Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at sterling silver platters, tea services, and silverware.. (See the Tangibles Investing section.)

Precious Metals:

To start off, here a link to an article that I missed when it was posted by Forbes, back in June: Emerging Technologies To Drive Silver Demand

o o o

Egon von Greyerz: Dark Years And Fourth Turning. A pericope:

“Since 2009, global debt has doubled to $280 trillion and risk has increased exponentially. The final stage of the collapse started in August of 2019 with the central banks panicking and embarking on a massive money printing spree due to major problems in the financial system.”

Economy & Finance:

At Wolf Street: Subprime, No Problem? FHA Mortgage Delinquencies Hit Record 17.4%, as Fed Triggers Mad Land-Rush in Split Housing Market

o o o

Grim Summer Turns to Long Cold Winter for European Airlines as Passenger Traffic Dives Again

o o o

Podcast — THE WOLF STREET REPORT: What’s Behind the Fed’s Project to Send Free Money to People Directly

o o o

And at Zero Hedge: Hedge Funds Flock To Florida As Wealthy Americans Seek Lower Taxes

Commodities:

OilPrice News reports: U.S.-Seized Iranian Fuel Cargoes Stuck In Legal Limbo

o o o

Commodity Markets: the New Normal for 2020 and beyond

Derivatives:

News from the New York Fed: Tentative Outright Agency Mortgage-Backed Securities Operation Schedule. “The Desk plans to conduct approximately $52.9 billion in agency MBS purchase operations over the period beginning September 15, 2020 on FedTrade.”

o o o

Tradeweb Announces Expansion of Mortgage Trading Platform

Forex & Cryptos:

Curious, isn’t it, that the official exchange rate is around $81 Zimbabwe Dollars to buy One U.S. Dollar, while the practical traded rate internationally is around $362-to-1. And meanwhile, the real rate can be found on the streets of downtown Harare. (The former Salisbury.) There, it takes somewhere around 400 Zim Dollars to buy $1 USD. The rate of currency inflation in Zimbabwe is now approximately 25% per month, and the food price inflation rate is 977% per year.

o o o

Why Iran could be approaching hyperinflation in coming years

o o o

New Zealand’s tax authority grills companies for info on crypto users

o o o

Cash a ‘melting ice cube’: MicroStrategy’s Saylor talks about move into Bitcoin

Tangibles Investing (Silverware):

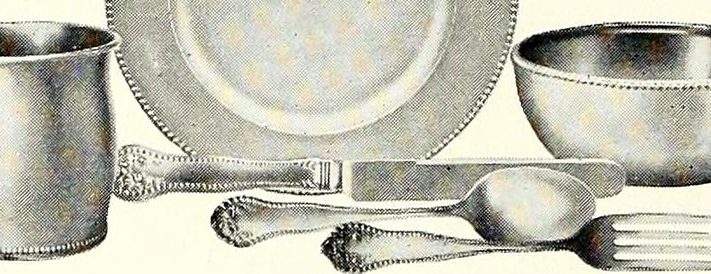

With the recent rise in silver prices (up 45% in 2020), now is probably a good time to renew your search for sterling silver platters, tea services, and silverware at estate sales, thrift stores, and elsewhere. As I’ve mentioned before, true Sterling pieces usually bear guild hallmarks and will be stamped “STERLING”, “STG”. “STER”, or “925”. The latter refers to the 92.5% silver purity of true sterling silver pieces. You might also find pieces that are marked “D”, “Coin”, “Coin Silver”, “Dollar”, or “900” usually have the same 90% silver content of pre-1965 dimes, quarters, and half dollars. But in all cases, beware of fakes. Usually, these are plate silver pieces being passed off as solid sterling silver. And beware of weighted pieces, particularly candlesticks. Here is a YouTube video by an Englishman who shows some key things to look for. Sterling silver hunting requires patience and persistence. Truthfully, 99 times out of a hundred, it will just be silver plate. But then there is that 100th dream piece. So it is indeed worth your time to prowl thrift stores.

o o o

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. And it need not be only about commodities and precious metals. Thanks!

Ok so once you’ve got that silverware, candlestick and serving tray then what?

Whatya do with them?

I’m asking because I seriously do not know but actually know where some is that’s not being used and no one seems to want.

Well, you get a Butler to bring whatever you desire on that serving tray of course. Elementary, Watson!

LOL but I failed elementary

you failed in comments too

Tammy D Rogers: You are right!

Matt around here we have pawn shops that will buy them for less than scrap value. But like searching half dollars for the 40% and 90% silver older coins that has been done by decades of seekers before you.

Thus the caveat of the 100th piece of non-plated silverware.

