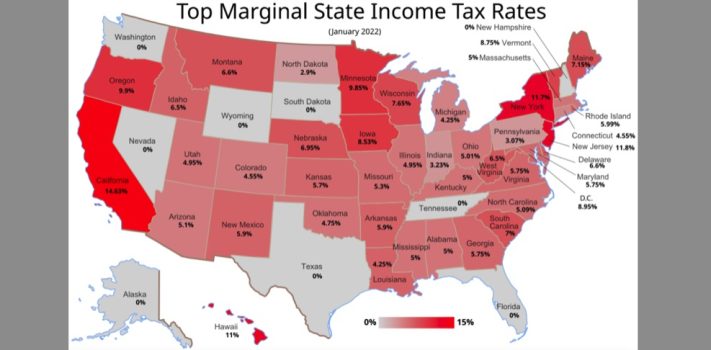

SurvivalBlog Graphic of the Week

Today’s graphic: A map showing Top Marginal State Income Tax Rates, as of 2024. (Graphic courtesy of Reddit.) The thumbnail below is click-expandable. — Please send your graphic ideas to JWR. (Either via e-mail or via our Contact form.) Any graphics that you send must either be your own creation or uncopyrighted.