“Government is ‘a group of people who sell retributive justice to the inhabitants of a limited geographic area at monopolistic prices.’ I think you will find that’s quite precise.” – Robert LeFevre

- Ad STRATEGIC RELOCATION REALTYFOR SALE: Self-sustaining Rural Property situated meticulously in serene locales distant from densely populated sanctuary cities. Remember…HISTORY Favors the PREPARED!

- Ad Don't wait - get the ultimate US-made ultra-high performance US-made SIEGE Stoves and stunning hand-crafted SIEGE belts for Christmas. For stocking-stuffers see our amazing fire-starters. Gifts that can save lives. Big Sale!Every bespoke SIEGE buckle goes through an hours-long artisanal process resulting in a belt unlike anything else, with blazing fast performance and looks and comfort to match.

Notes for Monday – February 01, 2016

February 1st is the anniversary of the secession of Texas from the United States in 1861. A State Convention considering secession opened in Austin on January 28th, 1861 and on February 1st, by a vote of 166-8, adopted an Ordinance of Secession from the United States. It’s important to note that not all Texans favored this act and the state Governor, Sam Houston, while being loyal to the union, refused offers from President Lincoln to keep him in office and was subsequently deposed as governer.

We also remember February 1st, 2003, when the Space Shuttle Columbia disintegrated over Texas and Louisiana as it reentered Earth’s atmosphere, killing all seven crew members.

- Ad Survival RealtyFind your secure and sustainable home. The leading marketplace for rural, remote, and off-grid properties worldwide. Affordable ads. No commissions are charged!

- Ad California Legal Rifles & Pistols!WBT makes all popular rifles compliant for your restrictive state. Choose from a wide range of top brands made compliant for your state.

Round 62 Non-Fiction Writing Contest Winners Announced!

This was a tough contest to judge as there were so many good entries. Ultimately, the top prize winners were multi-part articles, but SurvivalBlog would like to point out that there was no filler in these entries. They were long articles, but they were thorough and complete. All of the articles in this contest were good articles. All entries that were submitted, not rejected, but not yet published are automatically rolled over as entries into Round 63 of the Non-Fiction Writing Contest.

First Prize goes to J.R. for “What’s For Dinner – Part 1”, “Part 2”, “Part 3”, “Part 4”, “Part 5”, and “Part 6”, which was posted on January 8th, 9th, 12th, 13th, 14th, and 15th. She will receive the following prizes:

- A Tactical Self-Contained 2-Series Solar Power Generator system from Always Empowered. This compact starter power system is packaged in a wheeled O.D. green EMP-shielded Pelican hard case (a $1,700 value),

- A Gunsite Academy Three Day Course Certificate that is good for any one, two, or three day course (a $1,195 value),

- A course certificate from onPoint Tactical for the prize winner’s choice of three-day civilian courses, excluding those restricted for military or government teams. Three day onPoint courses normally cost $795,

- DRD Tactical is providing a 5.56 NATO QD Billet upper with a hammer forged, chrome-lined barrel and a hard case to go with your own AR lower. It will allow any standard AR-type rifle to have a quick change barrel, which can be assembled in less than one minute without the use of any tools and a compact carry capability in a hard case or 3-day pack (an $1,100 value),

- Gun Mag Warehouse is providing 20 Magpul PMAG 30-rd Magazines (a value of $300) and a Gun Mag Warehouse T-Shirt; (an equivalent prize will be awarded for residents in states with magazine restrictions),

- Two cases of Mountain House freeze-dried assorted entrees in #10 cans, courtesy of Ready Made Resources (a $350 value),

- The Ark Institute is donating a non-GMO, non-hybrid vegetable seed package (enough for two families of four) plus seed storage materials, a CD-ROM of Geri Guidetti’s book “Build Your Ark! How to Prepare for Self Reliance in Uncertain Times”, and two bottles of Potassium Iodate (a $325 retail value),

- A $250 gift certificate good for any product from Sunflower Ammo,

- KellyKettleUSA.com is donating both an AquaBrick water filtration kit and a Stainless Medium Scout Kelly Kettle Complete Kit with a combined retail value of $304, and

- Two cases of meals, Ready to Eat (MREs), courtesy of CampingSurvival.com (a $180 value).

Second Prize goes to JSP for “Water Works – Part 1”, “Part 2”, “Part 3”, and “Part 4”, which was posted on December 18th, 19th, 20th, and 22nd. He will receive the following prizes:

- A Glock form factor SIRT laser training pistol and a SIRT AR-15/M4 Laser Training Bolt, courtesy of Next Level Training, which have a combined retail value of $589,

- A FloJak EarthStraw Code Red 100-foot well pump system (a $500 value), courtesy of FloJak.com,

- A transferable certificate for a two-day Ultimate Bug Out Course from Florida Firearms Training (a $400 value),

- A Model 175 Series Solar Generator provided by Quantum Harvest LLC (a $439 value),

- A Trekker IV™ Four-Person Emergency Kit from Emergency Essentials (a $250 value),

- A $200 gift certificate good towards any books published by PrepperPress.com,

- A pre-selected assortment of military surplus gear from CJL Enterprize (a $300 value),

- RepackBox is providing a $300 gift certificate to their site, and

- Safecastle is providing a package of 10 LifeStraws (a $200 value)

Third Prize goes to Cracker Makk for “Attaining Food in Urban Locations (From Land and Sea) – Part 1”, “Part 2”, “Part 3”, “Part 4”, and “Part 5”, which was posted on December 1st, 2nd, 3rd, 4th, and 5th. He will receive the following prizes:

