Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. Most of these items are from JWR’s “tangibles heavy” contrarian perspective. Today, we report on Janet Yellen speaking the “D” word: Default. (See the Economy & Finance section.)

Precious Metals:

Posted last Friday: With gold ending the week above $1,900, analysts turn their focus to $2,000.

o o o

At Gold-Eagle.com: How Cheap are the Mining Shares? The Barron’s Gold Mining Index Tells All. A key quote: “…the broad stock market is nearing the edge of a big-bear market decline that will shock people. The gold miners have historically been counter-cyclical to the broad market in times of its distress.”

Economy & Finance:

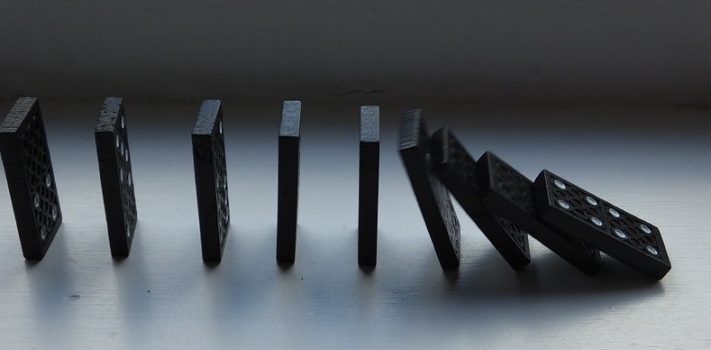

Yellen warns of US default risk by early June, urges debt limit hike. JWR’s Comments: When national treasury or central bank officials use the dreaded “D” word, beware! The Treasury Department’s cost of servicing the national debt is getting away from them. Once interest rates spike, the dominies might begin to fall.

A side note: Some 33 years ago, when I wrote the first draft of what later became my novel Patriots, I included this, in the opening chapter:

“In Europe, international bankers began to vocally express their doubts that the U.S. government could continue to make its interest payments on the burgeoning debt. In mid-August, the chairman of the Deutsche Bundesbank made some “off the record” comments to a reporter from The Economist magazine. Within hours, his words flashed around the world via the Internet: “A full-scale default on U.S. Treasuries appears imminent.” He had spoken the dreaded “D” word. His choice of the word imminent in conjunction with the word default caused the value of the dollar to plummet on the international currency exchanges the next day.”

o o o

I just found this web page, issuing a similar warning: Higher Interest Rates Will Raise Interest Costs on the National Debt.

o o o

Forbes: Recession Fears 2023: What Lies Ahead?

o o o

At Zero Hedge: How Crazy Will Economic Conditions Be in 2023?

Commodities:

S&P Global: Commodities 2023: Southeast US power markets face big changes as forwards indicate weaker prices.

o o o

China’s opening and U.S. rates to stir commodity markets in 2023.

o o o

Watch propane price curves to chart a course.

o o o

From OilPrice News: Washington Has Trouble Refilling The SPR After 220 Million Barrel Draw.

o o o

WSJ: Wheat, Soybean, Corn Prices Expected to Have Choppy 2023.

Inflation Watch:

FMI: Climate change, transportation & trade relations will test food inflation in 2023. A summary:

“While economists predict inflation will ease slightly in the coming quarters, this year could easily become a “groundhog day version of 2022” if the weather takes a turn for the worse and triggers a domino effect that strains transportation, commodity production and geo-political relationships ultimately pushing costs higher, warn industry leaders.”

o o o

US Inflation Rate by Year From 1929 to 2023. JWR’s Comment: The inflation estimates for 2023 and 24 at the bottom of the big table are ludicrously low.

o o o

The pain isn’t goin’ away: Inflation cost households an extra $10,000.

o o o

Inflation could rise beyond 10% in 2023, Fed rate hikes may make it worse – Peter Schiff.

o o o

At MarketWatch: Inflation is easing, but the prices of some grocery items are expected to soar in 2023 — including one whose price has risen nearly 60% over the past year.

Forex & Cryptos:

From left-wing CNBC: Why a strong U.S. dollar is bad for ‘the rest of the world’.

o o o

At Currency Thoughts: Less Confidence About Where Inflation May Be Headed.

o o o

Sam Bankman-Fried’s Hedge Fund Allegedly Stole $65 Billion From Customers. Here is a quote:

“We know what Alameda did with the money. It bought planes, houses, threw parties, made political donations. It made personal loans to its founders. It sponsored the FTX Arena in Miami, a Formula One team, the League of Legends, Coachella and many other businesses, events and personalities.”

o o o

At CoinJournal: Why have Some Exchanges not Released Proof of Reserves?

o o o

FTX says it has recovered over $5B, but customer losses still unknown.

o o o

Sam Bankman-Fried ordered $65 Billion ‘secret backdoor line of credit,’ lawyer says.

o o o

Cue the Doom music: Joint Statement on Crypto-Asset Risks to Banking Organizations.

Tangibles Investing:

Hey! Do you want to buy a little 1.5″-long unfinished block of steel with just one moving part, for just $59,995? If you are wondering how the market in transferable Class 3 guns and autosears got so wacky, then read this piece that I wrote for SurvivalBlog, back in 2007: How Federal “Bans”, “Freezes”, and “Price Controls” Spread Economic Chaos.

o o o

High-Net-Worth Individuals Asset Allocation Breakdown. Here is a key quote:

“However, while everyone dreams of becoming an HNWI, the journey to reach the milestone requires an effective strategy with the right investments. It is important to understand high and ultra-high-net-worth asset allocation and assess what type of investments you can make to achieve the target financial milestone. For example, while you may think that HNWIs and UHNWIs have access to wider investment opportunities than an average investor, such as expensive paintings, vintage cars, equity in private companies, expensive wine, real estate, and more, as the data suggests, the asset allocation for high-net-worth individuals’ lays 26% in alternative investments, a class of asset accessible and available even for an average investor. However, according to a recent survey, alternative assets only form 5% of the average investor’s portfolio.”

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. Thanks!