Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. This column emphasizes JWR’s “tangibles heavy” investing strategy and contrarian perspective. Today, a report on possible lower crude oil prices. (See the Commodities section.)

Precious Metals:

Silver and gold prices have continued to be quite strong. When I checked on Thursday evening (Friday morning in Asia), Spot Gold was at $2,677.70 per Troy ounce, and Spot Silver was at $32.43. Wow! The COMEX short sellers must be feeling very nervous.

I recommend holding on to your physical metals because this market is nowhere yet near the top! – JWR

o o o

Hub Moolman: Unlike The Great Financial Crisis This Will Be The End For Fiat Money.

o o o

Argentina Sends More Gold To London.

Economy & Finance:

WSJ: Oregon’s ‘Gross Receipts’ Tax Ballot Trick.

o o o

From the left-wing MSN: California unemployment rises as private hiring slows and state government payrolls tumble.

o o o

Which Countries Are Stashing The Most Wealth Offshore?

o o o

Barron’s: Swing-State Economies Won’t Decide the Presidential Race This Year.

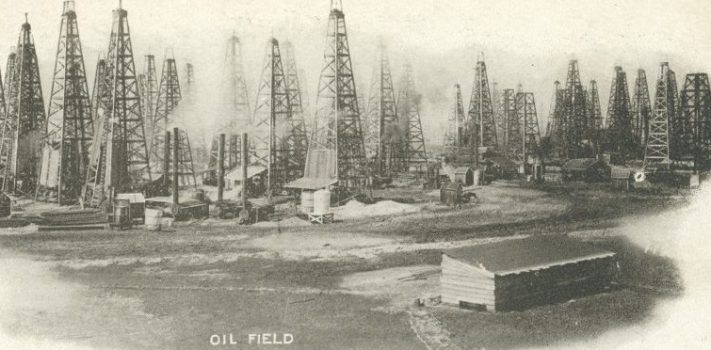

Commodities:

Claire sent us this: Saudi Arabia Warns Oil Prices Could Drop to $50. The article begins:

“Saudi Energy Minister Prince Abdulaziz bin Salman has warned fellow OPEC+ ministers that if other producers continue to flout their output quotas in the agreement, oil prices could slump to $50 per barrel, The Wall Street Journal reported on Wednesday, citing OPEC delegates who attended a conference call last week.”

o o o

Global Coal Consumption Is Still Soaring.

o o o

At Zero Hedge: Futures Slide, Oil Jumps As Middle East Tensions Soar.

o o o

Lithium-Ion Battery Prices Plummet.

Inflation/Deflation Watch:

The Post Office wants stamp prices to rise five times over the next three years.

o o o

U.S. Port Strike Could Trigger New Wave of Inflation.

o o o

Fortune reports: U.S. economy is on the cusp of another Roaring ’20s, says UBS.

Forex & Cryptos:

EURUSD Wave Analysis 1 October 2024.

o o o

At Currency Thoughts: September 2024 in Figures.

o o o

From Ban to Accumulation: Saylor discusses Policy shift and Election effect on Bitcoin.

o o o

Australia to mandate licenses for crypto exchanges, per report.

Tangibles Investing:

Housing Starts Are Tumbling As Completions Soar, It’s Very Recessionary.

o o o

Palmetto State Armory (one of our affiliate advertisers) has some great specials in their “Daily Deals” this week. For example, see: PSA 16″ 5.56 NATO 1/7 Mid-Length Stainless Steel 13.5″ M-Lok MOE EPT Rifle Kit with MBUS Sight Set. This normally $809 rifle build kit is sale priced at $479. To find this deal, paste the SKU “5165447814” in their search box.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. Thanks!