- A Royal Berkey water filter, courtesy of Directive 21 (a $275 value),

- A $245 gift certificate from custom knife-maker Jon Kelly Designs, of Eureka, Montana,

- A large handmade clothes drying rack, a washboard, and a Homesteading for Beginners DVD, all courtesy of The Homestead Store, with a combined value of $206,

- Expanded sets of both washable feminine pads and liners, donated by Naturally Cozy (a $185 retail value),

- Two Super Survival Pack seed collections, a $150 value, courtesy of Seed for Security, LLC,

- Mayflower Trading is donating a $200 gift certificate for homesteading appliances,

- Montie Gear is donating a Precision Rest (a $249 value), and

- Two 1,000-foot spools of full mil-spec U.S.-made 750 paracord (in-stock colors only) from www.TOUGHGRID.com (a $240 value).

Honorable Mention prizes ($30 Amazon.com gift certificates via e-mail) have been awarded to the writers of these fine articles:

- “Making A Conceal Carry Vest”, by C.E.

- “Left Of Boom – A Different Way of Thinking About Prepping”, by The Retired Professor

- “Being Anonymous”, by Spotlight

- “Can You Buy a Budget Sniping Rifle That Is Effective?”, by B.F.

- “Keep Your Bicycle Running in Tough Times”, by S.H.

- Ad Civil Defense ManualClick Here --> The Civil Defense Manual... The A to Z of survival. Looks what's in it... https://civildefensemanual.com/whats-in-the-civil-defense-manual/

- Ad Ready Made Resources, Trijicon Hunter Mk2$2000 off MSRP, Brand New in the case

Pat Cascio’s Product Review: ARMSCOR/Rock Island Armory 10mm

There was a lot of ink back in the late 1980s, when the 10mm round became readily available to the public. Colt was the first mainline gun maker to come out with a somewhat affordable 1911 Government-style handgun in 10mm. It was called the Delta Elite. I jumped on getting one, and loved the gun. However, there were only limited types of 10mm ammo available at the time; one was the 200-gr FMJ round, and one was a 155-gr Silvertip round from Winchester. Still, I was extremely impressed with the 10mm. The power level was close to the .41 Magnum round, in a semiauto handgun. Yes!

I used my Colt Delta Elite for deer hunting one year. I fired at a deer at less than 25-yards away with the 155-gr Silvertip round, and it should have easily been a kill shot. However, the deer took the hit and ran off. I searched for hours; the blood trail was every place. The next morning, some friends helped me continue the search. There was lots of blood, but the deer was never found. We surmised it jumped into a blackberry bush, and we couldn’t see it.

The problem as I now see it is that the 155-gr Silvertip round wasn’t heavy enough, and the bullet expanded too rapidly without penetrating deeply enough to get the job done. I stopped carrying this round shortly after that.

For the better part of a year, I carried a S&W Model 1006, 10mm handgun, and I had to send it back to S&W three times. The adjustable rear sight kept shaking loose, and the gun simply wasn’t accurate. After the third trip back to S&W and its return to me, I sold it. The problem with the 10mm round was that it was a pretty violent offender in the recoil department, and many guns just weren’t able to handle that sort of mechanical recoil. My Colt Delta Elite also shook itself “loose as a goose” as they say! In short order, even though the FBI had been using the S&W Model 1076 in 10mm, it fell out of favor. When the FBI dumps a gun or a particular caliber, then everyone follows.

The 10mm fell out of favor with the shooting public in the early 1990s. It wasn’t until just recently that folks are rediscovering this outstanding round, both for self defense and for hunting purposes. I’ve always longed for another 1911 style handgun in 10mm, since getting rid of my Colt Delta Elite. The local gun shop I haunt got in a used Delta; however, as I feared, the gun was loose, very loose. Obviously a lot of rounds went downrange and the owner decided to sell or trade it off. After looking at the gun, I passed on buying it myself.

Enter ARMSCOR and their line of 1911 style handguns, which are made in the Philippines. To be sure, they have a very extensive line-up of 1911 handguns in 9mm, .40 S&W, .45ACP, and 10mm. My local gun shop has been selling ARMSCOR/ Rock Island Armory for several years now, usually the bare bones, basic Mil-Spec type of guns in .45 ACP. They told me that no one has ever returned one of the guns for any problems. Finally, one day, my local gun shop got in an Rock Island Armory 1911 Government-style in 10mm– the Rock Island Armory model Rock Ultra FA-10mm. After looking the gun over and thinking on it for a couple of days, I decided I had to have this gun. It was super-tightly put together and seemed like everything I had been longing for in a 1911 in 10mm. A trip to the gun shop the next day revealed that they had left for Portland, OR for a gun show and took “my” gun with them. A quick text to the guys, and they set the gun aside for me to buy on Monday morning. It was a long, long weekend, waiting for Monday to roll around.

The Rock Island Armory Rock Ultra FA–10mm has a 5” button rifled, bull barrel, with no barrel bushing, that is fully supported. The 10mm round really needs this added support. There is also a full-length guide rod, which I can do without. It just makes disassembly all that much more complicated. The rear sight is adjustable for windage and elevation, and the front sight is a red fiber optic one that is easy to see. It really stands out. An ambidextrous safety is there, as well as a beaver tail grip safety. The ambi safety, snicked on and off with authority, is very well fitted. The greenish, though they look gray in my pics for some reason, G10 grips are very aggressively checkered. This is something I really liked for a sure hold on the gun. RIA says the trigger pull is 4-6 lbs, though my sample was much, much lighter. I did a little work on it, and it broke cleanly at 4.50 lbs, which is just about perfect for a self-defense carried handgun. The magazine release is slightly extended, too. I like that, a lot!

