Here are the latest items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on the recent market turmoil.

Stocks, Cryptos, and Gold (Market Turmoil):

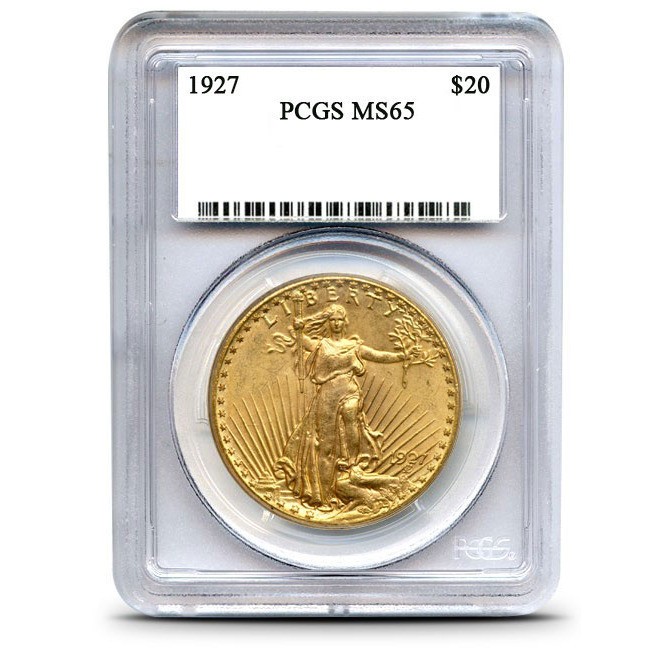

The top seems to have come off the equities markets in the last few days. This pretty well wiped out all of the gains since January 1st. (I hope that folks took my advice of placing stop loss orders!) Be ready for more volatility. And meanwhile, Bitcoin and the other cryptos have lost about 50% of their value since their high point, a month ago. Once again, gold seems to be a stable safe haven. When I checked on Monday, spot gold was up 1.57% in the past 30 days. But I still think that silver is the under-priced bargain.

o o o

Janet Yellen calls stock market, real estate valuations ‘high’ in last interview before exit as Fed chief. (Note: This has CNBC’s usual annoying auto-start video.)

Commodities:

Next, over at Platts: Oil futures fall as Dow Jones Industrial Average plunges

Economy and Finance:

Several readers recommended this piece: Many older Americans are living a desperate, nomadic life

o o o

At The Chicago Tribune: Analysis: Government set to borrow nearly $1 trillion this year, an 84 percent jump from last year. JWR’s Comment: At this stage, with compounding interest, it is nigh on impossible for the National Debt to be repaid, short of the advent of mass inflation.

Banking:

The WSJ had this: Banks Shutter 1,700 Branches in Fastest Decline on Record

Tangibles Investing:

The British magazine The Field posted this useful round-up article, four years back: The Best Shotguns in the World.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. So please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often “get the scoop” on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!

Really? A British article about the best shotguns in the world? Or course, since Britain is stuck in the 19th century, firearmswise, it only covers SXS and over unders. Also, that’s just about the limit on firearms you can own in th UK. And of course, Britain is the world….kind of a waste of space for this blog, isn t it?

Just my thoughts.

Understood. But if you want to survive, and your best firearm is a shotgun (applicable to thousands who visit SB)….

While the sun never sets on the US military, it is not ‘The World’. Brits are mere ‘subjects’. Sadly on New Years Eve 2011 (Republicans’ NDAA)with a stroke of a pen and not one shot fired, Americans became mere ‘subjects’ too. They will be the last to realize it.

From an investment standpoint, shotguns made by firms like Purdey and Holland & Holland have seen their prices go up substantially, over the past 20 years. Their owners have seen FAR MORE gain than with shotguns from any American maker. I’d be thrilled if I stumbled into one of these guns at an estate sale or at a gun show.

Many older Americans are living a desperate, nomadic life: good article and I requested the book, Nomadland from my local public library

I plan to live this life soon, turning 57 next month, I plan to travel across the U.S. on my bicycle and live in a tent. Maybe in the future post my adventure here.

Why am I doing it? I am growing tired throwing rent money away, working for nothing and nothing to show. So I decided to give everything up and live a nomadic lifestyle! Thank you!

“it is nigh on impossible for the National Debt to be repaid”

It could and should be done overnight. Some years back there was talk of minting $1 trillion dollar coins of platinum and pay off the debt. The actual coin is symbolic the debt would be paid off in dollars which of course would simply be printed or created out of thin air. As a one time option this would clear up our debt, remove the burden of interest payments and allow us to use the extra revenues (those not spent paying off the interest each year) to balance the budget. More importantly it would allow us to avoid that inevitable economic crash that hangs over our heads right now and when it occurs will destroy a generation of lives. Of course such a move should be coupled with a constitutional amendment requiring the federal government to have a balanced budget.

It would be a gutsy bold move that would free us from this Damocles sword that hangs over our economic future. I do not think any of our current or expect any of our future politicians will have that kind of guts. Therefore I expect instead we will be treated to a decades long soul crushing great depression when the national debt finally becomes unmanageable.

It wouldn’t avoid the economic crash, it would start it. Afterwards, who would be stupid enough to loan the U.S. money after we did a thing like that?

I understand why you might think it would precipitate the crash but most likely it would precipitate a boom not a crash. As for who would lend us money after that, hopefully we would stick to the balanced budget amendment and not borrow money. BUT you may well have misunderstood the process I suggested. If someone/some country loaned us a trillion dollars and we printed a trillion dollars and paid them back they would get their trillion dollars. Where I think you are going is “but the dollar wouldn’t be worth a dollar anymore”. True! Just like right now and the last 70 years of our history. Nothing new. BUT the value of a dollar is based not on how much we print (it can be but in America’s case it isn’t). It is based on our economy and what others and other countries think of our economy. A simple question: would you prefer to invest in Switzerland or Italy right now? Switzerland is the right answer. Why? Because Italy’s economy sucks and Switzerland’s economy is stable and growing. Same is true with the U.S. The day after we paid off all the debt with that printed money our economy would take off and our dollar would increase in value relative to other currencies.

How much of this national debt is owed to the federal reserve???? And why can’t we just decline to pay this debt to the reserve???