Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at Goldback currency. (See the Precious Metals section.)

Precious Metals:

o o o

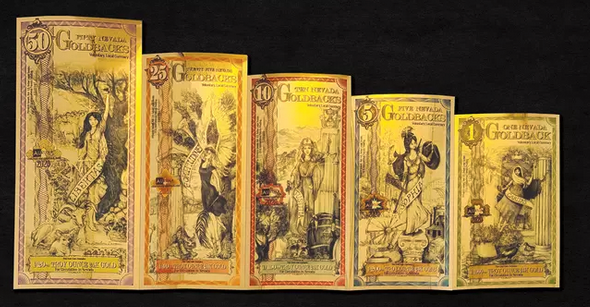

A reader kindly sent me a sample Goldback. This is a new private currency that is literally infused with fractional amounts of gold. The basic premise is sound, but for the Goldback to work, it needs several things:

- Great promotion.

- A budget to provide staying power, during a long ramp-up.

- Consistency of the gold content of the currency, for each denomination.

- A government that doesn’t see the Goldback as competition.

- Eventual widespread acceptance and use.

- Anti-counterfeiting protection features that the Chinese fakers cannot beat.

o o o

Video from a young silver stacker: I have changed my mind about silver.

o o o

Mike Maloney reviews some charts: Will $10,000 Gold Matter? Why YOU NEED Wealth Insurance NOW.

Economy & Finance:

Chinese Stock Crash: U.S. Losses Top $1.1 Trillion As Beijing’s Russia Ties Spark Investor Concerns.

o o o

Our own Mike Williamson flagged this article on “shrinkflation”: Huge Chip Company Reacts to Biden’s Inflation, Takes Major Measure to Keep Bags the Same Price.

o o o

Commodities:

The London Metals Exchange (LME) nickel market re-opened only briefly last Wednesday (March 15, 2022) with artificial price range limits — both up and down — imposed. When I checked on Thursday and Friday, the market was closed again. This article explains part of what is going on: Moral Hazard, Power & The London Metal Exchange. (Thanks to reader Brad V., for the link.) JWR’s Comments: This is a monumental short squeeze that will probably take several weeks — and several bankruptcies — to correct. Calling the global nickel market “manipulated” is an understatement. Save your nickels, folks!

o o o

“Media Isn’t Warning You” That US Careening Towards Food Crisis.

o o o

o o o

Montana Tells Joe to Take a Hike, Restarts Dormant Oil Wells.

o o o

Only OPEC Can Help The West Replace Russian Oil.

o o o

Energy traders sound the alarm over cash crunch.

Derivatives:

More questions than answers: Russia / Ukraine Crisis and Derivatives. JWR’s Comment: There is genuine peril in derivatives markets when a counterparty simply disappears…

o o o

Chinese Banks Assess Derivatives Risks After Nickel Turmoil.

Forex & Cryptos:

Digital Tyranny: Beware Of The Government’s Push For A Digital Currency.

o o o

USD/RUB: Ruble to face pressure through 2022 – Commerzbank.

o o o

Australia is eliminating physical currency, expects to become a ‘cashless society’ by 2031.

o o o

A detailed guide on how to lose all your Bitcoin investments.

o o o

Cardano (ADA) Attains 9th Position in Market Valuation During Ecosystem Inflows.

Tangibles Investing:

At Wolf Street: Mortgage Rates Spike, Home Sales Drop for 7th Month, and Suddenly Here Come the New Listings.

o o o

The latest mortgage rates, and what pros say will happen to mortgage rates in 2022.

o o o

The developing runs on everything from stores and hypermarkets in both western and eastern Europe should serve as a reminder: Don’t expect the panoply of product choices in the U.S. to continue much longer. We may be down to a scant few choices, shortly.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. And it need not be only about commodities and precious metals. Thanks!