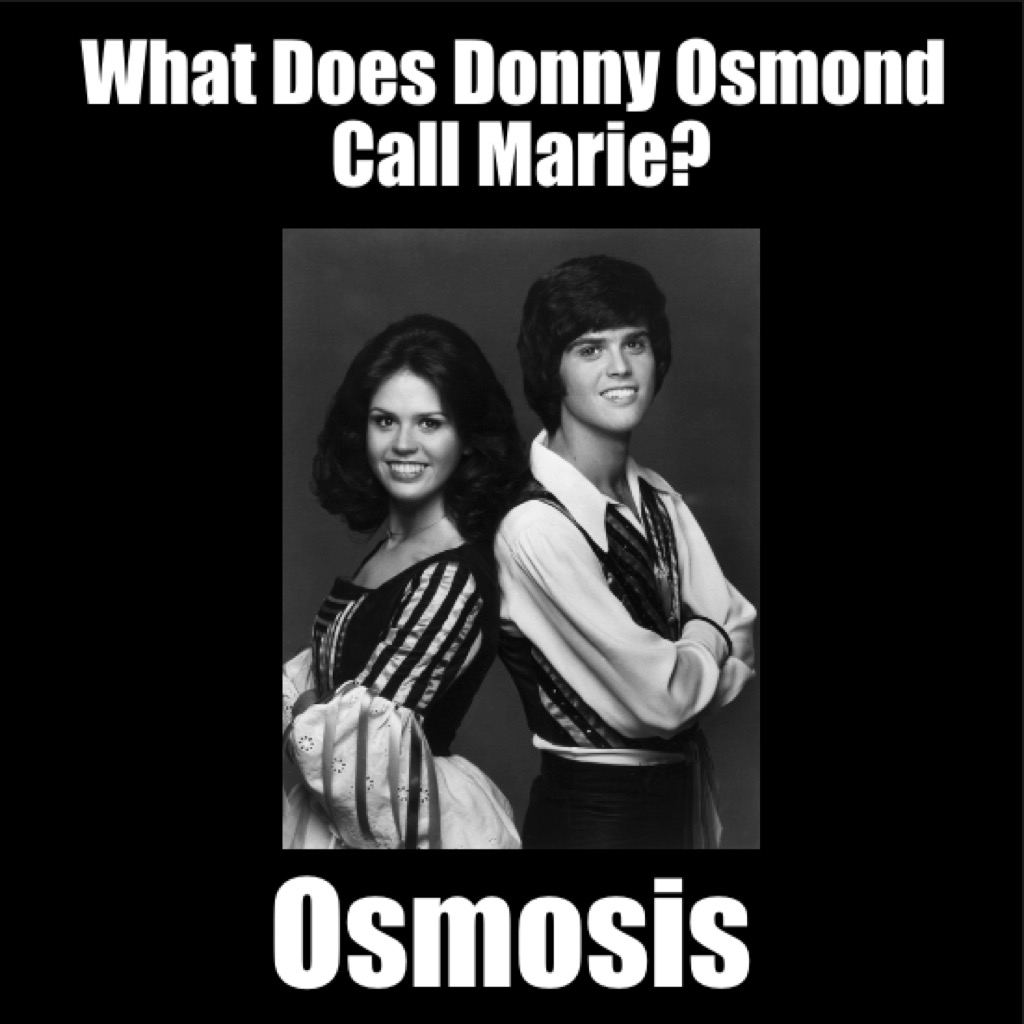

JWR’s Meme Of The Week:

The latest meme graphic created by JWR. This is based on a pun coined by my elder brother, who turns 71, today:

Meme Text:

What Does Donny Osmond Call Marie?

Osmosis

Notes From JWR: Do you have a meme idea? Just e-mail me the concept, and I’ll try to assemble it. And if it is posted then I’ll give you credit. Thanks!

Permission to repost memes that I’ve created is granted, provided that credit to SurvivalBlog.com is included.

- Ad Trekker Water Station 1Gal Per MinuteCall us if you have Questions 800-627-3809

- Ad Civil Defense ManualClick Here --> The Civil Defense Manual... The A to Z of survival. Looks what's in it... https://civildefensemanual.com/whats-in-the-civil-defense-manual/

The Editors’ Quote of the Day:

“But of the times and the seasons, brethren, ye have no need that I write unto you.

