Economics & Investing Media of the Week

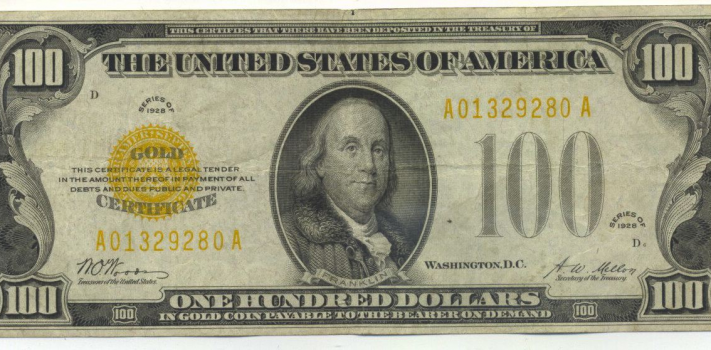

In Economics & Investing Media of the Week we feature photos, charts, graphs, maps, video links, and news items of interest to preppers. This week, another look at the penny shortage. The thumbnail below is click-expandable. Economics & Investing Links of Interest More retailers impacted by penny shortage: How they’re responding. Reader H.L. sent this: Copper Prices Hit a Record $13,000 per Ton in January 2026. During the annual Lunar New Year/Spring Festival, the Shanghai metals markets will be closed from February 15, 2026 (Sunday) to February 23, 2026 (Monday). They will open as usual on February 24, 2026. …