Gold and Silver’s Rise are Actually Symptoms of the Dollar’s Demise

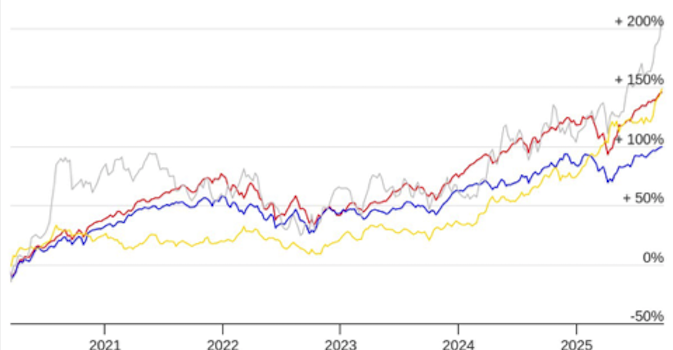

Today, in place of our usual Economics & Investing news column, we offer some brief commentary from Senior Editor JWR: — I’m often irritated to hear the mainstream financial media report on the gold, silver, and platinum markets. In reporting the ups and downs of the spot and futures metals markets, they seem oblivious to the bigger picture. The metals are all now in primary bull markets. They blithely report: “The price of gold rose today…” But the rise (in Dollar terms) of gold, silver, and platinum are actually symptoms of the U.S. Dollar’s demise. In fact, all of the …