Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today’s focus is on Iver Johnson Revolvers. (See the Tangibles Investing section.)

Precious Metals:

John Rubino: Three Things That Will Definitely Happen In 2019

o o o

Gold Hits 6-Month High, Closing In On $1,300

o o o

Gold Prices Holding Solid Gains As U.S. Manufacturing Sector Continues To Grow

o o o

Gold to Silver Ratio: So What?

Economy & Finance:

PRESS: “Lacklustre To Catastrophic” Brexit Impact Seen For UK In 2019

o o o

At The Economist: The return of gleaning in the modern world

Stocks:

In the past three months, the Dow stocks have dropped more than 14%. Just on Thursday (January 3rd) the Dow Jones Industrial Average (DJIA) lost 2.8%, the S&P 500 fell 2.5%, and the technology-heavy NASDAQ was off 3.0%. Ouch! There has been great volatility all through the past month. I expect this to continue. In the next rally, I recommend getting out of any stocks or mutual funds that are part of your retirement nestegg. Only gamble with what you can afford to lose. At this stage, nearly all American stocks are a gamble.

o o o

How Low Could The SPX500 Index Go?

o o o

Wall Street Breakfast: Stocks Skid Into 2019 With Slowdown Fears

o o o

Apple tanks 10%, on pace for its biggest single-day loss in 6 years

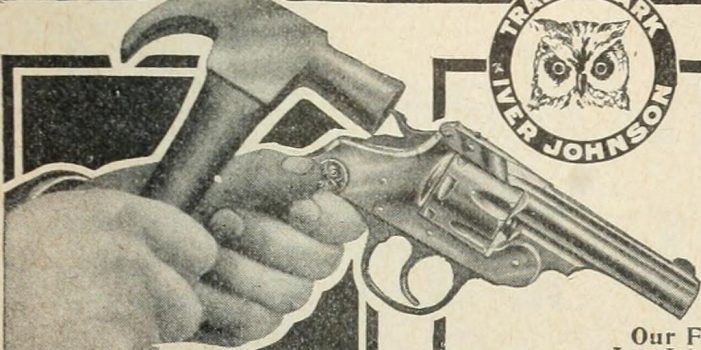

Tangibles Investing (Iver Johnson Revolvers):

Often dismissed as a “cheap brand” by antique gun collectors, Iver Johnson revolvers are finally being recognized for their good quality and practical reliability. Far from being cheaply-made, they were simply more plentiful than Colt and S&W’s small frame revolver offerings.

One difficulty for collectors is knowing which Iver Johnson revolvers are legally antique, per federal law in the United States. (That is, with 1898 or earlier frame production.) With Colt and S&W-made guns, it is a simple matter of knowing a “cut-off” serial number for each model, to precisely know the 1898 to 1899 transition. But Iver Johnson revolvers were made in batches with non-sequential groups of serial numbers. I’ll quote from my FAQ on Pre-1889 Guns:

Thanks to Ben Sansing for the following Iver Johnson (IJ) information:

There were three main models of Iver Johnson “Safety” top break revolvers. 1st & 2nd Model revolvers were built for black powder cartridges only. Continued use of higher pressure smokeless in these revolvers will result in them shooting loose, getting out of time, and parts breakage.

[JWR’s Note: So if you want to shoot smokeless in a pre-1899 IJ revolvers, you must hand load cartridges to match the lower black powder pressure. Use extreme caution and err on the side of lower pressure when working up a load.]

The 3rd Model was especially beefed-up, redesigned, and “fortified” for use with smokeless powder and is fine for modern factory ammo. Alas, only 1st (all) & 2nd (some) Model revolvers fall into the legal Antique category.

1st Model (1894-1896): SINGLE-POST top latch; leaf springs; cylinder “free-wheeling” when at rest

2nd Model (1897-1908): DOUBLE-POST top latch; leaf springs; cylinder “free-wheeling” when at rest

3rd Model (1909-1941): DOUBLE-POST top latch; COIL springs; cylinder locked when at rest

If you’ve determined, from the above characteristics, that you have a 2nd Model IJ revolver, here’s how to determine whether it was made before 1899 (and thus a legal antique) or not. Fortunately, Iver Johnson built revolvers by the “batch” system, and only changed & upgraded their guns once a year, so it is quite easy to determine whether an IJ is antique or not, just by cursory examination. In only *one* case (.32 small frame *hammer* model) does the serial number need to be checked. In other cases, you can “tell at a glance” once you know what to look for.

Pre-1899 2nd Model guns will exhibit the following characteristics:

Large frame (.38) HAMMERLESS: Separate hammer shroud on frame (shroud not integral with frame)

Small Frame (.32) HAMMERLESS: Separate hammer shroud on frame (shroud not integral with frame)

Note: Integral frame with shroud introduced start of 1899 production

Large frame (.38) hammer: Patent dates on top rib of BARREL.