For yourselves know perfectly that the day of the Lord so cometh as a thief in the night.

For when they shall say, Peace and safety; then sudden destruction cometh upon them, as travail upon a woman with child; and they shall not escape.

But ye, brethren, are not in darkness, that that day should overtake you as a thief.

Ye are all the children of light, and the children of the day: we are not of the night, nor of darkness.

Therefore let us not sleep, as do others; but let us watch and be sober.

For they that sleep sleep in the night; and they that be drunken are drunken in the night.

But let us, who are of the day, be sober, putting on the breastplate of faith and love; and for an helmet, the hope of salvation.

For God hath not appointed us to wrath, but to obtain salvation by our Lord Jesus Christ,

Who died for us, that, whether we wake or sleep, we should live together with him.

Wherefore comfort yourselves together, and edify one another, even as also ye do.” – 1 Thessalonians 5:1-11 (KJV)

- Ad SIEGE belts: The essential go-anywhere GRAY MAN accessory. Solid 5.5-7 oz of persuasive power has saved many on their daily routines & travels. Revered "Thousand-Year Buckles" with stunning hand-crafted finishes. Complements CCW. Lear more..SIEGE STOVES: the ultimate high-performance portable survival stove. SIEGE BELTS: Use code "SBLOG" at checkout for $20 off any belt & be ready! Gifts that will last lifetimes.

- Ad LifeSaver 20K JerryCan Water PurifierThe best water jerrycan you can buy on the market! Mention Survivalblog for a Free Filter ($130 Value)

Preparedness Notes for Saturday — September 27, 2025

On September 27, 1908, Henry Ford‘s first production Ford Model T automobile left the Piquette Plant in Detroit, Michigan. Mass production soon followed.

—

And on September 27,1936, the Netherlands left the Gold Standard and devalued the Dutch Guilder.

—

Today, we present a short guest piece by long-time SurvivalBlog reader and fellow blogger Reltney McFee. It first appeared in his entertaining but sporadically-posted blog: Musings of A Stretcher Ape.

—

Just a few days left! We are in need of entries for Round 120 of the SurvivalBlog non-fiction writing contest. More than $960,000 worth of prizes have been awarded since we started running this contest. Round 120 ends on September 30th, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging. In 2023, we polled blog readers, asking for suggested article topics. Please refer to that poll if you haven’t yet chosen an article topic.

- Ad USA Berkey Water Filters - Start Drinking Purified Water Today!#1 Trusted Gravity Water Purification System! Start Drinking Purified Water now with a Berkey water filtration system. Find systems, replacement filters, parts and more here.

- Ad Click Here --> Civil Defense ManualNOW BACK IN STOCK How to protect, you, your family, friends and neighborhood in coming times of civil unrest… and much more!

My Most Recent Lesson in Logistics, by Reltney McFee

Last weekend, I was performing my periodic battery survey, assessment and replacement ritual. I have a list of (I had thought) every battery device, and its location, along with a hidey-hole for the batteries to replace those that require them. This list, in the summer 2025 edition, runs 3 pages of 14 point type. On my yearly planner, it is slated for January. (Yes, I am aware that this is September. Let us consider the gulf between plans, and actions, shall we?)

As it developed, as I was working my way through each page, I would pass one shelf in my basement. On one of my passes, I noticed that I had a thermal camera, bought last winter so I can have some basis for triaging which particular insulation/air infiltration fail I should address and in what sequence.

It was not on the list. Powered by batteries.

Next to it sat an inspection camera, used to inspect voids such as you might see behind drywall, or on an exterior wall. Or, for that matter, where a bat might be hiding. It, too, runs on batteries. It, too was NOT on my list. Well, it used to be not on my list.

I entered my “Pooh Room” (where I keep “my pooh”), and noted that I had optics on several of my rifles. These optics required (say it along with me, now!) batteries, and, as well, had NOT been on my “check the batteries” list.

