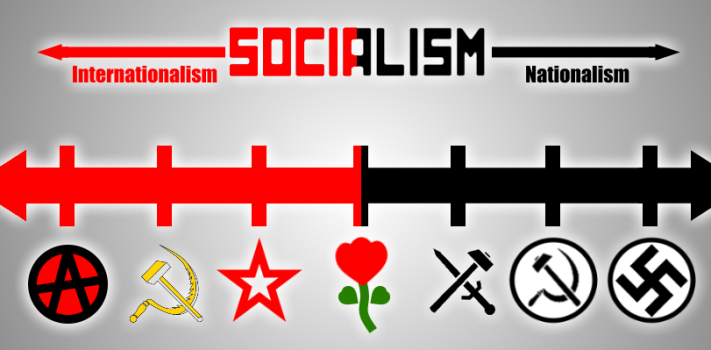

Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, a few glimpses at the latest socialist schemes. (See the Economy & Finance section.)

Precious Metals:

Stefan Gleason: Silver Supply Deficit Frames Bullish Outlook.

o o o

Gold Falls Below $1900 as DXY Rallies to a 25-Month High.

Economy & Finance:

Buttigieg floats ‘monthly transportation payment’ that ‘covers everything’ to replace car payments. Here is an excerpt:

“Secretary of Transportation Pete Buttigieg suggested that transitioning to a “monthly transportation payment” from monthly car payments could be in America’s future.

Buttigieg also said a “monthly mobility dividend” could lie further out in the future.

“What I mean by that is if we’re looking way out into the future, where we have things like, let’s imagine distributed energy generation where you have resources at your house, whether it’s a dramatically more efficient, even solar panels and wind resources,” Buttigieg said Wednesday at an event hosted by the liberal think tank New America.”

o o o

California Lawmakers Propose 4-Day Workweek.

o o o

Canceling student loan debt ‘still on the table,’ White House says: What to know.

o o o

US rent prices reach record highs as buyers pushed out of market.

Commodities:

From Reader Ted S.: Two charts that show the sharp rise in food prices.

o o o

OilPrice News reports: The Oil And Gas Industry Is Booming Despite Net-Zero Ambitions.

o o o

Russia’s war delivers massive boost to Australia’s commodities.

Inflation Watch:

In The Wall Street Journal: Inflation Got You Down? At Least You Don’t Live in Argentina. “Citizens cope with world’s second-highest rate by hoarding toilet paper, spending paychecks immediately; ‘Here, 40% is normal’”

o o o

o o o

Farm Inflation: Fertilizer, Food, and Equipment Manufacturing.

o o o

Fears of Yet More Inflation Hound Markets as China Tackles Covid.

o o o

Why Fed worries about the strongest US job market in decades.

Forex & Cryptos:

Dollar jumps on China growth fears, yen rebounds before BOJ meeting. This article begins:

“The dollar hit a two-year high on Tuesday as concerns about slowing growth in China and expectations that the Federal Reserve will aggressively hike rates boosted demand for the greenback.

The Japanese yen also rebounded as investors speculated that the Japanese central bank or government may act to stabilize the currency, which last week hit a 20-year low against the dollar.

Concerns about Chinese growth have increased with the financial hub of Shanghai having been under strict lockdown to fight COVID for around a month. Beijing overnight also ramped up plans for mass-testing of 20 million people and fuelled worries about a looming lockdown.”

o o o

10 Lowest Currencies In The World 2022.

o o o

Dogecoin (DOGE) Jumps 30% After Elon Musk Buys Twitter.

o o o

Market Nosedive Sends Cardano (ADA) Deeper Into Bear Territory.

Tangibles Investing:

If classic cars aren’t your style, then what about antique trucks?

o o o

Recap: Watches & Wonders Geneva.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. And it need not be only about commodities and precious metals. Thanks!