A far better rate of return would be putting on a Mc Donald’s shirt and going to work for the hours spent searching for the elusive .925 silver. At least you’ll get minimum wage+ and a free meal.

Or maybe improving your chicken yard to prevent losses to predators, 2-4 legged, winged and so on.

What is the value of a productive chicken house (And growing your own feed) when the grocery store is bare?

During Weimar Germany Hyperinflation “Rich” people traded family heirlooms for smuggled in sacks of potatoes. Something to think about. Food had to be SMUGGLED into the Cities to get past thieving Soldiers-Police and family silver traded for potatoes….

As it was in the past it will be again under Socialism.

Germany had 100.000 Soldiers during this time, Navy included, show me please how the soldiers did that

Always the Argumentative ThoDan 🙂 I HAD Relatives LIVING through the Weimar Germany episode so my information did not come from sanitized history lessons. They were also there during Kristallnacht and fled Germany with small gold coins hidden in their clothing to keep the soldiers and policemen from taking all their valuables.

Folks act poorly when hyperinflation and hunger is stalking the land.

Me Too, that was one of the reasons i asked, i think that this is possible with 100.000 soldiers vs 80 Million people and i heard nothing of that act.

Except you meant the entente soldiers did that, that could be possible in the occupied territories

I agree that it’s not a time worthy option but if I know where it’s sitting in storage then what do you do with it? Your also very right about the pawn shops not offering much but that’s business.

Matt, bring it a reputable pawn shop and they’ll give you money for it. We did it the last time silver was way high and brought a bunch of my wife’s no longer worn jewelry. A buddy was a coin collector so he told me where to go, it was actually a coin shop but he bought scrap gold & silver too.

I haven’t searched halves in over a year but that coin always gave the best results in searching a box from the bank. One time a friend got hand rolled nickels at a bank and they were all the silver war nickels! Only $10 but free silver. Also, as a note for finding silver in the wild, our local coin/precious metals dealers will NOT take even marked silver candlesticks. He stated many are weighted inside thus not solid silver and too much work to separate to scrap. Not to say they don’t have value but remember not solid silver

You need to have a scale so you can get an accurate weight measurement. Then you would calculate the weight of silver through percentage, followed by spot price of silver = value. There are many calculators available online that will give you the melt value of sterling, silver coinage and even dental gold by weight. There will of course be a dealer markup/discount. Happy hunting!

It is a classic example of supply and demand. You can make the same argument about classic cars, paintings and diamonds. It simply depends on what someone at some time in the future will pay for it. AND what you believe they will pay for it.

More millionaires have been made rich by real estate than all other sources combined. The asset appreciates and the owner sells at a profit. No different than buying silver, gold or M4 carbines.

Matt in Oklahoma: Most folks consider Egon von Greyerz to be the smartest guy in the room. With his gloom and doom predictions maybe he owns Zero Hedge?

I dunno. Never heard of him. I’m just an average guy. There isn’t much use in me following a Swiss gold banker anymore than me following the top brain surgeon on the latest techniques because I’ll need neither to educate me for my next life moves.

I do know that if you wake up and cry wolf everyday on your site or vocally no one listens to you and law of averages says eventually you might be right but it doesn’t negate all the wrongs.

Kids learn that in school. It sticks with most.

Once you find the sterling silver, it can be sold as scrap but I highly recommend doing research on whatever specific brand you find. Some older brands of silver are worth far more sold on eBay as a collectible.

Sterling silver IS OUT THERE for pennies on the dollar. I like to go thru boxes of silverware at estate sales, yard sales and flea markets. Bring a magnifying glass to check the proof marks and engraving. I’ve managed to fill a .50 cal ammo can with sterling flatware one piece at a time. My best find was an old Gorham sterling silver art moderne serving ladle for $2. Carefully researched and described on eBay it sold for $300. That bought a lot of silver eagles for savings.

Thanks for that suggestion

My local gold, silver, and coin dealer buys sterling silver for pretty close to spot. He calls it “melt”.

Montana Can Vote To Stop Gun Control

https://youtu.be/AyZvrBpeoyA?t=110

They are a storehouse of value just like gold and silver coins or bullion. If you need other survival supplies buy those. This is to preserve some wealth till after the event. Possibly even some barter during event.

Using silver utensils also gives your body trace elements of silver which is good for your immune system.

Hi, Matt!

Your question is a good and reasonable one. The first option would be to make daily use of the silver platter and flatware. Here’s a link to an article that explains why this is a good idea. https://bowlofherbs.com/silver-utensils-eating/

Consider the old sayings, “He was born with a silver spoon in his mouth,” and “He’s a blue-blood.” These expressions came about because people noticed that wealthy people who used silver dishes and flatware for daily dining seemed to remain in better health than people of lesser means who used wooden or pewter dishes and flatware.

