As long as I can remember, my father was prepared for the unexpected. I thought it was because he purchased a series of unreliable Chrysler products in the 70’s and 80’s that consistently broke down. (MOPAR– the name of Chrysler’s Parts Division– became an acronym in our house for “Moments Of Power Are Rare”). The fact of the matter was that my father “bugged out” of his native Lithuania with his family at the age of 14. Following World War II, he and his family were placed in a Displaced Persons (DP) camp for native Lithuanians in what would become West Berlin. The wisdom of my grandfather to leave Lithuania was based on his self-reliant attitude and world view. The lessons my father experienced and passed down have served me and my siblings well. In recent years, I have become more self-reliant as a result of my own personal experiences with Hurricane Sandy in 2011.

Just like The Clash song “Should I Stay or Should I Go” expresses great indecision, my grandfather’s decision in early 1944 was not a simple one. Lithuania is a small country located in Eastern Europe on the Baltic Sea. It has always been victim to many of the world’s largest conflicts. Nepoleon, Russian Czars, Hitler, and Stalin all have had their grip on the small Baltic nation. The capital city of Vilnius is crudely referred to as “the city built on bones”, as a reference to its storied history of genocide, death due to war, hypothermia, and starvation. In 1943 Hitler’s well-documented campaign to attack Russia went directly through Lithuania. Like well-seasoned chili, you know it is spicy when it burns twice; Lithuania was in fact burned twice by Soviet occupations.

My grandfather’s decision to leave was largely based on his experiences during the first Russian occupation of Lithuania (June 15, 1940-June 24, 1941). Lithuanian’s who did not sympathize with the Soviet Bolshevik ways were imprisoned, exiled, or killed. Any show of nationality, other than with Soviet views, was treated with harsh realities of imprisonment or torture. My uncle was imprisoned for singing the Lithuanian National Anthem in public during the first Soviet occupation. When Germany took over the small Baltic nation (June 25, 1941-July 1944), life was relatively good, if you were not Jewish. German leaders were warmly welcomed by most Lithuanians. A very dark history of the German occupation was the slaughter of almost all Jews in Lithuania; 95-97% were “liquidated”. I want to be perfectly clear on this point; some Lithuanians had anti-Semitic views and murdered many of their own citizens during the German occupation. It did not take the Nazi propaganda machine and extermination camps to almost annihilate every Jew in Lithuania. Business men, farmers, lawyers, laborers, and doctors rounded up Jews and marched them to their deaths in the forests of Lithuania (Paneriai, Ninth Fort). Obviously, the Nazi’s job was made easier by the hands of these native anti-Semites. This information is based on my grandfather’s first-hand accounts and experiences, not a slanted view text book or current Lithuanian government propaganda. Jews were hated in Lithuania mostly because they were successful, well-educated, and industrious people. God alone has been and will be the only true judge, jury, and justice for these crimes on my Hebrew brothers and sisters.

As German soldiers were retreating back through Lithuania, cold, hungry, and defeated, my grandfather determined it was time to go. My grandfather was not waiting for the second occupation by the Soviets. He was a well-traveled farmer, who had already been to the United States and Western Europe. He knew it was time when the Nazi soldiers were walking through his farmland dropping their heavy gear, to retreat at a greater place. The sound of Russian mortars and artillery in the distance was also a clear sign to start moving out. His instructions to my father, aunts, and uncle were to milk the animals and then slaughter them. Load up the milk, meat, dried cheeses, butter, breads, and water. They yoked the horses to the loaded carriage and west they went with the German soldiers into Poland and, eventually, Germany. To stave off recruitment into the German Army, my father made himself look smaller than he was, and my grandfather and uncle would hide under the wheel well of the wagon when in the company of the retreating German military. They also fed the retreating German soldiers on their track to the end of the war. Just five years ago, it would have been impossible for me to visualize telling my kids, “Grab your INCH bags, mobile food buckets, and filled Scepter water containers from the closet under the stairs, and get the dogs in the truck”. Today, that is a trained reality on our homestead; you need to be ready to leave when “Red Dawn” is happening.

