Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at declining oil prices. (See the Commodities section.)

Precious Metals:

Gold-To-Silver Ratio Rises To Highest Level Since 1990.

o o o

Gold Bull Peter Schiff Warns That This Recession Is Just Getting Started.

Economy & Finance:

Some creative tap dancing, by the Dallas Federal Reserve Bank: U.S. Likely Didn’t Slip into Recession in Early 2022 Despite Negative GDP Growth. JWR’s Comment: Levon Helm, portraying Mr. Rate in Shooter said it best: “They also said that artificial sweeteners were safe, WMDs were in Iraq, and Anna Nicole married for love.”

o o o

At Wolf Street: Layoffs, Discharges, Quits, Job Openings, and Hires: Still Massive Churn & Job Hopping, but Losing Some Steam.

o o o

At Quartz: The weird contradictions rendering the US economy inexplicable.

o o o

These Experts Predict the Worst Is Yet To Come in the Stock Market. Here’s Why — And How To Prepare.

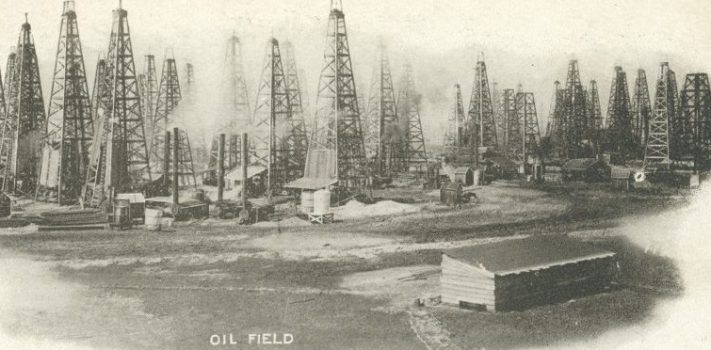

Commodities:

OilPrice News reports: WTI Oil Dips Below $90 For The First Time Since Ukraine War Began. Here is an excerpt:

“‘The main bearish signal for crude appeared to come from the Energy Information Administration’s data showing an unexpected and sizeable build in US commercial crude inventories and a plunge in gasoline demand for the week ended July 29,’ Vanda Insights said early on Thursday during Asia trade.

The U.S. inventory build and the growing concerns about oil demand in slowing economies were bigger drivers of oil prices than Wednesday’s decision of OPEC+ to raise the group’s targeted collective oil production by 100,000 barrels per day (bpd) in September, which was largely seen as a non-event by analysts.”

o o o

Oil drops as weak Chinese factory data heightens demand concerns.

o o o

All three Prairie Provinces say NO to Trudeau’s starvation policy. (Thanks to reader D.S.V. for the link.)

o o o

Inflation Watch:

At Forbes: Inflation Swells To 9.1%—Here’s What’s More Expensive.

o o o

Over at The Capital Spectator: Is There A Case For A Return Of Disinflation/Deflation? JWR’s Comments: In some sectors there may indeed be some price deflation during a recession — particularly in PV panels, consumer electronics, corporate aircraft, and some luxury goods. For many years, I’ve suggested a scenario with simultaneous inflation and deflation.

o o o

Report from the UK Guardian: Unilever lifts prices by 11% as it passes on higher costs to customers.

o o o

Soaring Inflation Puts Central Banks on a Difficult Journey.

Forex:

o o o

Turkish inflation hits almost 80%, peak might be near.

o o o

Euro area annual inflation up to 8.9%.

o o o

Meanwhile, the ShadowStats figures for the US Dollar look grim.

Tangibles Investing:

Up, Up, Up: 3-Year Farmland Price Trends from 18 States.

o o o

Will More Farmland Acres Hit the Market this Fall?

o o o

Palmetto State Armory (one of our affiliate advertisers)

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. And it need not be only about commodities and precious metals. Thanks!