Today, in lieu of or normal “E&I” column, we present a special examination of high dollar value industrial metals and some lesser-known precious metals, authored by SurvivalBlog’s Senior Editor James Wesley, Rawles (JWR).

Hopefully, this won’t sound like a high school chemistry lecture.

Industrial Metals

To begin, I must mention that many metals react with contact with the air, water, or salts. Lanthanum, for example very quickly turns blue, in air. A few — like europium, lithium, magnesium, metallic calcium, sodium, and potassium — can react quite violently and require special handling. None of those are recommended for metals investors!

Some high dollar value industrial metals are non-reactive — meaning that they have “forever” storage lives. All of the “noble” metals are essentially non-reactive. Treasure-hunting divers have pulled 2,500-year-old gold coins from the ocean floor that still look shiny and new.

A few base metals are sufficiently compact (in terms of dollars per pound) to consider stockpiling as an investment.

Note that some industrial metals are commonly available in only powdered form. Some metals and metals salts can be toxic if inhaled, ingested, or even touched. (Arsenic and mercury are good examples.) And then there is enriched uranium, that is deadly just to look at…

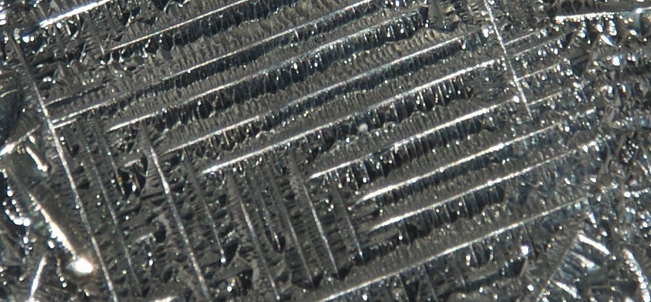

A few metals are sold to investors primarily as display piece oddities. For example, tellurium (pictured at the top of this article) often shows natural crystalline structures as it cools into an ingot, providing a quite dazzling effect.

Investment Metals – By The Pound

For practical investing, we’ll start at the low-end, with lead…

Lead

$0.20 to $0.40 per pound, depending on its form and purity. Can be readily re-sold on the scrap market.

Yes, lead. Yes, it is toxic if ingested and mildly toxic if touched. Yes, it is dense. But it is very useful. You can sometimes find ingots of bullet casting lead sold inexpensively at estate sales. Its low value per pound makes it just barely suitable for investing.

Copper

$2.75 per pound. Can be readily re-sold on the scrap market.

Copper can be found sold in coins or “.999”-marked ingots, but those are absurdly expensive–with a high premium charged over the spot price of copper. So if bought new, copper ingots are more of a novelty item than an investment. However, if you can find ingots on the secondary market with a low premium over the spot price of copper, then they are worth buying. Serious copper stackers tend to buy solid copper grounding rods or surplus copper electric busbars. These usually sell for just a little over spot. If you do some hunting around, you can find grounding rods at spot or even below spot. But beware of copper-coated steel grounding rods! A few strokes with a hacksaw will reveal if a rod is solid copper. Copper must be kept dry, or it turns brown and eventually green with corrosion. Some copper stackers who live in high-humidity climates like to paint their ingots or grounding rods with a clear varnish or with Future floor wax, to prevent corrosion.

Pre-1982 pennies are pure copper, but unfortunately, with the introductions of debased pennies (copper-flashed zinc tokens), pennies now require sorting — either by date or by density. A few enterprising folks manufacture automatic penny sorting machines.

Like lead, copper is a practical investment only for someone with a strong back, and plenty of storage space.

Nickel

$13.70 per pound. Can be readily re-sold on the scrap market.

I’ve written a lot over the years about U.S. five-cent pieces (“Nickels”), as an investment. (See my oft-quoted reference article.) These humble 5-gram coins are composed of 75% copper and 25% nickel, in an alloy. A cupronickel alloy is also used for jacketing rifle and pistol bullets. But note that it is still illegal to melt down any circulating U.S. coins.

Tin

$18.25 per pound. Can be readily re-sold on the scrap market.

Tin has a wide range of industrial uses. According to the Infogalactic wiki: “Tin is soft enough to be cut with little force and a bar of tin can be bent by hand with little effort. When bent, the so-called “tin cry” can be heard as a result of twinning in metallic tin crystals.”

Molybdenum

$21 per pound.

Commercially available in bars and rods. Difficult to re-sell at a profit.

Tellurium

$29 per pound.

Brittle, mildly toxic, and difficult to re-sell at a profit.

Neodymium

$75.75 per pound.

Usually sold as industrial-strength magnets. (Lots of fun!) But difficult to re-sell at a profit.

Investment Metals – By The Ounce

Now, moving up the list in value, I’ll switch to expressing all prices by the Troy Ounce.