The front grip of the frame has serrations, but it wasn’t to my liking. So, I stuck on some skate board friction tape over it and now it’s nice! There is a plastic detachable mag well extension on the gun, which I removed too. It just was too cheap-looking to my mind. The gun is finished in a dark gray/black parkerized finish. However, it wasn’t evenly applied, but I could live with that. The full retail price on this gun is only $745. I paid $699 for mine.

The RIA only came with one 8-rd magazine. That wasn’t going to do, so I ordered up some more spare mags to have on hand. The gun fits in any holsters designed to hold a 1911 handgun, too. Unloaded weight of the gun is 2.49 lbs. Unfortunately, the only 10mm ammo my local gun shop had in stock was some from ARMSCOR, and it was the medium velocity 200-gr FMJ ammo. It is good enough for target practice and killing rocks and pieces of wood, but it’s not what you want for self defense or hunting purposes. Still, I bought all of that ammo they had and ran out to test my new “toy”. For whatever reason, during the first mag of ammo through the gun, the trigger stuck back and didn’t fully return forward. I had to manually force the trigger back to the reset position. However, the gun never had that problem again.

I called long-time friend and fellow gun writer, John Taffin, and asked him about sending me some 10mm ammo. He had none on hand. Yikes! He turned me on to Double Tap Ammunition for a great selection of 10mm ammo, and they actually got their start in the ammo-making business by producing 10mm. The owner of the company, Mike McNett, couldn’t find any good source of 10mm himself, so he started loading for himself and his friends, and one thing led to another. He got into the ammo-making business, big time. I also contacted long-time friend, Tim Sundles, at Buffalo Bore Ammunition for some of his outstanding 10mm ammo.

From Buffalo Bore Ammunition, I received their 180-gr JHP Heavy load, 220-gr Hard Cast Flat Nose loading, 200 FMJ, 155-gr Barnes TAC-XP all-copper hollow point round, and their new 180-gr Low Recoil Low Flash JHP load. From Double Tap Ammo, I received their 135-gr Controlled Expansion JHP load, 165-gr Bonded Self-Defense JHP load, 180-gr Controlled Expansion load JHP round, 200-gr Controlled Expansion JHP load, 200-gr Hard Cast loading, and their 190-gr Equalizer load. And, from Sig Sauer, I received their new 180- JHP load. Sig is now producing an ever-expanding line of ammo.

So, as you can see, I had quite a selection of 10mm to run through this RIA 10mm pistol for this article; I had a lot of different loads. The good news is these are all full-powered 10mm loads, not the watered-down loadings that helped the demise of the 10mm in the first place.

One load in particular caught my attention, and that was the 190-gr Equalizer load. This is actually two projectiles– a 135-gr JHP with a 55-gr round ball load behind it. You get two hits with one pull of the trigger. Mike McNett says that at 10 yards the two projectiles will only hit about one inch from each other, and at 25 yards they will only be about 2.5 inches apart. I did my testing at 10 yards, and sure enough the two projectiles were only an inch from one another. This is a load you want in your gun, for use in your home. He also produces this round in several other calibers. Check out his website. However, McNett says not to use this round beyond 25 yards, as I’m sure the two projectiles will really start to spread out away from each other.

I will say that shooting all the above ammo– from Sig Sauer, Buffalo Bore, and Double Tap– was a real joy. They’re all full-powered loadings, even the Low Recoil/Low Flash loads from Buffalo Bore were full-powered loads. If you want to do a lot of shooting, I’d get some of the medium velocity loads that you can find at most gun shops and big box stores. Use that for punching paper and killing rocks, and reserve the full-powered loads for hunting and self defense use.

Picking one load, from all of the above ammo, for self defense or hunting purposes would be difficult for me to do. Before, we didn’t have many different loadings for different purposes. Now we have a big selection that will take care of any of your 10mm shooting needs. For out on the trail, where you might run into dangerous game, one of the Hard Cast loads from Buffalo Bore or Double Tap would be my choice. For self defense, I’d pick one of the JHP loads, and for home protection, I’d go with that Double Tap Equalizer load. However, I don’t think you can go wrong with any of the JHP loads above for self-defense purposes. I did like the Sig Sauer 180-gr JHP load; it was very accurate and full-powered, too.

During my testing, I did take some shots at large rocks that were out at 100 yards, and most of the time I was hitting them, if I did my part. The 10mm is a pretty flat-shooting handgun round, compared to many other handgun rounds. And, the 10mm is hitting with authority, too, at longer distances.

At 25 yards, using a sleeping bag as a rest over the hood of my pickup truck, I was getting groups under three inches most of the time, if I did my part. Picking a winner in the accuracy department was impossible. The Buffalo Bore, Double Tape, and Sig Sauer 180-gr JHP rounds were in a virtual dead-heat as winners, all shooting under three inches. Some groups, with different ammo, was giving me groups over three inches and some groups larger. I’m sure it was my fault. Over several days of shooting, I was getting tired. I put more than 700-rds downrange during my testing.

To be sure, I thought I’d mention that Double Tap has even a bigger selection of 10mm ammo than what was sent to me. I think there are more than a dozen different 10mm loads they offer. If you can’t find what you need in 10mm from them, then you don’t need it.

