February 2023 in Precious Metals, by Steven Cochran

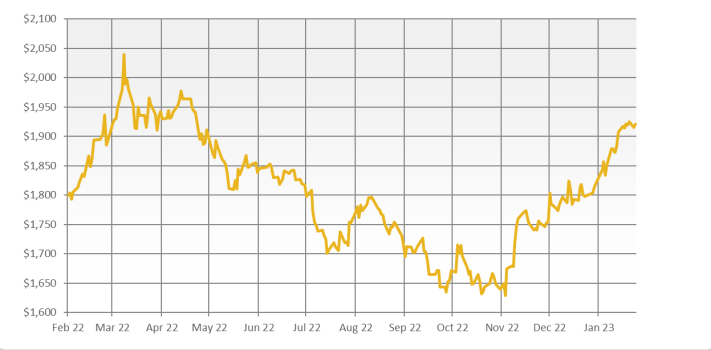

Welcome to SurvivalBlog’s Precious Metals Month in Review, where we take a look at “the month that was” in precious metals. Each month, we cover gold’s performance, and the factors that affected gold prices. What Did Gold Do in February? Gold gave back all of January’s gains in February in choppy trading, ending the month down about $10 for the year. Things started off badly on February 2nd, when the Fed, ECB, and Bank of England all hikes rates and announced that rates would be moving higher for longer than previously estimated. This sent gold down $34 to $1,916 an …