When you have a rifle in your gun safe for a couple of years, and have not taken it to the range in that time, well, as one might have wondered, the batteries die. So, I was given the opportunity to replace the batteries, and re-inventory all my spares.Continue reading“My Most Recent Lesson in Logistics, by Reltney McFee”

Editors’ Prepping Progress

To be prepared for a crisis, every Prepper must establish goals and make both long-term and short-term plans. In this column, the SurvivalBlog editors review their week’s prep activities and planned prep activities for the coming week. These range from healthcare and gear purchases to gardening, ranch improvements, bug-out bag fine-tuning, and food storage. This is something akin to our Retreat Owner Profiles, but written incrementally and in detail, throughout the year. We always welcome you to share your own successes and wisdom in your e-mailed letters. We post many of those — or excerpts thereof — in the Odds ‘n Sods Column or in the Snippets column. Let’s keep busy and be ready!

Jim Reports:

This week, I was very busy packing and mailing almost 30 Elk Creek Company mail orders. I had just cataloged a lot of FN FAL magazines. M1 Carbine flash hiders, and M1 Carbine muzzle brakes. And I started a big sale on almost all of our antique gun inventory. (I described the legalities and the logic of my strategy in my recent blog article: Firearms Ownership Privacy: The Pre-1899 Solution.) I expect to be packing even more orders next week. Busy, busy, busy! Hopefully, things will slow down before deer and elk hunting season begins.

Now, Lily’s part of the report…

The Editors’ Quote of the Day:

“And after this it came to pass that David smote the Philistines, and subdued them: and David took Methegammah out of the hand of the Philistines.

And he smote Moab, and measured them with a line, casting them down to the ground; even with two lines measured he to put to death, and with one full line to keep alive. And so the Moabites became David’s servants, and brought gifts.

David smote also Hadadezer, the son of Rehob, king of Zobah, as he went to recover his border at the river Euphrates.

And David took from him a thousand chariots, and seven hundred horsemen, and twenty thousand footmen: and David houghed all the chariot horses, but reserved of them for an hundred chariots.

And when the Syrians of Damascus came to succour Hadadezer king of Zobah, David slew of the Syrians two and twenty thousand men.

Then David put garrisons in Syria of Damascus: and the Syrians became servants to David, and brought gifts. And the Lord preserved David whithersoever he went.

And David took the shields of gold that were on the servants of Hadadezer, and brought them to Jerusalem.

And from Betah, and from Berothai, cities of Hadadezer, king David took exceeding much brass.

When Toi king of Hamath heard that David had smitten all the host of Hadadezer,

Then Toi sent Joram his son unto king David, to salute him, and to bless him, because he had fought against Hadadezer, and smitten him: for Hadadezer had wars with Toi. And Joram brought with him vessels of silver, and vessels of gold, and vessels of brass:

Which also king David did dedicate unto the Lord, with the silver and gold that he had dedicated of all nations which he subdued;

Of Syria, and of Moab, and of the children of Ammon, and of the Philistines, and of Amalek, and of the spoil of Hadadezer, son of Rehob, king of Zobah.” – 2 Samuel 8:1-12 (KJV)

Preparedness Notes for Friday — September 26, 2025

On September 26, 1508, Francis Drake completed his circumnavigation of the world, sailing into Plymouth, England, aboard the Golden Hind.

—

Our big inventory reduction sale at Elk Creek Company — with the prices of nearly all of our items reduced — is in progress. This is your chance to do some early Christmas or Hanukkah shopping. The sale will end on Wednesday, October 1st. Get your order in soon! Note: If the sale prices are not showing up for the majority of items with your browser, then please clear your browser’s cache. (With most browsers, click on “Clear browsing history” and select “All.”)

—

SurvivalBlog Writing Contest

Today we present another entry for Round 120 of the SurvivalBlog non-fiction writing contest. The prizes for this round include:

First Prize:

- A Gunsite Academy Three Day Course Certificate. This can be used for any of their one, two, or three-day course (a $1,095 value),

- A Peak Refuel “Wasatch Pack” variety of 60 servings of premium freeze-dried breakfasts and dinners in individual meal pouches — a whopping 21,970 calories, all made and packaged in the USA — courtesy of Ready Made Resources (a $350 value),

- American Gunsmithing Institute (AGI) is providing a $300 certificate good towards any of their DVD training courses. Their course catalog now includes their latest Survival Gunsmithing course.

