Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at the heavy truck market, as an economic indicator. (See the Economy & Finance section.)

Precious Metals:

A fascinating piece by Lyn Alden, over at Gold-Eagle: Gold Price Forecast: A Weaker Dollar Is The Easiest Path To $2,000 Gold

o o o

Gold Price Forecast: Gold To Rise On Fed Dollar Debasement

Economy & Finance:

My wife (Avalanche Lily) suggested this: 2020 FINANCIAL CRISIS — Has it started? The $500 Billion Dollar Question

o o o

Is the Fed’s $3 Trillion in Loans to Trading Houses on Wall Street Legal? (Thanks to G.P. for the link.)

o o o

2020 FINANCIAL CRISIS — Has it started? The $500 Billion Dollar Question

o o o

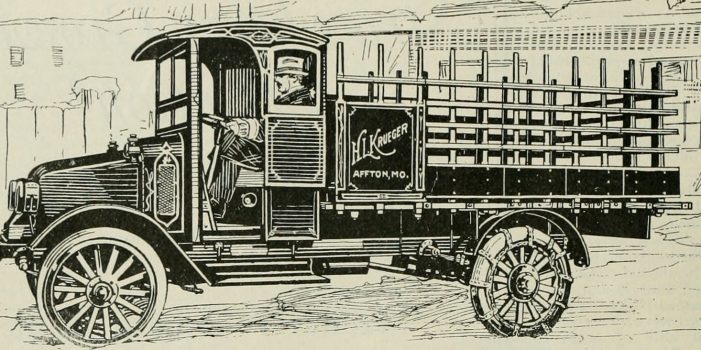

At Wolf Street: Turmoil in the Heavy-Truck Market as Seen by a Truck Dealer. The piece begins:

“‘On our lots, there are no lookers for used sleepers, and we will sell new sleepers at a loss to clear them out, and new orders for sleepers have come to a stop,’ a heavy truck dealer who owns two stores with several franchises told me. The truck dealer was talking about the turmoil in the heavy-truck business, where orders for new Class-8 trucks have collapsed by as much as 80% year-over-year…”

Reader H.L. sent this: Americans Are Back To Using Their Home Prices As ATMs: Most Cash Pulled Out in 12 Years!

Sweden: First Central Bank Exits Negative Interest Rates.

Commodities:

All the odds are stacked in favor of commodities for 2020; here’s the ultimate forecast

o o o

OilPrice News reports: The 10 Most Important Oil Market Trends For 2020

Bonds:

At Zero Hedge: Even Goldman Bristles As Junk Bond Rally Smashes All Records.

o o o

Bond Market Outlook: Treasury Yields May Rise in 2020. Here is a snippet:

“Bond investors have enjoyed strong returns in 2019. The steep drop in yields and declining credit spreads (the yield difference between corporate bonds and Treasuries of the same maturity) combined to boost returns in a wide range of fixed income asset classes. In 2020, we expect returns to be more subdued. From current levels, yields are likely to move modestly higher, while there isn’t much room for credit spreads to fall further. Consequently, we expect returns to be in line with the current income offered on bonds, while price gains are likely to be limited. “

Cryptos:

There is already some conjecture on the planned mining reward “halving” of Bitcoin on May 14, 2020. This next reduction will drop the incentive for miners down to 6.25 bitcoins per block. (It is presently 12.5 per block.) I posit that this next BTC halving (or “halvening”) will actually benefit Ethereum more than Bitcoin, since many miners might switch over. Presently, Ethereum is the most profitable e-coin to mine. But after the May 14, 2020 BTC halving, Ethereum will become even more profitable, at least in relative terms. I believe that will focus more attention on Ethereum.

o o o

More, on the same topic: Relying on Bitcoin’s Halving Price Pump Could Be a Huge Mistake, Warns Asset Manager

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News from local news outlets that is missed by the news wire services is especially appreciated. And it need not be only about commodities and precious metals. Thanks!

With the now explosive Iran situation (literally) one might heavily consider investing in any particular goods or weapons that are missing from your homestead. Take stock. If you see a glaring hole, fill it.

BGF: It’s always something isn’t it. Every day there is another event or happening that causes alarm.There is so much going on in the world it is hard to keep up with it all,let alone get ahead of the threats.

Sometimes you feel like the blind dog in the meat house,snapping at everything.

True. However, let us not lose our heads but rather use such shocks and events to have an honest look at our situations and take stock. If we should find any particular areas to be wanting, fill the gaps. Better to be honest and prepared than sorrowful later.

I’m not telling anyone that “this is it” and to go out and max out the credit cards for more gear…just have a look and see where you stand, and by extension where your family stands too.

Re: Iran

You are in good company. Gerald Celente believes that this is first shot of WW3. I’ve been working hard in recent months and days making double dog gone sure I do not miss the opportunity to top off important supplies etc as I figure 2020 will bring in more ‘black swans’. Tonight’s project is servicing all old and new magazines, and loading a new type of ammunition for testing in all mags. The new ammo is a soft point and has COL (cartridge overall length) that is .005” longer. Soft point ammunition may not be as reliable as FMJ. If there is no opportunity to test a small batch new ammo before buy in bulk, buy FMJ in brass cases, as this is the most reliable.

Here is Celentes video only a few hours old:

https://youtu.be/pqPy17h-rrE

Does anybody know of a good food cooperative to purchase bulk items that delivers in the KCMO area? Azure Standard is forever short and back ordered. Hard to find one locally other than ordering from a store and paying high prices. Food prices are climbing and availability is decreasing. It is time to order if you have not.

Missouri Mule: Take a look at Rainy Day Foods.They have a great selection of bulk food.

Their prices are good but they are located in Idaho so shipping will be a factor.

Thanks for the lead, Norml Chuck. I did a quick go round on the site.

Will do a deeper dive another time.

Carry on

Another economic indicator like the heavy trucks is cardboard boxes. Its intelligence leads the talking heads.

Aside from the hard gear, look at water purification supplies, for those of you who are light in this area. Liquid bleach lasts 6 months to a year, and does not kill cysts in ditch water.

Calcium hypochlorite, the dry form of sodium hypochlorite (bleach), stores for over a decade and will make a LOT of treated water. Dry Tech is the best pool shock for treating drinking water. Read all instructions and warnings. It’s a powerful oxidizer. Aside from drinking water, you’ll need this stuff to sterilize filthy laundry and used cotton toilet wipes (after your TP has run out). Yes, the diaper pail will rise again! Calcium hyperclorite does not kill Giarida or Cryptosporidium, either. But it’s useful for many other organisms.