Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at the global credit market turmoil that started in England. (See the Economy & Finance section.)

Precious Metals:

Goldman on what oil and gold have to offer: this commodity is ‘welcome opportunity’.

o o o

Hedge funds are still bearish; gold investors want more proof the Fed will slow its rate hikes.

Economy & Finance:

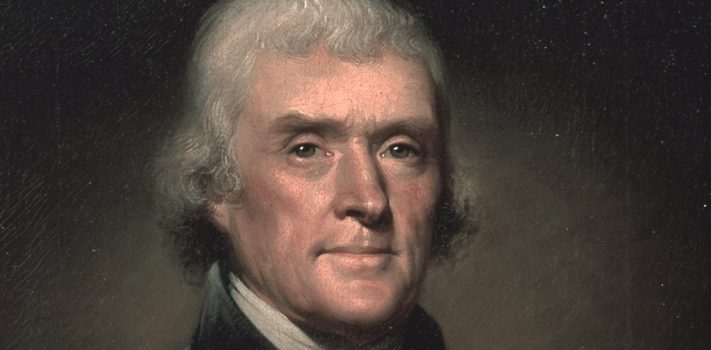

A consulting client asked me for my opinion on when the Federal Reserve will pivot from the current tight credit environment back to loose credit. I told her that the FOMC would likely wait until the US was in a deep recession or in the throes of a credit market freeze or collapse. When could that be? They probably won’t get desperate about a recession until at least the spring of 2023. But a credit freeze — much like the one that England recently suffered — could happen at any time. In the interim, we can expect more Dollar strength on the Forex, and short selling of precious metals by institutional investors and speculative traders.

o o o

UK scraps tax cut for wealthy that sparked market turmoil.

o o o

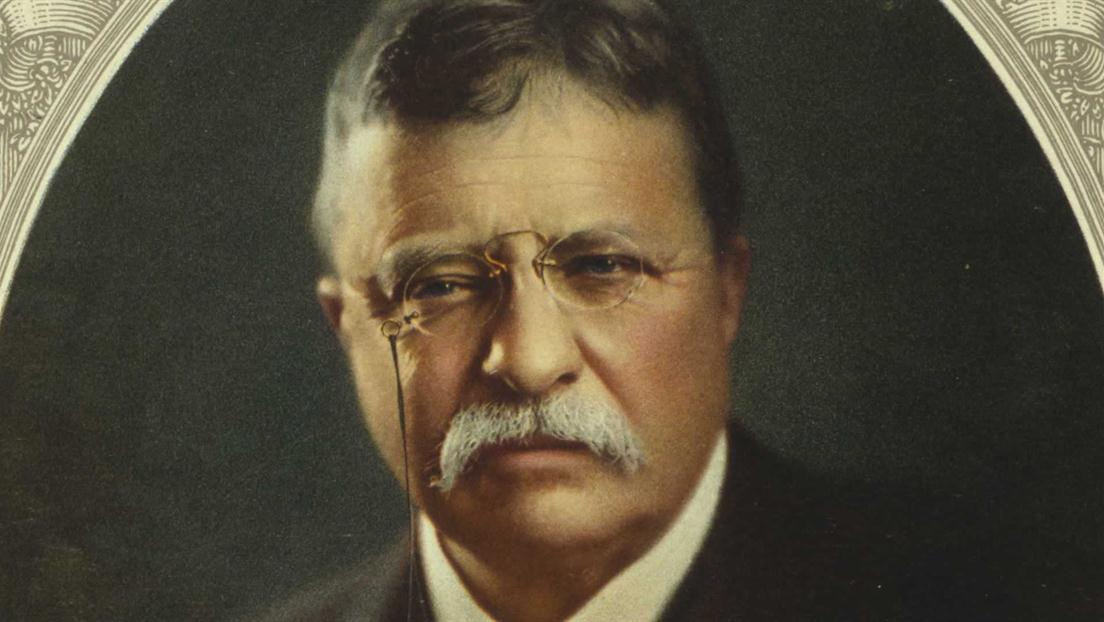

Video from Neil McCoy-Ward: And So It Begins… JWR’s Comments: Yes, there something fishy about Rishi. Take note that Rishi Sunak is a proponent of both a British CBDC and government-administered digital identification.

o o o

From the Perpetual Cheering Section at CNBC: Stay the course? Bear market reminders for long-term investors.