Economics & Investing For Preppers

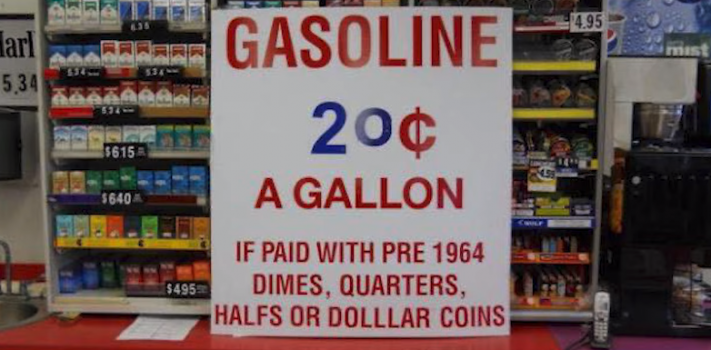

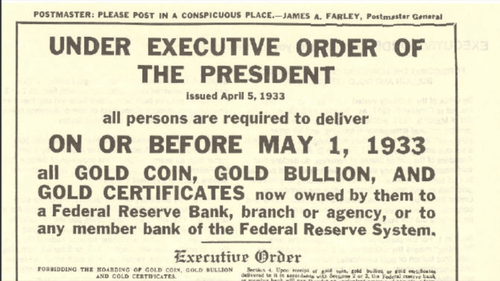

Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. This column emphasizes JWR’s “tangibles heavy” investing strategy and contrarian perspective. Today, news of BRICS countries dumping U.S. Treasuries. (See the Economy & Finance section.) Precious Metals: Costco says its 1-ounce gold bars are real and have been selling out in hours. o o o Spot silver and gold both dipped sharply, over the weekend. This is another buying opportunity, for those of you who stack bullion …