A second option would be to pack these items away as a tangible investment, just as you would do with silver coins.

Ma G! These are very good thoughts… My first impression about the silverware was “hold it and maybe use it, but don’t sell it”.

Yeah but we don’t have much use for a silver serving tray round here.

The coin dealers don’t buy this stuff so I’m just trying to figure out what you do with it once you’ve got it.

Hi Matt,

An answer has already been posted, but I’d like to address why I purchased some Sterling silverware about a year ago. It was at an auction and researching prior to bidding I was knew the spot price of silver and the weight of the silverware set. Deducting the weight of the knives that typically have stainless blades, I did the math and my winning bid out the door price was well below spot. Since that time the price of silver has gone considerable higher making the purchase an even better value. It is worthwhile to note that I have not had that below spot financial advantage when purchasing silver coins or bullion.

Now what to do with it? Silver coins are set aside as a way to store wealth, but from my perspective they are primarily worthwhile as a viable unit of exchange, like a dime or two for a loaf of bread. Similiarly, a Sterling tablespoon could be used in a manner akin to silver coin(s). However, something the size of a tray would necessitate bartering for a more expensive item(s), or receiveing coins in change, or even perhaps removing a piece from the platter.

Just the other day I was looking at a heavy Sterling chain necklace and had the thought that one could remove a link at a time for bartering. I think as a group, Preppers have the imagination to see opportunities and sometimes we only need a little nudge to get us thinking….

Respectfully,

Interesting suggestions

Thanks

Precious metal hoards from the time of the Roman Empire’s collapse contain both gold coins and what is called “hacksilver” — silver fragments cut from silver dinnerware, etc to be used as improvised currency. With the gold coins used to buy off invading warlords.

http://www.thehistoryblog.com/archives/30361

Fortunately our Empire has fiat money from the Federal Reserve’s Philosopher Kings and so we don’t need to resort to such expedients.

If you sell the silver, the dollars will lose value. The silver will in crease in value.

The only good use for dollars today is to buy tangibles…oh, a hold a few as gifts/bribes for folks who think they are worth something in times WROL.

Carry on

Peter Schiff Argues with Marxist Richard Wolff

(YouTube Video, 26:47)

Peter Schiff

Sep 28, 2020

https://www.youtube.com/watch?v=hhPmV7kpqE8

Good example of an academic economics professor teaching Marxism…

I need a job and will apply for the “Butler” position once posted…

JWR is handing you pearls here.

1) There have been multiple news reports of people being burned by fake bullion coins and slabs from China –both silver and gold. The only good way I know of verifying that gold or silver is real is to melt it. That’s how the Big Guys do it.

2) Fortunately, gold and silver have low melting points — which is probably why they are prized and platinum –which has a very high melting point — is selling for much less even though it is more rare.

3) I think in the future scrap gold or silver will be the primary version of precious metals. With bullion coins not being accepted — or scrap for that matter — unless they are melted and weighed in front of the buyer.

4) Plus if you can find real silver at flea markets, thrift shops, etc you avoid the ridiculous premium bullion dealers impose.

5) Two points: The US Tax Code is pretty hostile to “collectibles” other than official US Eagles from the US mints. And you may find that any dealer buying your stuff will collect your personal identification for reports to state and federal tax authorities. And the tax guys may want to know what your “basis” is –what you paid for it originally — to judge your ill-gotten gains. If you don’t have receipts then the basis may be set very low by them. You can check the tax publications for current details.

6) I think of PMs as something to carry to foreign lands or post-TEOTWAWKI purchasing. If you envision them as stores of value for recovery in foreign lands after the US dollar crashes, then it makes more sense to buy them now overseas and bury them there somewhere rather than think you can smuggle large amounts past border guards in a chaotic crash.

7) As far as use here in the USA goes, Franklin Roosevelt banned private possession of gold in the Great Depression –everyone had to turn their private hoards into for $35? an ounce. So much for the “government can’t take private property without compensation” clause in the Bill of Rights.

8) I personally don’t put any faith in the sealed plastic cases of “certified” bullion coins — since I think those cases/seals can be faked as well.

And I think when Roosevelt had the gold turn in the people could keep five $20 gold pieces. They received $20 each and then he turned around and revalued it to have it become the $35/oz that was in effect til Nixon took the US off the gold standard.

Looking for this stuff can be tedious and as one suggested it’s probably easier to just get a job but my wife and I like to go antiquing and I sell a lot of cr*p (I mean, high quality products) on eBay so they go hand in hand. I don’t actually look for silver as I don’t know much about it, but if it sells on eBay it’s worth looking for if you’re at a garage sale or something similar. I find lots of stuff to sell online that way, but I stick to stuff I know.