Sig Sauer is also offering a 180-gr FMJ 10mm load, too, for target practice. It’s a bit less expensive than the JHP loads. Of course, Buffalo Bore (I do love their 220-gr Hard Cast FN load) would probably be my first choice for out in the boonies or hunting medium to large game. Yes, I wouldn’t hesitate to hunt Oregon black bear with this load. It would give me all the penetration needed to anchor one in our black bears. The same goes for wild pigs, any place in the country!

During all my testing, other than that one time when the trigger didn’t reset for me in the first mag of ammo, the RIA 10mm never gave me a hint of a problem. It just perked along with any and all of the different ammo I ran through it, everything! The gun was as tight after all my shooting as it was on the first day. The only change I made was to replace the red fiber optic front sight with a green one; that’s just my druthers!

The 10mm is making a come back. That is obvious, by the big selection of 10mm ammo that is on the market these days. If you are a handloader, you can down load the 10mm, if that’s what you like, or load it up to full-power, too. There wasn’t anything I didn’t like about my RIA 10mm 1911, nothing! The price was right, the gun was very well assembled, and it was plenty accurate, too. If you’re in the market for another 1911, because you always “need” another 1911 (at least that’s what I keep telling my wife) and you want something a little different, take a close look at the 10mm from ARMSCOR/Rock Island Armory. They even have one in a Commander length– a little bit shorter slide/barrel.

For survival purposes, the 10mm makes a lot of sense. It can be used for self defense against humans and dangerous game. The only drawback is that many gun shops don’t have a big selection of 10mm on their shelves, just yet. So, take advantage of what Buffalo Bore, Double Tap, and Sig have to offer. I’m sure you’ll find some ammo to your liking. Just stock up for the bad times. Things are getting bad these days. Make sure you have a good supply of 10mm on hand. For my purposes, I think 1,000 rds per gun per caliber is a good rule of thumb. If you get a 10mm handgun, then try to keep 1,000 rds of 10mm ammo on hand. The 10mm is a winner, once again, in my humble opinion.

– Senior Product Review Editor, Pat Cascio

- Ad USA Berkey Water Filters - Start Drinking Purified Water Today!#1 Trusted Gravity Water Purification System! Start Drinking Purified Water now with a Berkey water filtration system. Find systems, replacement filters, parts and more here.

- Ad Click Here --> Civil Defense ManualNOW BACK IN STOCK How to protect, you, your family, friends and neighborhood in coming times of civil unrest… and much more!

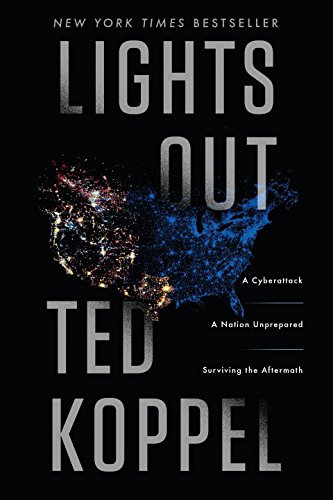

Book Review from TM in Arkansas – Lights Out

- © Ted Koppel 2015

- Published by Crown Publishing Group, New York

- ISBN: 978-0-553-41996-2 (Hardback) 978-0-553-41997-9 (eBook)

- There are twenty chapters, 279 pages, index, and notes.

This is not another fictional EMP book. It is facts concerning an intentional attack on the electrical grid of the USA. I have studied that particular threat for many years, so I thought I would read this book, confirm what I already knew, and pass it on to the local public library. After my first read, I have decided to keep the book in my personal library for reference. Sorry folks, you will have to buy your own copy.

The author is a well-known journalist and ably uses his skills to cut through the chatter and get down to the facts. He interviewed dozens of present and former government officials entrusted with protecting the Unites States from a cyberattack and executives from numerous electric power companies. He did the same with several individual “preppers” around the nation, including some members of the Mormon church who have a reputation for being prepared for emergencies to ascertain their plan for surviving this type of calamity. Do they even have a plan?

The premise of the book is who will attack our national power grid, how they will attack, why they will attack, and what will happen in the aftermath. What is the likelihood of such an event? Is it doable? What is the plan or plans for recovering?

We are given details on who is responsible for reacting to a cyberattack and how the USA will retaliate, if it can. After much personal research over the years, I was unpleasantly surprised at the answers and scenarios in this book. I think most of you will share my discomfort. If you truly think your government and industry leaders are on top of this problem after numerous expert warnings of the likelihood, you need to read this book right away.

There are several instances in this story when you will be angered and dismayed. I will not give away too much by saying there is no consensus of government officers on anything concerning a cyberattack. They do not agree it will even occur, much less how to deal with it. There is no plan to deal with it. The emergency response folks (FEMA) are duplicating the military who prepare for the last war. In this case, they are preparing for the last regional or local hurricane, earthquake, flood, et cetera but not the complete loss of electricity across the entire nation.

The same holds true for electric power company officials. They cannot agree on whether or not to coordinate their defensive plans with each other or the government. They cannot agree on the probability of a cyberattack against their particular company. They cannot agree on how to harden their computer systems. They cannot even agree to disagree in a civil manner.

Emergency preparedness supply companies do not want to contemplate a grid failure, especially in the dead of winter. Without electricity, they cannot freeze-dry or dehydrate anything for even their own families. Delivery to you is out of the question.

Current estimates say less than one percent of U.S. citizens are preppers. That is less than three million in a nation of 335 million. What happens to the 332 million with no preps on hand?

