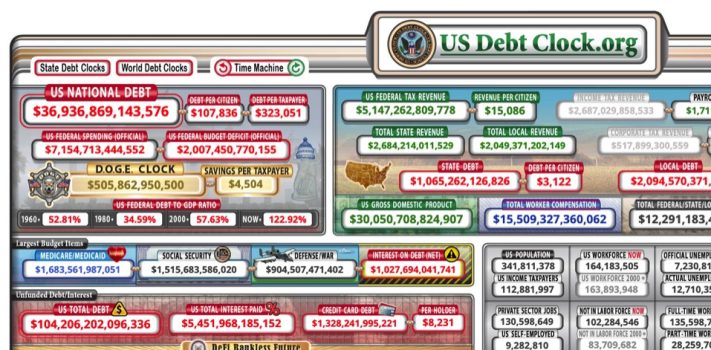

Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. This column emphasizes JWR’s “tangibles heavy” investing strategy and contrarian perspective. Today, we look at the global debt crisis in general and the U.S. National Debt, in particular.

Precious Metals:

With both world war tensions and a global debt crisis brewing, the precious metals bull market is picking up speed. I took note that spot gold stood at $3,393.60 USD per Troy ounce on Thursday morning. It seems likely that Mr. Bull may be taking another run at $3,500, soon. The last time that happened was on April 22nd. Meanwhile, spot silver jumped 3.74% to a quite respectable $36.03 per Troy ounce. I expect the silver-to-gold ratio to continue to narrow, throughout the rest of 2025. Ditto for the platinum-to-gold ratio. – JWR

o o o

Bank of America Eyeballs $4,000 Gold and $40 Silver.

o o o

‘Gold As Collateral For Internationalized Yuan’ Is Agenda For BRICS 2025 Summit.

Economy & Finance:

A very informative video, from Jeff Snider of EuroDollar University: This Is What An Economic Collapse Actually Looks Like. JWR’s Comments: I concur with Snider, generally. A global recession is waiting in the wings and there is a likelihood of deflation in Europe in China. But meanwhile, inflation will re-emerge in the United States. If interest rates spike in the U.S., there could be a debt crisis for the U.S Treasury — and the Federal Reserve banking cartel will not be able to stop it. Plan accordingly. (Especially vis-à-vis your precious metals and crypto portfolios.)

o o o

Brookings: What are the risks of a rising federal debt?

o o o

o o o

Billionaire Ray Dalio warns of ‘economic heart attack’ as debt crisis escalates.

o o o

OECD: Global Debt Report. Here is an excerpt from the report’s opening summary:

“Sovereign bond issuance in OECD countries is projected to reach a record USD 17 trillion in 2025, up from USD 14 trillion in 2023. Emerging markets and developing economies’ (EMDE) borrowing from debt markets has also grown significantly, from around USD 1 trillion in 2007 to over USD 3 trillion in 2024. The outstanding global stock of corporate bond debt reached USD 35 trillion at the end of 2024, resuming a long-term trend of over two decades of consecutive increases in indebtedness that came to a temporary halt in 2022.”

Commodities:

H.L. sent us this: China Drowning In Soaring Coal Inventories Amid Sinking Power Demand, Crashing Coal Price.

o o o

Reader Terry C. wrote to ask: “Is it still wise to continue collecting/saving Nickel coins?”

JWR Replies: Yes, indeed. Now, more than ever, since pennies will no longer be minted. The Nickel is now the only still-minted U.S. coin that has a melt value higher than its face value. The rest are merely tokens.

o o o

Report: The Top 5 Most Stolen Vehicles. (A hat tip to D.S.V. for the link.)

Tech & Market Trends:

Meet the $7,000 mini EV that’s taking Japan by storm.

o o o

What’s Coming Next for the Drone Industry in 2025?

o o o

Stanford HAI: The 2025 AI Index Report.

o o o

Shocking U.S. Migration Trends for 2025.

o o o

Book Publishing Trends 2025: 4 Predictions from a Professional Book Editor.

o o o

25 New Technology Trends for 2025.

Forex & Cryptos:

Lite Finance: US Dollar Struggles to Remain Resilient. A quote:

“Speculators continue to inflate the US stock market bubble. The S&P 500 index is rising, forcing the EURUSD pair to retreat. However, the bubble will inevitably burst at some point due to the ongoing trade war, recession risks, and fiscal problems. The US dollar is likely to weaken significantly. However, it remains resistant for the time being.

The White House has reached out to numerous countries, encouraging them to submit their most competitive trade proposals swiftly. The deadline is approaching, with only a limited timeframe remaining before the start of July. At the same time, tariffs may rise in the future. However, the ongoing legal battle over the legality of US import duties may impact the timeline. According to UBS, President Trump’s patience with the current state of affairs is waning. He is expected to raise tariffs, which could lead to an escalation in trade conflicts and hurt the US dollar.”

o o o

At Currency Thoughts: Bearish Global Growth Outlook, Dutch Government Collapses, and In-Target Euroland Inflation.

o o o

Long-Term US Dollar Risks Persist.

o o o

Bitcoin, Ethereum, XRP and Dogecoin soar in June rally—here’s why.

o o o

Ripple’s latest regulatory nod sends XRP on a rally.

Tangibles Investing:

I found this linked over at the Whatfinger.com news aggregation site: Home sellers face an ‘absolutely brutal’ market that’s tilting in buyers’ favor.

o o o

Our featured Pre-1899 Gun Of The Week, at Elk Creek Company: Scarce Argentine M1891 Mauser Cavalry Carbine – Early DWM. Oh, and by the way, all of our Mausers are presently on sale, and we have increased our silver divisor to an unprecedented 26.5! (Take the listed price and divide by 26.5, if you want to pay in pre-1965 U.S. “junk” 90% silver coins. Use the “cash or check” payment option, and send us an e-mail stating that you’ll be mailing in silver coins.) So, for example, that $875-priced Mauser would be just $33 face value in any combination of 1964-or-earlier mint-dated silver dimes, quarters, or half dollars.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. Thanks!