- HSM Ammunition in Montana is providing a $350 gift certificate. The certificate can be used for any of their products.

- Preparedness author Jennifer Rader is offering a $200 purchase credit for any of her eight published food storage and medical preparedness books, including the

Second Prize:

- A SIRT STIC AR-15/M4 Laser Training Package, courtesy of Next Level Training, that has a combined retail value of $679

- A $269 retail value survival-ready power package from Solar Power Lifestyle. This includes two Solar Power Lifestyle 25W Portable Solar Panels, plus a $150 gift card to use for any purchase at solarpowerlifestyle.com.

- Two 1,000-foot spools of full mil-spec U.S.-made 750 paracord (in-stock colors only) from TOUGHGRID.com (a $287 value).

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun. There is no paperwork required for delivery of pre-1899 guns into most states, making them the last bastion of gun purchasing privacy!

Third Prize:

- A Berkey Light water filter, courtesy of USA Berkey Filters (a $305 value),

- Two sets of The Civil Defense Manual, (in two volumes) — a $193 value — kindly donated by the author, Jack Lawson.

- A $200 credit from Military Surplus LLC that can be applied to purchase and/or shipping costs for any of their in-stock merchandise, including full mil-spec ammo cans, Rothco clothing and field gear, backpacks, optics, compact solar panels, first aid kits, and more.

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun.

—

More than $960,000 worth of prizes have been awarded since we started running this contest. Round 120 ends on September 30th, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging. In 2023, we polled blog readers, asking for suggested article topics. Please refer to that poll if you haven’t yet chosen an article topic.

Text Comms in a Post-Disaster World – Part 5, by J.M.

(Continued from Part 4. This concludes the article.)

There are a lot of different complicated characteristics in the LoRa radio configuration that can be changed that impact range and transfer speed, so Meshtastic has defined a number of preset configurations so you don’t need to mess with the technical details. The first word of the preset defines range, and the second defines bandwidth, with ‘Long Fast’ being the default. I strongly recommend that you stick with the ‘Long Fast’ preset until you gain more experience with Meshtastic, so make sure the ‘Modem Preset’ field says ‘Long Fast’. Once you’ve selected the preset look for the ‘Frequency Slot’ field at the bottom of the same page.Continue reading“Text Comms in a Post-Disaster World – Part 5, by J.M.”

Economics & Investing For Preppers

Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. This column emphasizes JWR’s “tangibles heavy” investing strategy and contrarian perspective. Today, an update on the state of the global economy. (See the Economy & Finance section.)

Precious Metals:

The Precious Metals bull continues his charge! On Tuesday, spot Gold hit an intraday price of $3,801.40 per Troy ounce. That was another all-time high. And meanwhile, spot silver briefly touched $44.66 per Troy ounce.

By Thursday afternoon (yesterday), spot gold was bouncing around the $3,765 region, after some profit-taking. But spot silver was up to a very respectable $45.46 per Troy ounce. Late this morning, it was up to $46.36! And Spot Platinum was at $1,586.50. Hang on, folks. This bull has just been turned loose on the streets of Pamplona, and he is feeling feisty! And, FWIW, I’m still predicting that silver will out-perform gold, substantially. – JWR

o o o

Rick Mills, over at Gold-Eagle.com: Precious Metals and Critical Minerals Feeling Market Love.

Economy & Finance:

From the leftist and anti-Trump policy Bloomberg: Resilient World Economy Set for Tariff Hit in 2026, OECD Says.

o o o

IGC: Remarkable Resilience: Global Economic and Private Markets Update.

o o o

From the UN’s DESA: World Economic Situation and Prospects 2025 September Update.

o o o

Martin W. Armstrong: When Monetary and Fiscal Policies Blur. A great quote from his essay:

“The reason politicians love low [interest] rates is not to help the people but to help government. With the US national debt now spiraling out of control, every uptick in rates increases the cost of debt service. Trump knows this. Biden knew it too. Every administration eventually leans on the Fed to keep rates down because the alternative is insolvency.”