Do you and your family have a plan for the complete, long-term absence of electricity from your lives? My family does, and we pray hard we never have to use it.

I will close with one quote from the book by Rudolf Giuliani: “… the more you prepare, the better off you are going to be, even if you haven’t quite anticipated the thing that happens.” Please read the book for the enlightening details and facts to help you be prepared.

- Ad Trekker Water Station 1Gal Per MinuteCall us if you have Questions 800-627-3809

- Ad LifeSaver 20K JerryCan Water PurifierThe best water jerrycan you can buy on the market! Mention Survivalblog for a Free Filter ($130 Value)

Recipe of the Week: Raisin Spice Cake, by R.E.

Depression era cake with no eggs.

Ingredients:

- 1 cup brown sugar, packed

- 1 1/2 cup water

- 1/2 cup butter (or oleo)

- 1 tsp cinnamon

- 1/2 tsp nutmeg

- 1/2 cup chopped pecans

- 1 tsp baking powder

- 1/2 tsp allspice

- 2 cups flour

- 1 tsp soda

- 1/2 tsp salt

- 3/4 cup raisins, chopped

Directions:

- Boil sugar, raisins, water, butter and spices for 5 minutes, let cool.

- Mix flour, soda, baking powder, salt, and pecans together and add to first mixture.

- Pour into paper lined pan 9x5x3.

- Bake at 350 deg for 40 to 55 min.

- Cool 5 minutes and turn onto cake plate.

- Remove paper.

o o o

Do you have a favorite recipe that would be of interest to SurvivalBlog readers? Please send it via e-mail. Thanks!

- Ad USA Berkey Water Filters - Start Drinking Purified Water Today!#1 Trusted Gravity Water Purification System! Start Drinking Purified Water now with a Berkey water filtration system. Find systems, replacement filters, parts and more here.

- Add Your Link Here

Letter Re: Digital Currency

Hugh,

Here are a few additional comments about Bitcoin that might be of interest to SurvivalBlog readers:

Bitcoin is the best bet for digital currency that’s outside the banking system; it has the largest market cap and network of developers/miners. There is no Know Your Customer or Anti-Money Laundering with Bitcoin, which means you don’t need to show any ID to get it if you buy it in person. In the U.S., the Bank Secrecy Act, Patriot Act, and other bank/money-related U.S. laws keep Bitcoin from being a legally compliant currency. As these laws are written, they also apply to digital currency.

Bitcoin has a number of other problems. First, it’s not as secure as people believe; key generation for wallets is weak. This encryption has no doubt been broken by security agencies, and there are short cuts that can make guessing an early Bitcoin key a modest computing problem (48 bits). Second, the decentralized network is extremely slow to process transactions, and the network is subject to attacks that can prevent transaction processing. Transaction processing is now about 50% in communist China, where they are using stolen power for the mining (that’s how they confirm transactions). Some mining operations are located inside power plants, where local communist party officials and plant managers are cut in on the action. Denial of service attacks that flood the network with bogus transactions have proven to cause problems. Third, many of the use cases for Bitcoin have attracted criminal elements, which will become a target for law enforcement. I have been told, personally, by two people in a position to know that if Bitcoin becomes successful it will be shut down and forced underground. Finally, the value fluctuates with rumors, which makes it difficult to use as a stable exchange of value and payment medium.

Even with all these problems, it’s probably a good idea to keep a little Bitcoin around on a memory stick as a hedge, as it’s difficult to send silver coins around the world. However, it will only work when the Internet continues to operate and electricity is available. – C.K.

Economics and Investing:

Venezuela is on the brink of a complete economic collapse – G.G.

o o o

Baltic Dry Index Falls to 325, 1,430 Vessels Need to be Laid Up to Restore Balance – B.B.

o o o

Items from Professor Preponomics:

US News

70% See American Dream Out of Reach (Washington Examiner) Herein lies a substantial portion of the problem. People do not see solutions coming from within themselves, and so they seek solutions through government. Excerpt: “The current political environment has voters thinking the federal government is an ineffective mess that is causing more harm than good. However, they still want this government to be doing more…”

Lost Decade for the US Economy (Business Insider) Excerpt: “Wait for it … welcome to the new normal. The economy hasn’t managed a single year of even 3% growth since 2005. A lost decade, at least by American standards. (We’re not Japan, after all.)”

The $29T Corporate Debt Hangover That Could Spark a Global Recession (Contra Corner) Excerpt: “Whether this debt overhang proves to be a catalyst for recession or not, one thing is clear in talking to credit-market observers: It’s a problem that won’t go away any time soon.”

Mortgage Rates Fall for Fourth Week in a Row (Washington Post) Excerpt: “Investors remain leery of stocks and instead are seeking safety in bonds, which in turn drives down home loan rates.”

Real Estate Wars: Inside the Class and Culture Fight That’s Tearing San Francisco Apart (Business Insider) Excerpt: “America’s biggest cities are experiencing a land rush, with the wealthiest residents buying up property and squeezing out the middle and lower classes…” Environments like this are ripe for increasing use and abuse of eminent domain. From Reason.com: Theft by Government Continues Through Eminent Domain

International News

Swiss Government Proposes Paying 1,700 a Month Whether They Work or Not in a Big to End Poverty… (Daily Mail) Helicopter money is not the solution. It will never lead to freedom from want. It will only lead to the growing dependence of people on government, to the ever expanding role of government in the lives of those people, and ultimately to tyranny.

