This weekly column features news stories and event announcements from around the American Redoubt region. (Idaho, Montana, eastern Oregon, eastern Washington, and Wyoming.) Much of the region is also more commonly known as The Inland Northwest. We also mention companies of interest to preppers and survivalists that are located in the American Redoubt region. Today, we focus on RINO Congresswoman Liz Cheney. (See the Wyoming section.)

Region-Wide

I just picked up a copy of an advertising-supported tabloid that I hadn’t seen before, called Out There Outdoors. It is an outdoor recreation paper that is published in Spokane. It gets fairly wide free circulation (30,000 copies) in the Inland Northwest. The publishers mention that they “…produce six print magazines a year and host two of the largest outdoor festivals in the Northwest: Spokatopia and the Spokane Great Outdoors and Bike Expo. Don’t consider my mention of this publication an endorsement. It is just a mention. The editors of this tabloid seem to live in an alternate universe Inland Northwest where mountain biking is more popular than hunting and horseback riding. Out There Outdoors is a publication that seems aimed at outdoorsy liberal city folk. Their mantra is “Just Get Out There!” (In a non-binary, non-polluting, social justice way, of course.)

o o o

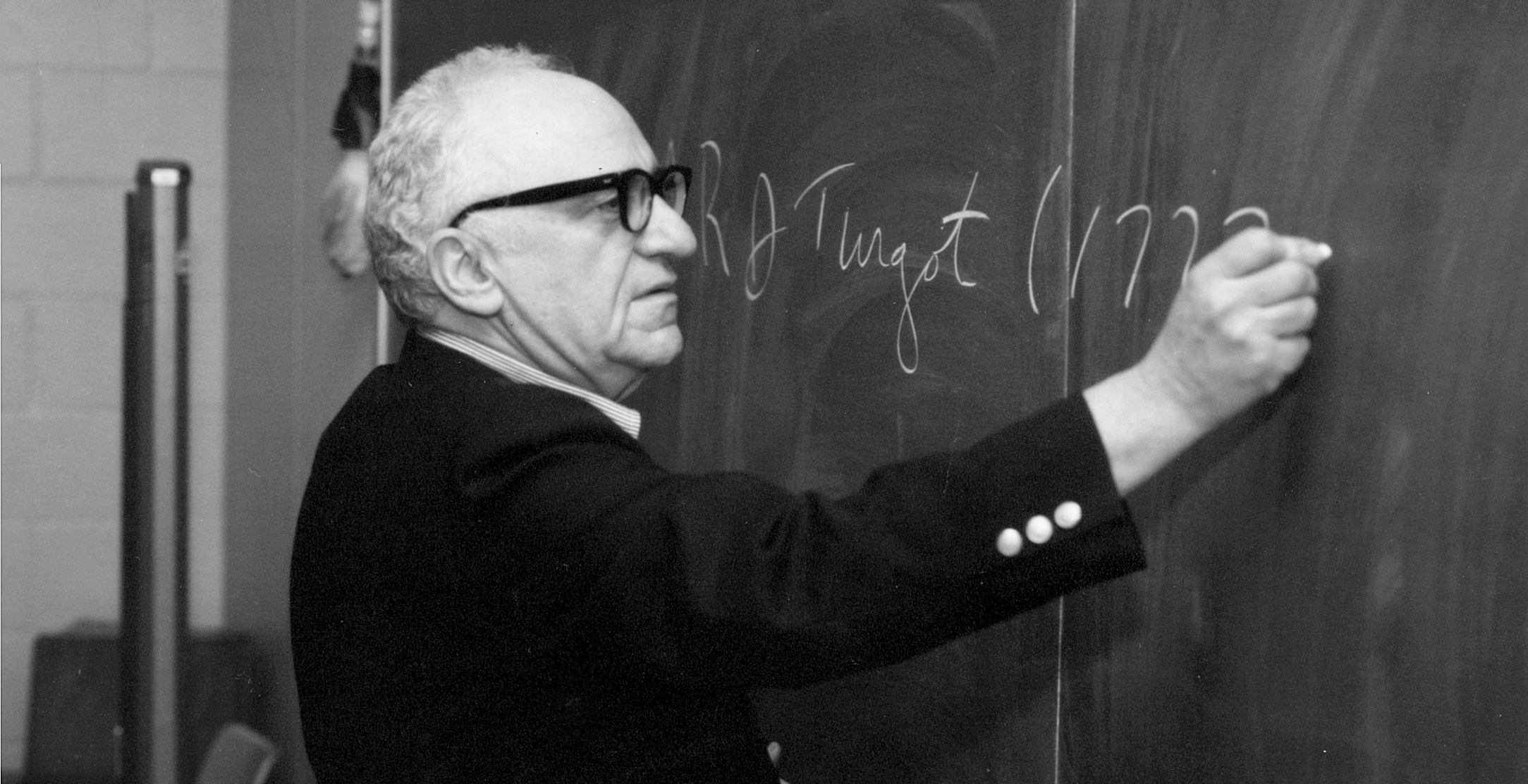

From a 2015 conference, but I’m told that much of it was repeated in a recent Liberty Fellowship message: Pastor Chuck Baldwin – “The American Redoubt”.

o o o

On Radio Free Redoubt: Parallel Economic Groups and Freedom-Minded Employers Offering Jobs.

o o o

An update on the Greater Idaho project, from a recent press release:

“The number of valid signatures submitted by the Greater Idaho movement is enough to earn a position on the May 2022 ballot, according to Klamath County Clerk Rochelle Long. She assigned the county measure the number 18-121 for the May 2022 election. By her count, the movement collected 2371 valid signatures, 140% of the required number.

The excess signatures indicate enthusiasm in the county for the idea of moving the Oregon/Idaho border so that southern and eastern Oregon will be governed as a part of Idaho instead of Oregon. The county feels that state officials failed to defend its interests in dealing with the federal government on how Klamath River water was distributed during the drought this year. Local volunteers such as Maria Bradbury and Allen Headley collected hundreds of signatures at rodeos, gun shows, the county fair, and at Casey’s restaurant, which remained open during the lock down, according to the movement’s website greateridaho.org.

The ballot measure, if approved by voters, would create a county board to evaluate benefits to the county of moving the state border.

The movement is waiting for the Douglas County Clerk to announce his count of their signatures for a their measure for the Douglas County ballot.

The movement expects three or four counties to vote on its initiatives this May. So far, eight counties have voted for ballot measures submitted by the movement: two in November 2020, five in May 2021, and one in a special election last month.

Oregon and Idaho state legislators have said they will introduce legislation in the next session of each state legislature. Mike McCarter, the leader of the Greater Idaho movement, claims both states stand to gain financially from the border shift, as rural Oregon’s resource-based economy is better suited to Idaho law than Oregon law. Eastern and southern Oregon are like Idaho in the percentage of their vote they give to each political party, he said.”

Idaho

N. Idaho man attacked by bull moose.

o o o

Some news that I find difficult to believe: N. Idaho man charged with sexual abuse of a child, rape. Yes, that is Alex Barron — former candidate for State Representative and member of a Republican Central Committee — that they are talking about. The “adult woman” mentioned in the article was apparently Barron’s wife.

o o o

Idaho Tribe Accepts Massive Battery Made With Chinese Lithium While Protesting U.S. Mining.

o o o

Bingham County commissioners condemn ‘drunk Indians’ remark from sheriff. And now, even deeper trouble: Idaho sheriff charged after pulling gun on youth group leaving thank you notes.

Continue reading“SurvivalBlog’s News From The American Redoubt”