Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at the recent spike in spot palladium. (See the Precious Metals section.)

Precious Metals:

Lyn Alden: Silver Price Forecast: Most Likely A Strong Decade Ahead

o o o

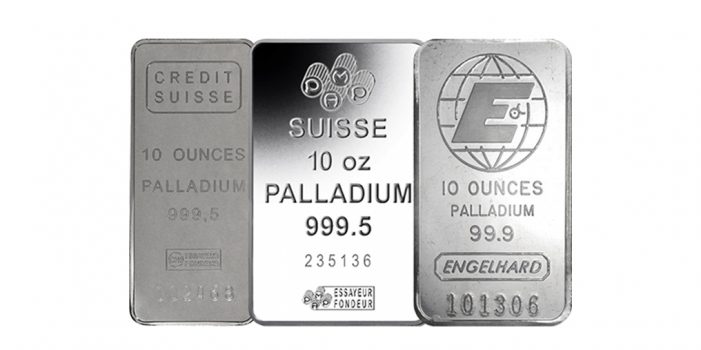

Palladium Hits New Record; Gold’s Gains Continue to Chip Away. Here is a pericope:

“Spot palladium was up $53.36, or 2.5%, at $2,185.63 per ounce at 3:00 PM ET (20:00 GMT). It earlier hit an all-time high of $2,193.

Palladium futures settled up $44.20, or 2.2%, at $2,123.30, after touching a record high of $2,126.55 earlier.

Palladium, the commodities star of 2019 with a 55% gain, is once again leading the pack, with a return of nearly 11% year to date.

An ingredient for cleaner emissions and better performance from gasoline-powered engines, palladium has been boosted again in the past two weeks by a supply squeeze in major producing countries South Africa and Russia.”

o o o

Goldman Says Gold Is A Better Hedge Than Oil

Economy & Finance:

At Zero Hedge: US Consumer Prices Accelerate At Fastest Since Oct 2018

o o o

Another at Zero Hedge: Repo Shrinkage Begins In February: That’s When Fed Cuts Each Term Repo By $5 Billion

o o o

This was mentioned by the McAlvany Intelligence Advisor: $1,163,090,000,000: Federal Spending Sets Record Through December. This CNSNews article begins:

“The federal government spent a record $1,163,090,000,000 in the first three months of fiscal 2020 (October through December), according to the Monthly Treasury Statement released Monday afternoon.

That was up $48,008,200,000 from the $1,115,081,800,000 (in constant December 2019 dollars) that the federal government spent in the first three months of fiscal 2019.

o o o

At Wolf Street: Fed Pays $35 Billion to Banks, $6 Billion to Reverse-Repo Counterparties in Interest for 2019, Remits $55 billion to US Treasury

o o o

Treasury to start issuing 20-year bonds to fund ballooning deficit

Commodities:

What to Watch for in Commodities in 2020

o o o

OilPrice News reports: Bad News For Oil: Refinery Profits Are Sliding

Hedge Funds:

Hedge Funds Could Make One Potential Fed Repo-Market Fix Hard to Stomach

o o o

Fed Considering Lending Cash Directly To Hedge Funds In Next Repo Market Crisis

Forex & Cryptos:

In The WSJ: U.S. Drops China’s Currency Manipulator Label Ahead of Trade Deal

o o o

Stop Hunting With the Big Forex Players

o o o

Bill to Exempt Small Crypto Transactions From Taxes Returns to US Congress

o o o

Jameson Lopp: What are the Key Properties of Bitcoin?

o o o

Sorry Bulls, Bitcoin Isn’t Going Parabolic Just Yet: Here’s Why

Tangibles Investing:

Millennials, priced out of homes locally, shop for investment properties online

o o o

Finally Legal: Cars You Can Bring to the U.S. in 2020. JWR’s Comment: It is unfortunate that most Land Rover Defenders are still considered “Gray Market.” Clearly, clearly, we are governed too much, in every aspect of our lives, folks!

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News from local news outlets that is missed by the news wire services is especially appreciated. And it need not be only about commodities and precious metals. Thanks!