Personal Economics and Household Finance

12 Skills for Preppers that Money Just Can’t Buy (Backdoor Survival) Invest in your mindset, your skill sets, and train up! Excerpt: “The biggest stockpile in the county won’t be enough if you don’t learn the important skills that will carry you through when you’re faced with hard times. Likewise, there are certain personality traits that will enhance your ability to survive.” Read on.

o o o

SurvivalBlog and its editors are not paid investment counselors or advisers. Please see our Provisos page for details.

Odds ‘n Sods:

“Free French”, a retired cop, has a video commentary out on the LaVoy Finicum shooting video released by the FBI. From the start there were serious issues in how the OHP and FBI set this arrest up. From starting with lethal force options where there was no justification to placing their own officers/agents in a cross fire situation, to using illegal roadblock techniques, to breaking cover to engage Finicum while standing behind an uncleared vehicle, there are serious problems all the way through.

o o o

Israel’s power grid has been partially taken down by a cyberattack. If theirs can be taken down, so can ours. – D.S.

o o o

From the desk of Mike Williamson, SurvivalBlog’s Editor At Large: Amazon security leak of personal info. Human engineering at its finest. This likely applies to many retailers. It’s safest if you don’t keep a mailing address on file, or use a rechargeable card for purchase and not your standard credit cards.

o o o

Carla Emery’s daughter continues her mom’s off-grid tradition. (Carla Emery wrote the bestseller Encyclopedia of Country Living)

o o o

SurvivalBlog reader MtH wrote in: This was disturbing news considering the problems that stem from these “refugees”. Figured those in the Redoubt and elsewhere should be aware of this and the push. Helena and Missoula situational awareness

Hugh’s Quote of the Day:

“A few years ago, users of Internet services began to realize that when an online service is free, you’re not the customer. You’re the product.” – Apple Corporation CEO Tim Cook

Notes for Sunday – January 31, 2016

On January 31st, 1950, President Harry S. Truman publicly announced his decision to support the development of the hydrogen bomb, a weapon theorized to be hundreds of times more powerful than the atomic bombs dropped on Japan during World War II. Truman called it the “superbomb” in his public announcement. His decision was driven by the discovery that Klaus Fuchs, a top-ranking scientist in the U.S. nuclear program was a spy for the Soviet Union and that the Soviet likely knew everything the U.S. did about building a hydrogen bomb.

January in Precious Metals, by Steven Cochran of Gainesville Coins

Welcome to SurvivalBlog’s Precious Metals Month in Review, by Steven Cochran of Gainsesville Coins where we take a look at “the month that was” in precious metals. Each month, we cover the price action of gold and examine the “what” and “why” behind those numbers.

What Did Gold Do in January?

Gold started the year around the $1,061 mark and quickly blew that away as stocks worldwide saw the worst start to a year in nearly forever. This caught a record number of speculators short, who had to scramble to cover their bets. By the 7th of January, gold had rallied above $1,100– the best rally since last October.

Between oil falling below $30 a barrel, economic reports around the world signaling the start of another recession, and stocks bleeding all over everyone’s portfolios, gold was the best game in town. Spot prices hit an intraday high of $1,128 an ounce for January, on the 26th.

For a look back at gold’s performance in 2015, this retrospective by our own Everett Millman hits the highs and lows.

Factors Affecting Gold This Month

January was an extremely bad month for equities and oil, and most of the pain originated in China.

SHANGHAI MELTDOWN

Interventions by the Communist government in Beijing failed to mask that the economic slowdown in China is far worse than the official numbers say. In an effort to stop the big sell-offs the Shanghai stock market experienced last fall, the government implemented a “circuit breaker” to temporarily halt trading, similar to the ones used in Western stock markets. However, they set the bands way too tight, halting trading for 15 minutes if stocks fell by 5% and closing the market for the day if losses hit 7%. This led to more panic selling, instead of calming the nerves of investors.

In what may have been the shortest trading day for a major stock market in history, the Shanghai stock market closed for the day after only 29 minutes of trading. Thirteen minutes after the market open, stocks had already fallen 5%. This led to a 15 minute halt in trading, which was used by panicked investors to prepare sell orders to immediately execute when trading resumed. A frantic race to sell before trading was halted led to the market hitting a 7% loss in less than two minutes. Trading was halted for the day 29 minutes after the opening bell, with only 14 minutes worth of actual trading occurring.

NIGHTMARE ON WALL ST

The total meltdown in China combined with disappointing economic data in Europe and the U.S. caused the U.S. stock market to have its worst start to a new year ever. The Dow fell so badly that you had to go back to 1892, four years before the Dow was even invented, to find a worse start for the year for blue chip stocks. Disappointing earnings, weaker than expected economic data, and plummeting commodities (especially oil) combined for a perfect storm that sank everyone’s portfolios for the month.

OIL PLUMBS NEW LOWS

The oil glut continued to spread the pain in January, dipping below $30 a barrel at one point. Saudi Arabia’s arch-enemy, Iran, returned to the oil markets this month and immediately cut prices in an effort to win back customers in Europe and Asia. The two nations have seemed at the brink of war, with riots breaking out in Iran after the Saudis beheaded a Shiite cleric who was involved in the failed “Arab Spring” movement in Saudi Arabia. Rioters in Tehran burned the Saudi embassy, and the Saudis broke all diplomatic and trade ties in retaliation. However, the oil market is so flooded with crude that even this was unable to get prices to rise.