Indium

$18.66 per ounce

Along with germanium and gallium, indium is considered a “minor” metal. Normally sold by the kilogram for around $600 (or half-kilogram, for around $300). Since there are 32.15 Troy ounces per KG, this equates to $18.66 per ounce, at the time of this writing. So, like silver, Indium lies at the threshold between “industrial” or “commodity” metals, and the precious metals. Indium is sought-after by electronics manufacturers because of its excellent conductivity. Indium is mined in Japan, South Korea, and China.

Precious Metals

Silver

$22.40 per ounce

Of all the metals, silver has the best thermal and electrical conductivity along with the lowest resistance for electrical contacts, making it one of the most versatile of the precious metals. Its wide range of uses includes jewelry, photography, dentistry, batteries, coinage, and circuitry. It also naturally prevents the growth of bacteria, so it has some medical uses. Silver does corrode (“tarnish”), over time if exposed to air or water. The world’s largest producers of silver are China, Mexico, Chile, and Peru.

Osmium

$200 to $800 per ounce, depending on form, and purity

This very dense metal is extremely difficult to manipulate because it is a hard metal with a high melting point. It is most commonly used for hardening alloys, for electrical contacts, and for filaments. Reportedly, it is non-toxic only in crystalline form. It is mined in North America, South America, and in Russia.

Ruthenium

$620 per ounce

Ruthenium is a member of the platinum family (or “group”). Industrially, ruthenium is often alloyed with platinum or palladium, for strength. Used for plating electrical contacts, especially in high-abrasion applications. Ruthenium is mined in Canada, Russia, North America, and South America.

Platinum

$977 per ounce

Platinum is a malleable metal used in jewelry, aerospace, dentistry, and in catalytic converters. It is one of the heaviest metals. Up until 2001, platinum was more valuable than gold, but they’ve now switched places, in value. When I checked last week, spot gold was at $1,876.10 per Troy ounce, and meanwhile platinum was at just $977. Yikes! That is nearly a 2-to-1 ratio. The pricing ratio might not fully revert, but anywhere below 1.5-to-1 makes platinum a bargain. Platinum is mined in South Africa, Canada, and Russia.

Gold

$1,876 per ounce

Gold needs no introduction. It is considered a centuries-old store of wealth, and has tremendous industrial and electronics uses. Pure gold foil can be rolled into incredibly thin sheets — so thin that light can pass through them. Gold is mined in quantity in South Africa, China, United States, Australia, and in Russia.

Palladium

$2,102 per ounce

Though palladium is 30 times as rare as gold (as found in the earth’s crust), it oddly sells for not much more than gold. And before 2001, it sold for less than gold. Commonly used in catalytic converters. The largest producers of palladium are Russia, Canada, the United States, and South Africa.

Rhenium

$2,987 per ounce

Rhenium is one of the densest metals. It has the third-highest melting point. It is often used in nickel-based superalloys. Rhenium is used in turbine engines, in filaments, and it is plated on electrical contacts.

Iridium

$4,900 per ounce

Iridium is one of the dense members of the platinum metals group. It is a corrosion-resistant noble metals, and has a very high melting point. It is used in the automotive industry, electronics, and medicine. It is only mined in quantity in South Africa, so its price is volatile and dependent on the vagaries of South Africa’s politics and labor union strikes.

Rhodium

$15,400 per ounce. (Wow!)

Rhodium is now the most highly-valued precious metal. I recommended investing in rhodium in SurvivalBlog in 2016, when (briefly) it sold for just $670 per ounce. I just wish that I’d taken my own advice, and bought a lot of it.

Buying and Selling Metals

A key factor in buying or trading metals is the “bid-ask” spread. This spread is the difference between what a retail customer pays for a metal (at the “ask” price) and what they can later sell it for on the open market (the “bid” price). The spread is this difference and it represents the trader’s handling costs and profit. Retail buyers typically absorb the spread. Coin dealers sometimes make money both buying and selling. Therefore, be warned: If you immediately sell an investment metal — before a rise in the market occurs — then you will lose money.

Where to Buy Scarce Metals

There are just a few companies that sell small quantities of scarce metals to individual investors, rather than to commercial/industrial customers.

One of the companies that I’ve dealt with is Element Sales, in Watertown, Massachusetts. They primarily sell exotic metals samples to universities and museums, for display or for use in laboratory research. The markup on some of these metals is huge, so your chances of eventually turning a profit are slim.

Another dealer (again, with widely ranging markups) is Rare World Metals Mint. I haven’t ever done business with them, so I can’t vouch for them.

It is important to do your Due Diligence before you buy, regardless of where you buy. I have found that the more exotic the metal is, the wider the range of prices demanded. Markups can range from “reasonable” to “highway robbery.”

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.