Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at predictions for crude oil prices. (See the Commodities section.)

Precious Metals:

Platinum Begins A New Rally – Gold And Silver Will Follow

o o o

CME Lowers Silver Margins $1000, Shorts Covering?

o o o

JP Morgan Is “Dominating” Gold And Silver Prices

Economy & Finance:

There’s a New $908 Billion Stimulus Proposal on the Table. Here’s What’s Inside

o o o

At Zero Hedge: The State of the American Office: Suddenly Emptying Out Again Under the Second Wave

o o o

A D.K. interview: Fed to BUY IT ALL with Devalued Dollars — Lyn Alden

o o o

At Wolf Street: Junk Bond Yields Hit Record Low: Most Distorted Markets Ever

Commodities:

M.M. sent us this report, published last month: Robust U.S. economy, higher commodity prices in 2021, says USDA

o o o

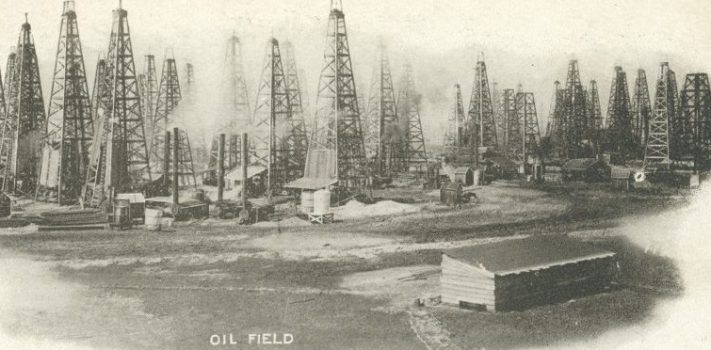

OilPrice News reports: The End Of Growth For U.S. Shale

o o o

At The Balance: Oil Price Forecast 2020–2050. An excerpt:

“The EIA predicted that, by 2025, Brent crude oil’s average price will rise to $79/b. This figure is in 2019 dollars, which removes the effect of inflation.

By 2030, world demand is seen driving oil prices to $98/b. By 2040, prices are projected to be $146/b, again quoted in 2019 dollars. By then, the cheap oil sources will have been exhausted, making it more expensive to extract oil. By 2050, oil prices will be $214/b, according to the EIA’s Annual Energy Outlook.”

o o o

Oil Prices Drop After OPEC+ Reaches Deal, Will Boost Output In January. Here is a snippet:

“According to overnight reports from the WSJ, OPEC and its allies were closing in on an agreement to modestly boost their collective oil output by as much as 500,000 barrels a day starting January, although according to more recent reports from Reuters, the increase won’t happen until February.”

Forex & Cryptos:

Euro Surges To 18 Month High Amid Speculation ECB Is “Out Of Policy Tools”

o o o

Futures Stuck At All Time High As Dollar Slide Continues

o o o

Bitcoin arrives on Wall Street: S&P Dow Jones launching crypto indexes in 2021

o o o

Ethereum ETF to debut on the Toronto Stock Exchange

o o o

Some in-depth analysis form Jameson Lopp: The Rise of Corporate Bitcoin Key Management

Tangibles Investing:

The Texan reports: Despite Ammo Shortage, Gun Sales Still Rallying in Texas

o o o

Swiss watch exports sank 20% in 2020. JWR’s Comment: I suspect that this was more about supply, than demand.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. And it need not be only about commodities and precious metals. Thanks!

The ammo is almost like drugs or gas. The People are going to buy it no matter the cost it seems.

They complain a little but have kinda accepted it and are still buying it at the inflated prices.

It apparently hasn’t reached the tipping point yet where demand lessens until prices return.

I went to an indoor range, to do one sight check, thinking it would be slow and had to wait in line for an opening. Admittedly they aren’t shooting as much and more 22s than anything but still I had to laugh over it.

I live in Tucson, Arizona and we have plenty of guns here for sale and many first time gun buyers like senior citizens. 9mm is the most common handgun caliber that is in short supply. It is available and can be purchased for about .50 a round if one is able to check out several gun shops. .223 is quite rare and 7.62X39 is somewhat available at a fair price. Like everywhere else people are scared about the uncertain times we are living in right now and buying a gun somehow makes them feel more secure.

I’m still trying to figure out how WTC building 7 fell on 9-11. A 500ft tall skyscraper falling in 4.5 seconds…and it wasn’t even hit by a plane. Dr Judy Woods made a great documentary that is amazingly still on YouTube called ” where did the towers go”.

Big Mike: Did you have a chance to check out Dr. Martensons video on Ivermectin?

Seriously!?

Hundreds of tons of debris from the two towers feel onto the building. It began to creak and shift, noticibly leaning and then collapsed under it’s own weight after the debris had destroyed it’s integrity. Your welcome!

Thats a new conspiracy theory I hadn’t heard before. Thanks for the laugh anon!

The only possible way that you not have heard this is if you never heard that building 7 collapsed. That was a description of what happened, it’s on video, there are even I-beams from the twin towers sticking out of bldg 7.