On the Retail Front

Once again, all the mainstream talking heads were unable to dent retail demand for precious metals. 2016 American Silver Eagles kept the ball rolling after the bullion coin set another all-time record in 2015. Forty-seven million ASEs were sold last year, compared to the previous record of 44 million. Silver Eagles have set new records in seven out of the last eight years.

Silver Eagle sales in January topped six million ounces, with Gold Eagles and Gold Buffaloes combining for a very respectable total of 156,500 ounces.

The Chinese government continues to gobble up physical gold, adding 610,000 troy oz (19 metric tons) to its reserves in December. The Germans are finally prying a decent amount of gold from the New York Federal Reserve’s claws, announcing that it repatriated 100 metric tons of gold from the Fed, and 110 metric tons from the Bank of France.

Market Buzz

Speaking of central banks, Jeff Neilson relates how Iceland broke the grip of the international banking system and even jailed some of the bank officials responsible for Iceland’s financial crisis.

The mainstream is finally getting a dose of bullion reality from their own, as top money manager Jeff Gundlach predicts gold will rise 30%.

Short-term investors are fleeing the nightmare of the stock market and increasing their exposure to precious metals. Inflows to gold ETFs have increased dramatically this month.

Famous investor Marc Faber says that if he had to choose between the Dow Jones stock index or gold, he’d choose gold.

Even “too big to fail” megabank Royal Bank of Scotland is telling its clients to “sell everything” as they see a “cataclysmic year” for 2016.

Much of that pain is in the commodities sector, as producers of everything from lead to oil struggle to survive.

Another TBTF bank is looking to exit the London Gold Fix in light of regulatory attention, as Barclays is rumored to be looking to sell its entire precious metals operation.

As the Western banks exit the gold fix, China steps to the plate. ICBC, the world’s largest bank, has purchased the London gold and silver vaults of Deutsche Bank, who abandoned its seat on the gold fix after investigations into wrongdoing focused attention on its precious metal operations.

China, which is the world’s #1 gold producer and #1 gold importer, is tired of the Western banks setting the gold price. It is starting a yuan-denominated Shanghai Gold Fix in April and will punish foreign banks that do not participate.

Looking Ahead

The dismal state of the world’s economies, including the U.S.’s, makes any more rate hikes by the Fed unlikely. The next Fed meeting is in March, but market analysts think the next rate hike, if any, will not be until July. At press time, rumors are spreading that Russia and Saudi Arabia will agree to oil production cuts. Cratering oil prices over the last year and a half have put both totalitarian regimes in danger of popular unrest, and the only cure is to get the price of oil to rise. (What! You think they’d allow democratic reforms?)

In good news in the fight against the militarization of local law enforcement and the over-aggressive behavior it seems to promote, the government is forcing police and sheriff departments across the nation to return the heavy machine guns, armored personnel carriers, grenade launchers, and bayonets they received as part of the “war on terror” on American soil. Some gung-ho law enforcement officials are upset at losing their army toys, but what does a sheriff’s department need a Ma Deuce for?

Two Letters Re: Bug Out Boats

Hugh,

Anyone considering a bug out boat should take a look at steel hulled sailboats in the 30 to 40 foot range. They offer excellent ballistic protection as well as the structural strength to resist all manner of collision or grounding incidents. Additionally, steel will not burn or be damaged if frozen in place by thick ice. Most of the modern steel boats sail well, are insulated for warmth, and are often equipped with a wood stove. A quick search on sailboatlistings.com will yield some affordable options. Stay safe! – Fixer

o o o

Hugh,

I’m sorry, but I have to say something about the armchair sailors thinking of taking to the water when they bug out. I was a professional sailor (Merchant Marine with Coast Guard Docs) until the late 80’s. I don’t think many things have changed, but sailing back then was dangerous, and I’m sure it’s even more so now.

Fact: Most Merchant Mariners don’t and won’t own a boat. A boat is one of the most fickle of living environments and the hardest to guard against from bad guys who might want to take your home. You will always be limited on water, food storage, and personal belongings. With more people, you have even less room.

Remember the people on shore can watch you in the bay setting up your anchor and have all the time in the world to overcome you later at night or when you come to shore. All it takes is a quiet row or swim around your boat when you are sleeping and then quietly climb aboard and overcome you.

Fact: There are pirates everywhere, especially in the Caribbean, tropics, and along Mexico down to South America. You just never hear about them. Pirates can be a couple who look like nice friendly folks who might be great friends until they overtake you and take your boat away. Many of these people have hopped on many boats over the years and dump the old one when they need a new vessel and they have usually killed the old owners or left them to die. When I was sailing on the bigger boats (tugboats, et cetera) we had a lot of strange things happen. You have a large boat and small crews, so it’s hard to watch every inch of the boat or to hear anything unusual over the engines. We had other vessels come close with their lights out, and when you tried to hail them they would keep radio silence. We had other vessels warn us that we had a stow-away on our barge, but the stow-away would be gone by the time we got out the skiff and went back to the barge.

Boats need a lot of maintenance and are very easy to get hurt; also, when you are working it’s easy to fall overboard. You should have a lot of skills such as navigation, sailing and boat handling skills, mechanical, electrical, plumbing, hydraulic, and woodworking skills. Also, welding, wire working, rope, and splicing skills are needed too. I have been on boats that have broken down, and it was up to us– the crew– to fix all of the above. Many times we’d find we were out of fresh water or that the refrigerator/freezer system had gone down. Boats and the equipment on them take a hard beating.

