Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. Most of these items are from JWR’s “tangibles heavy” contrarian perspective. Today, we look at the Federal Reserve’s balance sheet. (See the Economy & Finance section.)

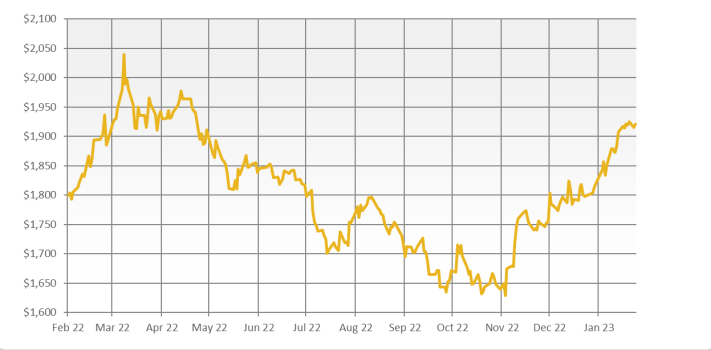

Precious Metals:

You may have heard that silver tumbled 5.19% on Friday, to $22.57 USD per Troy ounce. That was attributed to a briefly-strengthening Dollar. But the Dollar’s prospects look dim for 2023, while the prospects for silver look bright. Buy on dip days, like these!

o o o

o o o

Stefan Gleason, at Gold-Eagle.com: Gold Market Isn’t Buying Powell’s ‘Disinflation’ Declaration.

Economy & Finance:

Our own Tom Christianson recommended an article in City Journal: The Fed Goes Underwater. This piece begins:

“Before new trillion-dollar federal spending bonanzas became a regular occurrence, the Federal Reserve’s announcement that it lost over $700 billion might have garnered a few headlines. Yet the loss met with silence. Few Americans have noticed the huge increase in both the scale and the scope of the central bank or the dangers that it poses to the American economy. As Fed-driven inflation becomes the Number One political issue in America, that will change.

The Fed’s losses owe to a shift in the way it does business. Before the 2008 financial meltdown, the central bank tried to control interest rates by buying and selling U.S. bonds. A few billion in purchases or sales could move the whole economy, and this meant that the Fed, which operates much like a normal bank, could keep a relatively small balance sheet of under $1 trillion.”

o o o

Over at Yahoo Finance: The word that made stocks fall in love with the Fed: Morning Brief.

o o o

This WND article was linked over at the Whatfinger.com news aggregation site: 6-year-old spends $1,000 on food delivery app while playing on his dad’s phone.