Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, I describe ratio trading, in your tangibles portfolio. (See the Tangibles Investing section.)

Precious Metals:

There should be a bounce-back in precious metals, from the drops on the mornings of Thursday and Friday, last week. I try not to let short-term market volatility bother me. I’m more of a “Long Haul” metals investor.

Once there is a public realization that the claimed “transitory” price inflation of the U.S. Dollar will actually become chronic inflation, I expect to see a substantial rally for precious metals and many durable base metal commodities. I anticipate that chromium, copper, and nickel will all increase, in Dollar terms. Those “in Dollar terms” rallies will most likely begin in October or November of 2021. Time will tell.

o o o

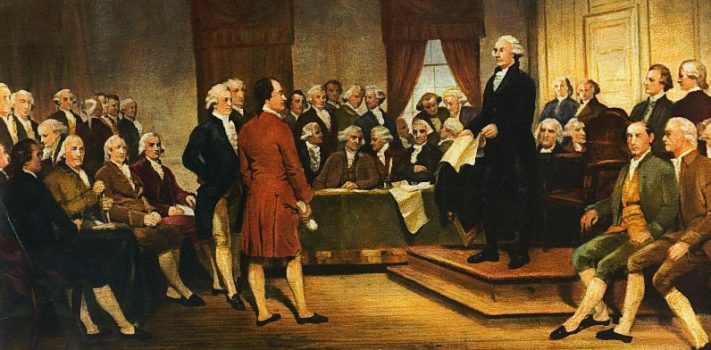

50 Years Since The Closure Of The “Gold Window” (Part 1)

Economy & Finance:

Who Pays For Dems’ Plan To Spend Trillions To ‘Stimulate’ Economy? Hint: Not The Rich.

o o o

H.L. sent us this: Here’s how coin circulation issues are affecting some CT retailers. JWR’s Comment: Presumably, many of these same effects are still being felt nationwide.

o o o

Jobless claims rise to 332,000 as economy tries to regain momentum.

o o o

Treasury Department Seeks to Track Financial Transactions of Personal Bank Accounts Over $600.

o o o

At Wolf Street: Business Travel, Conventions, Office Occupancy Stuck in Collapse: Been so Long, People Forgot What Old Normal Was.