The Editors’ Quote of the Day:

“Economics has revealed a great truth about the natural law of human interaction: that not only is production essential to man’s prosperity and survival, but so also is exchange.” – Murray Rothbard

Preparedness Notes for Thursday — September 25, 2025

September 25, 1066: The Battle of Stamford Bridge: The English army under King Harold II defeated invading Norwegians led by King Harald Hardrada and Harold’s brother Tostig, who were both killed. (Above is an undated painting of the event as imagined by Norwegian artist Peter Nicolai Arbo, 1831–1892.)

—

On September 25th, 1789, the first Congress of the United States approved 12 amendments to the U.S. Constitution and sent them to the states for ratification.

—

This is also the birthday of Will Smith (born 1968), who in my opinion should be best known for his roles in I Am Legend and Enemy Of The State.

SurvivalBlog Writing Contest

Today we present another entry for Round 120 of the SurvivalBlog non-fiction writing contest. The prizes for this round include:

First Prize:

- A Gunsite Academy Three Day Course Certificate. This can be used for any of their one, two, or three-day course (a $1,095 value),

- A Peak Refuel “Wasatch Pack” variety of 60 servings of premium freeze-dried breakfasts and dinners in individual meal pouches — a whopping 21,970 calories, all made and packaged in the USA — courtesy of Ready Made Resources (a $350 value),

- American Gunsmithing Institute (AGI) is providing a $300 certificate good towards any of their DVD training courses. Their course catalog now includes their latest Survival Gunsmithing course.

- HSM Ammunition in Montana is providing a $350 gift certificate. The certificate can be used for any of their products.

- Preparedness author Jennifer Rader is offering a $200 purchase credit for any of her eight published food storage and medical preparedness books, including the

Second Prize:

- A SIRT STIC AR-15/M4 Laser Training Package, courtesy of Next Level Training, that has a combined retail value of $679

- A $269 retail value survival-ready power package from Solar Power Lifestyle. This includes two Solar Power Lifestyle 25W Portable Solar Panels, plus a $150 gift card to use for any purchase at solarpowerlifestyle.com.

- Two 1,000-foot spools of full mil-spec U.S.-made 750 paracord (in-stock colors only) from TOUGHGRID.com (a $287 value).

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun. There is no paperwork required for delivery of pre-1899 guns into most states, making them the last bastion of gun purchasing privacy!

Third Prize:

- A Berkey Light water filter, courtesy of USA Berkey Filters (a $305 value),

- Two sets of The Civil Defense Manual, (in two volumes) — a $193 value — kindly donated by the author, Jack Lawson.

- A $200 credit from Military Surplus LLC that can be applied to purchase and/or shipping costs for any of their in-stock merchandise, including full mil-spec ammo cans, Rothco clothing and field gear, backpacks, optics, compact solar panels, first aid kits, and more.

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun.

—

More than $960,000 worth of prizes have been awarded since we started running this contest. Round 120 ends on September 30th, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging. In 2023, we polled blog readers, asking for suggested article topics. Please refer to that poll if you haven’t yet chosen an article topic.

Text Comms in a Post-Disaster World – Part 4, by J.M.

(Continued from Part 3.)

Flashing

I’ve covered a lot of details regarding how Meshtastic works, so let’s walk through an example of configuring an actual device to see how it all applies. Note that one of the results of Meshtastic currently being primarily a hobbyist activity is that there are multiple ways of doing things. For example, you can connect a Meshtastic device to a PC via serial (over USB) or Bluetooth, you can manage the device from a PC using an Internet-based web interface, a locally hosted web interface or a Command Line Interface (CLI), you can update the firmware on a device from a PC via a different Internet-based web interface or another CLI (with different options for different types of microprocessors), and you can configure/manage a device from the Android/iOS apps (but not update the firmware). I’m going to focus on the USB-connected web-based option on a Windows PC for flashing firmware and the Bluetooth-connected Android app for managing/interfacing in my examples since those tend to be the most common approaches.Continue reading“Text Comms in a Post-Disaster World – Part 4, by J.M.”