This brings me to the point of my article– you will only know when it is time to leave when it is time to leave! I have never had to bug out. I live in a relatively stable county in Upstate New York. For the most part, we do not have natural disasters, with the exception of Hurricane Sandy’s flooding and an occasional ice storm that knocks electricity out for a week or so. Bugging out for my family will be an absolute last-minute decision based on real-time on-the-ground intelligence. We are prepared for many scenarios, but economic collapse and consequent government overreach is our main concern. In New York, we have been warmed up to the government overreach and the deterioration of our constitutional rights. The New York “Un-Safe Act”, ridiculously high taxes for everything from birth to death, and limits on fountain soda procurement are just a few examples of the overreach. The wisdom that has been passed on to me is: Be prepared. Get ready now. Apply what you know.

My grandfather’s intelligence was talking to citizens, traveling to other countries, being occupied and propagandized by Nazi’s and Soviets, and watching neighbors murder innocent people because of their religious beliefs and relative view of success. The art of my grandfather’s wisdom during his SHTF scenario was to become the “gray man”– don’t be noticed, don’t stand out, don’t take a side, get on the fence and get out of the war zone. Fast forward to our intelligence today in the good old United States of America. The lame-stream media that has become lazy, reporting only what they are told to report for political reasons (propaganda). We have hate and bigotry toward Jews and Christians alike for their beliefs and application of faith (targeted hatred). Perceived bigotry toward black and Hispanic people is perpetuated by the lame-stream media to try and make us feel sorry for the way we treat people when they break the law (illegal challenges to the rule of law). Politically charged courts have now crossed over from interpreting the laws to making laws (lack of checks and balances). Biased laws and interpretations benefit protected classes to the exclusion of unprotected classes (another form of hate). Executive branch leaders have exerted their political power to undermine the foundations of our constitution (more lack of checks and balances). This intelligence is telling me again to get ready now!

I will finish on the practical applications learned from my forefathers:

- Have a bug-in plan and a bug out plan with supplies and vehicles. Put these plans in a binder with your gear for all family members to reference. Make sure it includes a communication plan if phone services are down.

- Have a way to store and carry water.

- Have long-term food available and some packaged for easy transport. Also, have enough food to share and barter.

- Be supplied with firearms, ammunition, and cleaning tools/supplies. Make sure you train and practice with your family how to use, clean, and secure all firearms.

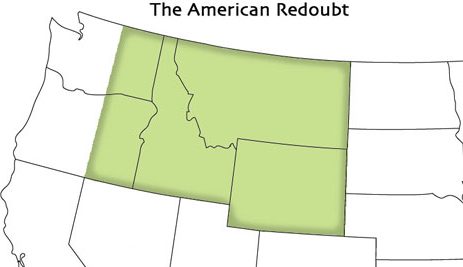

- Have a plan B and C. Know where you can go to be with like-minded individuals, if your initial plan A is altered. Train and put up supplies/tools with these people so you become an asset and not a liability.

- Be the “gray man”, when it is time to move. Do not bring attention to yourself or your family members.

- Have all of your documents in order. These include passports, birth/death/divorce certificates, social security cards. Many of my father’s relatives could not leave Lithuania, because they did not have the proper documents updated or at their disposal when it was time to leave. Keep a copy of these and other important documents on an encrypted thumb drive. This is a good common practice when you travel anywhere.

- Train your spouse and children how to execute your bug out plan. You are doing yourself a disservice if you are the only one that can execute the plan. Many hands make light work.

- Stay physically, mentally, and spiritually fit.

- Consistently, analyze and update your plan; also, keep your supplies fresh and rotated.

At my father’s funeral almost twenty years ago, a story was shared about his faith and what he had been through fleeing war-torn Lithuania. At one point the Soviet army was dropping shells near the roadside that they traveled. All of his family retreated off the road into a nearby clearing in the forest. My father jumped into a roadside ditch and would not join his family in the safe shelter of the cleared field. He had mentally broken down. My grandfather went up to him during the chaos, reached into the ditch and said, “Get up; it will be okay”. It was that moment that my father looked up and saw the light of God surrounding my grandfather’s silhouette. Be that person my grandfather was for your family. Teach your loved ones that through faith in God and organized preparation, you can not only survive but thrive in any situation life brings.

May God bless you and this country we currently and hopefully always call home!