Here are the latest items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on S&W Firearms. (See the Tangibles Investing section, near the end of this column.)

Precious Metals:

Gold Pushes To Daily High On Positioning Ahead Of FOMC

Cryptos:

Jim Wyckoff: Bitcoin Daily Chart Alert – Bulls Showing Strength This Week – March 21

o o o

Forex:

NZD/USD Price Forecast March 21, 2018, Technical Analysis

Economy & Finance:

This past week all eyes in the financial world were on the Federal Reserve Board banking cartel’s Open Market Committee. On Wednesday, as expected, they raised rates by 25 basis points. (As reported from the perspective of the statist/pro-bankster CNN.) That 1/4 of 1% rise had long been expected. The big question is: How many more rate hikes will there be in 2018 and 2019? Higher interest rates will slow the economy and probably take the tops off the bubbly stock market, the new car market, and the housing market. If the Fed banksters take a dislike to the Trump Administration, a series of rapid rate hikes could tip the scales in the November 2018 mid-term elections.

o o o

Brexit Betrayed by UK Government of Globalists

Tangibles Investing (S&W Firearms):

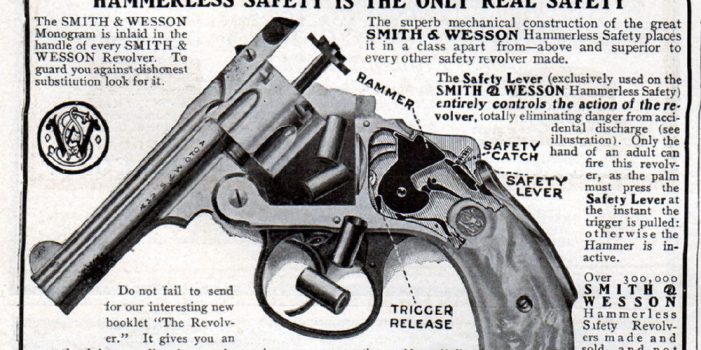

While many American gun collectors focus on Colt revolvers, there is growing interest in Smith & Wesson (S&W) firearms. The company is nearly as old as Colt, and many of their guns are just as well made.

I think that it would be wise to shop around for some desirable S&W firearms still in their original factory boxes. The most obvious choices would be the “pinned and recessed” (or P&R) swing-out cylinder revolvers, made before 1983. And, as preppers, for longevity and weather resistance we’d probably want to concentrate on the subset of their stainless steel P&R revolvers. These include the Model 66 (K frame) and and the Model 629 (N Frame.)

One as yet mostly-overlooked category for long term appreciation would be Smith & Wesson M&P-10 ARs. These are large receiver AR-10 family clones made by S&W that are mostly chambered in .308 Winchester. They presently sell for only slightly more than generic AR-10 clones.

Another good choice would be S&W’s .45 ACP M1911 clones. Both of these have been made only in the last few years of the company’s operation. If S&W ever goes the way of Remington, then I predict that many Smith & Wesson-marked guns will see large price gains in the next few years. But regardless, they are a great tangible investment.

As always: Do your homework and shop around for the best prices before you buy.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. So please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often “get the scoop” on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!

Was good to see the picture of Louis Lamour on yesterday’s blog. I suppose I have read almost all of his books as a teen and enjoyed every one, especially the Sacketts. I believe he did receive some sort of an accommodation from one of our presidents (Reagan?)

I believe it was Reagan. I had the privilege to meet Mr. Lamour at a small gathering, many, many years ago. He signed one of my books, one of the first Sackett books. I was even quoted in the paper when I asked him about Shalako. I don’t think that town ever became a reality.

If the fed banksters decide to torpedo the economy because they do not like Trump they will certainly be in violation of their charter. But it is time to eliminate them anyway. They have caused untold recessions, depressions, deaths and onerous borrowing rates for far to long. Congress created them in violation of the Constitution in 1913, just in time for WWI Where they (The big Banks) made fortunes. They have been using Wars to continue their policies of self enrichment ever since. Congress created them and it is time to return our economy to people who do not have extreme conflict of interests in their hearts. How to pay off the national debt is fairly simple. Since they have legalized Bail Ins where the banks can now take depositors money for their own uses and issue stock certificates to remain afloat in times when they create economic chaos. (Who amongst us would actually invest our money in a failing financial institute willingly ?) I suggest we have a national Bail In whereby we eliminate the Federal Reserve System, take enough of their money in a government Bail In to cover the national debt, require a balanced budget and replace them with a hard currency that cannot be over inflated by congress and fix interest rates for specific time periods of 2 or more years to promote stable economic growth and put caps on interest increases. Break them up to stop the Big Bank monopoly as well as looking into prosecuting their executives for Rico Violations. We also need to stop allowing banks to borrow money from the government with only $15 reserves for every 100 dollars they borrow at almost a nothing interest rate and then loan our money back to us with a 800% markup. Also selling mortgages back to quasi government agencies like Fanny Mae when they are going bad, putting the burden of bad investment on their part back on the public. Check out how we are getting screwed and let you Congress Members know that they need to fix Bank abuse and not just let the Federal Reserve System keep bleeding us dry as a nation. Lincoln abolished slavery yet we were enslaved by Congress on a golf course in 1913 with the creation of the illegal Federal Reserve System. Perhaps it is time for a little more work on a golf course?

Joe, I like what you are saying. But, I’m afraid it will be China and Russia Bloc that will finally bring in hard currency. Our government seems to have signed a death pact with our central bank and their fiat currency.

It is only a matter of time until they take out Bitcoin and all the clones. If current laws does not do it, new ones will. The banks want the monopoly on money and every level of government wants / needs taxes on everything.

Do you seriously believe any government will allow that level of privacy? Enjoy it while you can!