Fact: There are “deadheads” everywhere and will probably be more if shipping companies go broke. Deadheads are items floating in the water just below the waves; these include shipping containers that have fallen off of freighters in a storm and other items, like floating logs. It’s very hard to see these. One time our tug hit one; it completely destroyed our huge propeller. There are also numerous fishing gear traps, along with large rope lines floating, that can get wrapped around your propeller and foul it up. (It’s very hard to get these unwrapped.)

Anyway, these are just a few things to think about and prepare for. There is nothing better than a great sailing voyage, and there is nothing worse than a horrible one. If you do this, please know as much as you can. The ocean and weather can be very unforgiving. – R.R.

Economics and Investing:

How Do You Know When Your Society Is In The Midst Of Collapse?

o o o

Unsocial Insecurity: Social Security Fund loses money for the first time since 1983. The new retirement model will have you working until you fall over from a heart attack.

o o o

Items from Professor Preponomics:

US News

Are Government Regulators More Virtuous than Everyone Else? (Mises) Excerpt: “One can’t help but notice the central contradiction in this analysis. On the one hand, it is assumed that markets fail because of “normal human weakness.” On the other hand, it is assumed that regulation, which must necessarily be implemented by human beings with equal or greater “weaknesses,” will somehow solve the problem.”

10.2 Million “Detached”, Jobless Millenials, Potential Lost Generation (Washington Examiner) Tragically, this is a crisis not likely to be understood for a very long time. Excerpt: “Teens and young adults were among the groups hit hardest by the global financial crisis. And while many young people have since regained their footing – as employees, students or both – there are still millions in the U.S. and abroad who are neither working nor in school.”

Puerto Rico Plans Debt Exchange Offer Friday (Market Watch) Commentary: The proposal is interesting in that it includes one fixed rate return and a second variable rate return tied to Puerto Rico’s fiscal health. However, it really is just old debt exchanged for new debt. Based on the history of a spendthrift government, it’s difficult to imagine a successful outcome in this endeavor if the goal is to truly reduce debt. Fiscal discipline always sounds good on paper, but its application over the long run is much more difficult. This is especially true where politicians are involved. Furthermore, the amount of debt in the context of all other conditions affecting Puerto Rico may simply be beyond repayment. It is my opinion that write downs are inevitable, although all parties will attempt to kick the can still further down the road.

International News

Bank of Japan Stuns Markets with Surprise Move to Negative Interest Rates (Reuters) Excerpt: “In adopting negative interest rates Japan is reaching for a new weapon in its long battle against deflation, which since the 1990s have discouraged consumers from buying big because they expect prices to fall further. Deflation is seen as the root of two decades of economic malaise.”

It’s Starting to Look Like Russia Will Have the Biggest Impact on Oil Prices This Year (Business Insider) Despite the tough talk, the collapse in oil prices may be creating economic strain sufficient to bring the most powerful decision makers back to the negotiating table. Will they come to a new agreement on production? We’ll see.

Goldman Sachs Calls Brazil a MESS After Warning on Depression (Bloomberg) Excerpt: “We don’t know the bottom…. It’s hard to talk business when the person across from you will go to jail. We don’t know which government will be there tomorrow.”

Personal Economics and Household Finance

How “Mean Moms” Teach Their Kids About Money (Living on Cheap) Excerpt: “How much do your kids know about money? I don’t mean, how much do they know about how to wheedle a dollar out of your wallet for the vending machine; I mean, how much do they know about how money is earned, saved, invested, spent?”

o o o

SurvivalBlog and its editors are not paid investment counselors or advisers. Please see our Provisos page for details.

Odds ‘n Sods:

Someone has released stabilized and zoomed-in video of the Lavoy Finicum shooting that makes the tragic event a lot more clear. Without correlated audio of the FBI’s gunshots, this video is still inconclusive. But to describe this as evidence of Finicum exiting the vehicle and “charging at” the ambushing officers (as it was described by the FBI) is ludicrous. And the sight of him dropping his hands is just as consistent with reacting to the pain of being hit in the abdomen with bullets as it is with the alleged “reaching for his waist” to draw a handgun. There is also a question regarding the officer shooting from the right side. As the officer steps over the snow embankment created by Finicum’s truck, it appears that his foot slips and the firearm recoils. Immediately afterward, Finicum grabs at his abdomen. Did the officer “accidentally” discharge the first round because he slipped with his finger on the trigger? If that was indeed the first round discharge, then Finicum was shot with his hands high in the air.

Any knowledgeable coroner would be able to reconstruct the position of Finicum’s arms at the time of the bullet impacts, at least those that presumably hit his upper torso. But will such an autopsy report ever be released? I have my doubts about the eventual release of any more clear video of the event with an accompanying audio track. I expect the response to inquiries to be something along the lines of, “Sorry, that’s all the video you get. Nothing to see here; move along.”

This whole takedown smacks of jack-booted thuggery with total dominance as the goal– “Do what I say now or die!”.

o o o

Government Using The Psychology Of “Lockdown” To Make Martial Law The Norm

o o o

Several readers sent in the article on SHTFplan.com about The Web Sites They Don’t Want You To Read. We are downright disappointed that we didn’t make the list, as are our readers. Fortunately, Mac Slavo added his own short list, and now you have a page to bookmark with links to all your favorite alternative new sites in one location.

o o o

Vigilant is starting to sound like SkyNet from Terminator: The Ticket Machine – T.Z.

o o o

Sweden’s Army Chief Warns Of WORLD WAR 3 Inside Europe ‘Within a Few Years’ – G.P.