In Economics & Investing Media of the Week we feature photos, charts, graphs, maps, video links, and news items of interest to preppers.

The thumbnail below is click-expandable.

Economics & Investing Links of Interest

- As reported by the leftist Washington Post: How tech billionaires spurred an exodus from California.

- Spot silver broke out again to $94.77 per Troy ounce on Monday morning. By Tuesday afternoon, it was at $95.57. And just after Thursday’s Comex market close, it touched $99.64. This morning, it was $100.41, in Asian trading. That was another all-time high. Gold was at $4,968.70. (Another all-time high.) A $1,000 face value bag of circulated “junk” silver now sells for about $74,400. I feel obliged to remind SurvivalBlog readers of a caveat: On-paper profits are illusory until you actually take a profit. Silver at above $95 per ounce is a good opportunity to begin to gradually recoup your original silver cost, especially if you bought your stack at less than $30 per ounce. Do not attempt to time the top of a market spike. I recommend parlaying any silver proceeds into another tangible — such as a big propane tank, some nice investment-grade guns, or paying down your home mortgage. Once you’ve recouped your investment, you may then hang on to the rest of your silver stack as a hedge against further U.S. Dollar declines with no regrets and feeling no angst as the market gyrations continue. – JWR

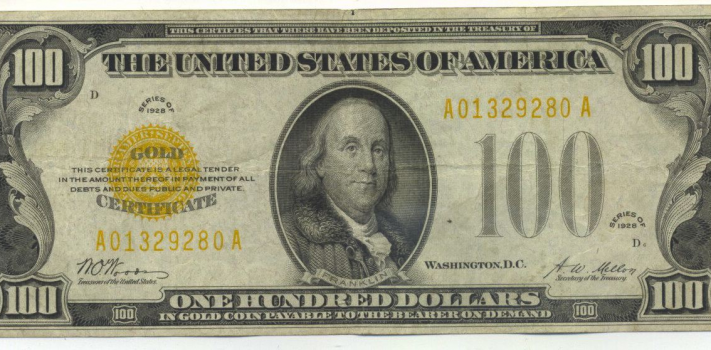

- Video: What a Currency Reset Might Actually Look Like.

- Interview: ‘I think this is a once in a generation. We don’t often see monetary regime change’: McAlvany.

- WSJ: Soaring Electricity Costs Are Now a Hot Political Issue.

- Broken Currency: The Mechanics of Regime Change.

Economics & Investing Media Tips:

Please send your economics and investing links to JWR. (Either via e-mail or via our Contact form.) Thanks!