Economics & Investing For Preppers:

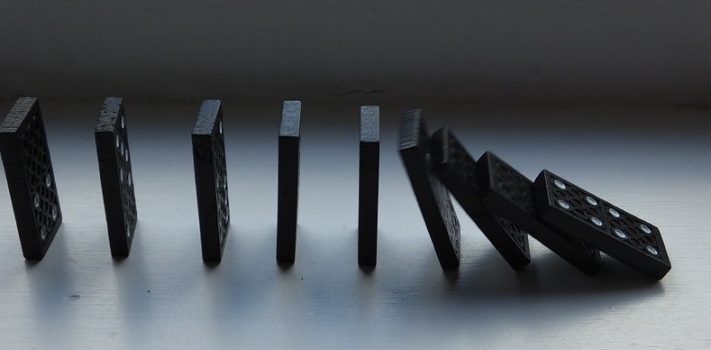

Today, in lieu of my usual economics and investing news and commentary, I’d like to briefly expound a bit on my view of the collapsing real estate market in the United States. I’ll begin by mentioning something published in Investment Watchblog that I found linked over at the Whatfinger.com news aggregation site: US Median Home Price Drops 12% in Six Months – Largest Drop Since 2009. Please take the time to read that article. Now take a look at an ominous figure that was neatly buried down in the ninth paragraph of an article with a cheery headline over at the …