Building 7 did NOT collapse! Building 7 was “pulled”. Controlled demolition. Here is four different views of building 7:

https://youtu.be/ELSn0VttdXg

ABSOLUTELY !!!

Anon – I, and I expect some other readers would benefit from some links to the information you shared… specifically – the “Hundreds of tons of debris” and also the ibeams sticking out…

I haven’t seen that info and would appreciate it.

Thank you.

I bet the MSM all but ignores that this is Pearl Harbor Day.

…The MSM doesn’t value the America these guys died for…

Out of curiosity, a quick check showed the following MSM outlets reported on Pearl Harbor today (Dec 7, 2020): Chicago Tribune, Washington Post, CNN, Fox News, ABC, CBS, NBC, and Associated Press. The following did not: Drudge, New York Times, Bloomberg, The Atlantic, Wall Street Journal, and Forbes. Interesting but perhaps not significant.

Big Mike…

You can stop figuring. Here’s the results of honest scientific investigation.

http://ine.uaf.edu/wtc7

Download the complete report for you reading enjoyment.

DNI Ratcliffe spoke about the economic implications of a rising China involved in all kinds of nefarious activity (intellectual theft, and much more). The full interview is worth watching.

First Video Link is a “Clip”

https://www.citizenfreepress.com/breaking/intel-chief-urges-durham-to-release-interim-report/

Second Video Link is for the “Full Show” (and so you’ll need to “fish out” the interview)

https://rumble.com/vbmugb-sunday-morning-futures-with-maria-bartiromo-full-show-6th-december-2020..html

From an economics standpoint, your political voice matters. Make it heard. Speak up, and then speak up some more. Do not stop speaking. Do not give an inch. Do not back down.

We will not bend.

We will not break.

We will not yield.

We will never give in.

We will never give up.

We will never back down.

We will NEVER, ever surrender!

Right there with you, SaraSue! FIGHT FOR TRUMP. …and AMEN, SISTER!

JPMorgan dominating Au and Ag prices: After paying a huge fine for price rigging why are they still allowed to have anything to do with these markets? Security Exchange Commission heads need to roll, more graft and corruption being ignored by an apparently useless Government agency. Just look at what they did to Martha Stewart for a minor infraction. I sincerely hope President Trump can remain in office as he has no problem with firing inept and corrupt government employees. While on this subject the FBI and the DOJ seem to be just not doing their jobs, perhaps a major thinning of their ranks might help. Anyone who still has any confidence in our government might want to rethink their position at this time.

So true, Joe!

From your post: “Anyone who still has any confidence in our government might want to rethink their position at this time.”

For this reason, and so many others, President Trump MUST succeed to a second term. Not only did he earn it at the ballot box before the massive theft of votes in oh-so-many criminal ways, but our Republic depends on his success and support for all of us.

This is telling and should be taken very seriously… Certainly appears to be a threat to Sidney Powell, Lin Wood, Legislative Leaders in Virginia, the President and others. Sure hope Secret Service is investigating, and that the US Marshalls will be called in to protect those who are in danger.

https://twitter.com/LLinWood/status/1335814945213132801

RE: Economics & Investing…

I have spoken with three realtors in the past few months. Was looking to sell and buy with a bit more land. Basically what I kept hearing from all of them (Idaho here) is Out of State buyers are buying anything available, in most cases sight unseen, all cash, no contingencies, no inspections. Idahoans are priced out of their own market. I didn’t actually believe the rumors until I ran into it myself. Realtors and others advised me to SELL in advance of buying and then, don’t count on being able to buy unless it’s all cash (20% down isn’t even in the running!), and prices are crazy inflated. Builders are backed up for over a year, so building isn’t an easy option. Lumber prices have gone through the roof. Not enough contractors to do the work if you decided to be your own builder and subcontract. Try getting a well driller any time soon… I’m hearing it’s the same in northwest Montana. I’ve probably mentioned all this before… it just hit me harder today because my realtor dragged their feet (not intentionally, they are crazy busy) and an offer was put in on a house before I could even get an appointment to see it. So I looked up the listing agent and called myself. Nice gal. She took the time to explain to me what she’s seeing and experiencing in real time. Cr@ZyTiMeS.

Good times for realtors, title companies, trades people, services, etc. I should change my thinking and open a bakery! LOL. Honestly tho, I should figure out how to capitalize on the influx of people with lots of cash rather than irritably licking my wounds.

To anyone looking to come to Idaho, it’s all cash and good luck. I’m very curious to see how this changes Idaho.

“I should change my thinking and open a bakery!”

[Flinging hand in the air] Oooo ooo, pick me! Hire me! Breads, rolls, specialty cakes, and my candies are always a huge hit too! 😉

This article is from the Mises Institute, and appeared at ZeroHedge. As we may yet face a “Global Reset”, it will be important to understand how the debt of one is being associated with the savings of another. The implications for savings is potentially severe. How to make financial decisions in the face of this? This is an interesting and very important question.

https://www.zerohedge.com/markets/great-reset-and-plans-global-war-savings