Small Frame (.32) hammer: Patent dates on top rib of BARREL, *AND* must check serial number prefix (left side of grip strap underneath grip – Yes, you must remove the grips for this one): A = 1897; E = 1898; F = 1899. The easy way to remember: If it has an ‘F’ it FLUNKS the Antique Test.

Note 1: Patent dates were moved from top rib of barrel at start of 1899 production.

Note 2: All .22 rimfire IJ topbreak revolvers are post-1898 (The .22 chambering began in 1901).

All in all, Iver Johnson revolvers are worth collecting. And now that both antique Colts and S&Ws are getting priced up to the stratosphere, it is nice to know hat Iver Johnson revolvers are still affordable, for shooters.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often get the scoop on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!

How Low Could The SPX500 Index Go?

These guys have been reading my notes. I’m joking of course, nobody cares what I think but I agree 100 percent with the target and support levels of the ’16 top/’15 low range and that pesky 01/08 double top in the SPY which are based, in part, on human behavior and naturally occurring patterns in nature (and therefor markets), such as Fibonacci and Elliot. This is a good note because some factors were used that I’m less familiar with. I will completely agree that the yearly RSI (Relative Strength Indicator) is ridiculous. Markets go down a lot faster than up but the yearly RSI has a very long way to come back down before a long term buy signal would be in the making.

While I certainly appreciate self-aggrandizing and self-deprecating statements in the same thought, rest assured they’re not reading your notes. Charts, theories, and other forms of technical analysis steeped in jargon-heavy mumbo jumbo can be found on a thousand different websites or blogs and they are all equally meaningless.

For them to have any relevancy would mean we are dealing with actual markets. We are not. This is an algo-driven casino and trying to predict future outcomes based on past events is pure folly at best. If you are relying on technical analysis to determine trades, the only sure thing is that you are forever behind the curve with zero chance of making any meaningful profits.

Well, the article did hit me squarely in the confirmation bias. Grandma wasn’t humming and canning fruits while she’d look over at you and smile because she was loopy, depressions cause a lack of things to buy not a lack of money. And when the next very real depression comes, and it will, you won’t be calling the markets fake then, nobody will. It’s easy to be a modern skeptic but like Plato, a cynic merely makes critical observations which is much more fun. I agree, never try to time a market for a trade. It’s the fastest way to lose your shorts. I wasn’t talking about trading, I specifically mentioned a “long term buy signal.”

“Corporate share buybacks will slow to a trickle” ~ From ~The Three Things That Will Happen~ article.

Many of the ‘Finance related articles’ are written as though the Executives in charge are concerned about the Shareholders, the Company, the Economy, and even America. … Too often, the Executives in charge of the big corporations set things up, so they can ‘parachute’ out of a business, with an enormous amount of money.

Many of the Corporation Executives and Wall Street Traders seem to be modern D.B. Cooper characters. They will run a business to engage in legalized looting.

GGHD, you nailed it.

Carry on

Once a Marine ~always a Marine, Thank you.

Regarding gleaning.

When I lived in Southern Idaho in the late 70s, gleaning was allowed in the harvested potato fields. I would go out and pick up a years supply of potatoes in an afternoon. Had a rudimentary root cellar dug into a small rise that I would store them in. Worked on a dairy farm and had access to a small disk and rototiller and all the fertilizer you would ever need. With that we grew about all the other vegetables you would ever need. Excellent yields. Good memories of that.

I will say that even in the 70s and it being pretty well known that you could just go get free potatoes, I did not see very many people in the fields. I seem to remember talking to one or two people who availed themselves of the opportunity but as a whole not many thought it worth their while. A shame I think.

Gleaning is done in my community by organizations that, as the article stated, give the food to people in need. Indeed, they recruit those people who are “food insecure” to join in the harvest. Perhaps, they have read the passage in Matthew regarding “whatever you do unto the least of my children, you do unto me”. As the article states, gleaning is an organized activity in service to those who are struggling. If I remember well, Sarah Latimer posted a piece two years ago addressing this issue.

As JBH notes, there is a great abundance to be had by any individual with a bit of gumption. Knowing that 40% of food produced in our country (yes, 40%, and yes that is wrong) goes to waste, I often save food from grocery store dumpsters. My cost of eating has gone way down since I have adopted this practice of saving food from the landfill.

Carry on

A monumental RED FLAG just happened and I hope nobody missed it. The Federal Reserved backpeddled on interest rates to calm the markets and banks! Forget the fundamentals or the real economy, protect the interests of the banks!

After all they are holding trillions in worthless debt they can’t unload or pay higher interest rates on. I never though I would see the day, when the Fed can’t print money fast enough to keep the bubble inflated, but here it is.

The crash will happen when the banks have to sell stocks to cover their bad loans. There is now more debt in the world than assets – it is just that simple.

The fed didn’t change anything they just,”jawboned” the markets(press announcement to alter market perception),otherwise known as defrauding investors(why it isn’t prosecuted?). They will still sell off assets at higher prices

I would have liked to have read the article on gleaning but you have to subscribe to The Economist.

Preception is everything and the Fed dances to the tune of its master