Editor’s Introductory Note: This article was first published by Sunshine Profits. It is reposted with permission.

—

As the Fed tightens monetary policy, fears of overdoing it are rising. However, the US central bank is far from overtightening. It increases the odds of stagflation and a bullish time for gold.

As central banks all over the world are tightening their monetary policies, more and more analysts, including Paul Krugman, are afraid that Powell and his colleagues are hiking interest rates too aggressively, risking going too far. They believe that inflation will soon decline, so the Fed is braking too hard.

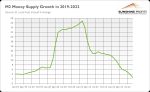

Well, as always, there is some truth in these opinions. The inflation rate is likely to decrease as the growth in the money supply decelerates and even declines below the pre-pandemic rates (see the chart below). And monetary policy operates with a long lag, which means that the effects of the hawkish Fed’s actions haven’t been fully felt by the economy. Hence, the central bankers could easily overdo. After all, they are so incompetent that overreacting to inflation after a long period of underreaction wouldn’t be surprising at all.

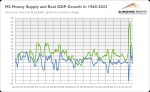

However, even my students are aware of lags in monetary policy, so there is a chance that someone from the army of PhDs working for the Fed has heard about them and taken them into account. But more seriously, although the pace of money supply growth has normalized, there is still an excess of money supply relative to output. As the chart below shows, since the global financial crisis, the increase in M2 money supply has been outpacing real GDP growth, reaching a peak during the pandemic. This growth differential hasn’t disappeared or turned negative yet, so with too many people chasing too few goods, inflation won’t go away very soon.

You see, the current monetary policy is hardly a tight one. According to the Taylor rule, the key tool used by the central banks, the Fed should set the federal funds rate at least at 6.7% (see the chart below) – just to have a neutral stance!

As the chart above shows, the real federal funds rate – understood as the federal funds effective rate minus the CPI annual rate – is still deeply negative. I’m not saying that inflation won’t disappear without the real federal funds rate being positive. After all, what’s fundamental for inflation is what’s happening with the money supply.

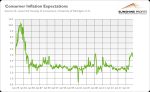

However, positive real funds rates are high enough to slow nominal growth and reduce demand in excess of supply. The point is that it could be difficult to re-anchor inflation expectations without positive interest rates. Inflation expectations seem to have already peaked, but they remain historically high (see the chart below). As a reminder, what Paul Volcker did was take a huge hike in the federal funds rate to bring rates into positive territory and restore confidence in the Fed, pushing inflation expectations down. He raised the federal funds rate to 19% at the end of 1980. The real rate surged from -4.8% to 7.3% and then to the record 9.4%. Compare it with the current -5.7 (as of the end of October). We are not even close.

What does it all mean for the gold market? Well, the truth is that the Fed is still conducting too easy, not too tight, monetary policy. The lending conditions have tightened, but this is because the financial sector has been cautious and forward-looking, not because the US central bank has become restrictive. We’re moving into this territory, but very slowly.

It implies that a recession is coming just when the real federal funds rate is still deeply negative and the chorus of voices calling for a softening of the Fed’s stance gets louder and louder. For me, this is a recipe for stagflation rather than a successful disinflation. So far, the Fed has kept a stony, hawkish face, but when the economic situation deteriorates, I bet it will blink and won’t try to fight with inflation at all costs. Have you seen how quickly the Bank of England intervened during the recent market turmoil? Actually, stagflation is certain, in the sense that the next recession will be accompanied by higher inflation than the last few ones. The question is how serious it will be?

That’s excellent news for the gold bulls, as stagflation is what gold likes best. This is because during stagflation, we have both economic stagnation and high inflation. When attacked by two enemies at the same time, most assets become vulnerable, and gold tends to outperform them. This is not surprising, as during stagflation there is a huge amount of economic uncertainty, confidence in the central bank is low, and real interest rates are on the decline, with some of them falling into negative territory. In other words, stagflation makes gold’s fundamental factors bullish.

—

Arkadiusz Sieroń is the author of Sunshine Profits’ monthly gold Market Overview report, in which he keeps subscribers up-to-date on key fundamental developments affecting the gold market and helps them prepare for the major changes. Sunshine Profits publishes free gold e-newsletter.