Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at the looming threat of a Federal Universal Background Checks law. (See the Tangibles Investing section.)

Precious Metals:

The bond worm has turned: Sharp price declines in gold, silver amid firmer USDX, rising bond yields

o o o

Sprott: Historic Washout in Bond Market Clearly Impacts Precious Metals

Economy & Finance:

At Zero Hedge: Rickards: The Great Reset Is Here

o o o

Reader G.G. flagged this, over at the AIER website: Yes, This Time We’ll Have Inflation, and Here’s Why.

o o o

At Wolf Street: Fed’s QE: Assets Hit $7.6 Trillion. Long-Term Treasury Yields Spike Nevertheless, Wall Street Crybabies Squeal for More QE

Commodities:

H.L. sent us this:

o o o

US May Boost Rare Earths Mining to Counter Threat From China. JWR’s Comment: Don’t count on President Joe Biden (aka “Joe Xiden”) doing anything to counter the strategic interests of China.

o o o

Reader H.L. spotted this item: Framing Lumber and Foodstuffs Soar as Fed Balance Sheet Approaches $8 Trillion

Derivatives:

o o o

Spike in bond yields dented some hedge fund February returns

Forex & Cryptos:

Over at Currency Thoughts: U.S. Manufacturing Advantage Narrows Relative to Euroland

o o o

Sound as a Pound? The Growing Pains of Brexit, 50 Days In. And the same author had this follow-up: Looking on the Bright Side of Brexit, 60 Days In

o o o

Crypto Trader Lark Davis Lists Top Six Altcoins To Buy in March

o o o

Video interview: Building a Bitcoin Prison – Catherine Austin Fitts

o o o

Bitcoin Price Outlook: Executive Sees BTC/USD At $60,000

Tangibles Investing:

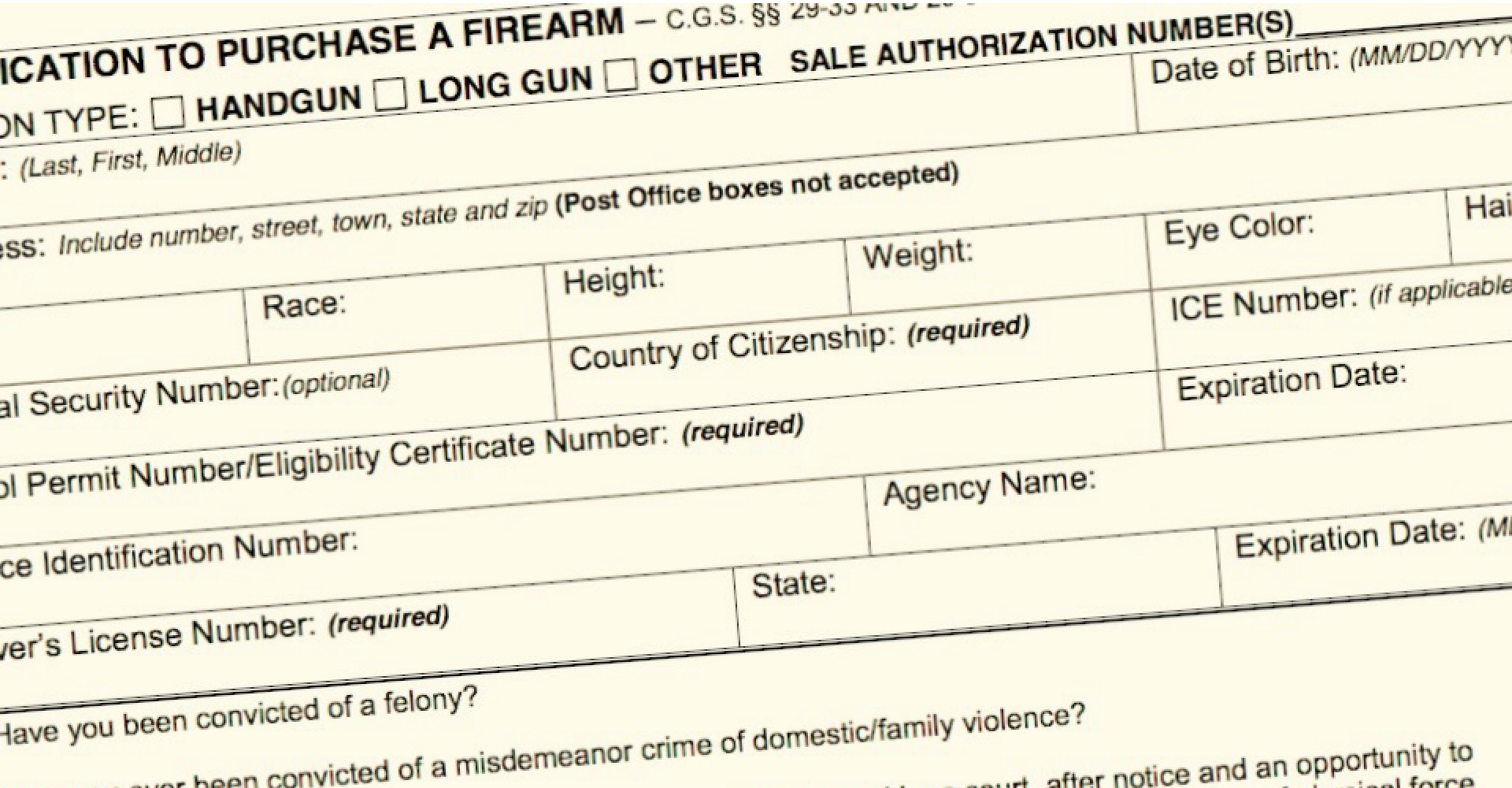

I warned you, folks! Three different “Universal Background Checks” bills are now pending in Congress. It has been reported that the Democratic leadership is pushing to fast-track their favored bill for a floor vote within 10 days. The passage of this legislation is a fait accompli in the House, and quite likely in the Senate. A few traitorous RINOs have signed on. The word from inside the District of Criminals (DC) is: “We have momentum on this.” So please contact your Senators and demand that they oppose this and all other “gun control” legislation.

Meanwhile, I suggest that you hedge your bets, as follows:

- Take a long, hard look at your family’s firearms battery. Determine what you really need. Also, determine what guns you consider excess and could trade for more important guns. (That is, without sacrificing any family heirlooms.)

- Think through a multi-generational scenario. What are the gaps in your collection?

- Re-prioritize your budget and your tangibles investing portfolio.

- Seriously consider drawing down some of your savings to fill in any gaps.

- If you live in one of the 33 States that still allow private party transfers, then buy or trade privately, with CASH.

- If you have an expensive vacation planned, then cancel it. Go to a few gun shows, instead,

- If your budget is tight, then try to find unpapered AR-15 stripped lowers that you can finish building later.

- If you have any liquid assets that are unimportant, then consider selling or trading them, for guns. What will be more important to your family’s future? Your 1978 Trans-Am, your collection of obscure mint error coins, or a good selection of battle rifles?

I believe that time is short — “Universal Background Checks” could become the law of the land in as little as 120 days. Get serious about this, folks. If you don’t already have a sense of urgency, then you may very well get blindsided.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. And it need not be only about commodities and precious metals. Thanks!