Economics & Investing For Preppers

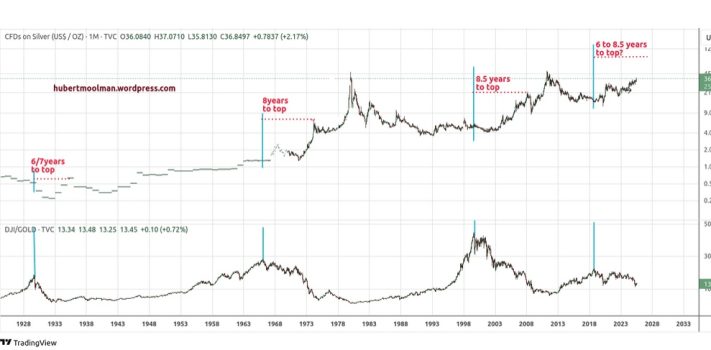

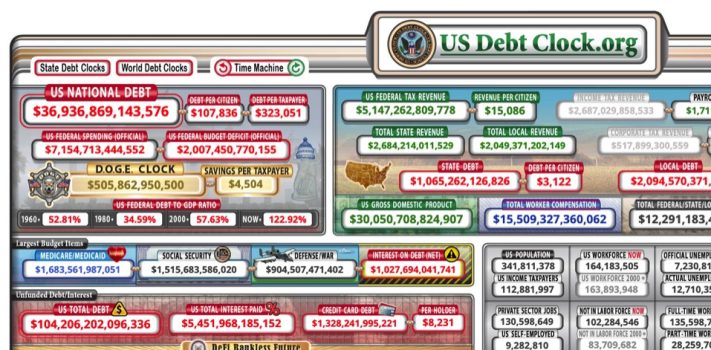

Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. This column emphasizes JWR’s “tangibles heavy” investing strategy and contrarian perspective. Today, we look at some threatened tariffs on gold, and a quick reversal. (See the Precious Metals section.) Precious Metals: Trump says gold will not be tariffed. o o o I noticed that spot silver bounced back to $38.82 USD per Troy ounce in after-hours trading on Wednesday. (Thursday morning trading, in Asia.) Let’s see if …