Slowing Money Supply Growth in 2022 Points to Recession, by Ryan W. McMaken

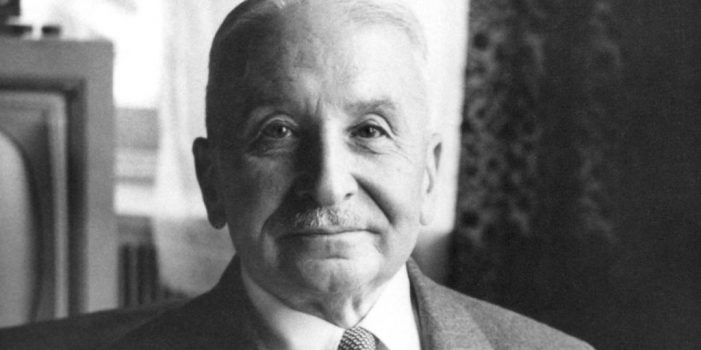

Editor’s Introductory Note: This guest article was selected by JWR. It was first published by The Mises Institute. It is reposted with permission. The Mises Institute is named in honor of the much-revered Austrian School economist Ludwig Von Mises. (Pictured, above.) — Money supply growth fell slightly in April, falling below March’s eight-month high. Even with March’s bump in growth, though, money supply growth remains far below the unprecedented highs experienced during much of the past two years. During the thirteen months between April 2020 and April 2021, money supply growth in the United States often climbed above 35 percent, …