Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at the manifold signs of rising general price inflation, with postage stamps as the poster child. (See the Inflation Watch section.)

Precious Metals:

On June 2nd, it was reported: Gold futures hold above $1,900 as spot gold trades just below at $1,899.30

But then on June 3rd, both gold and silver took a dip. Gold was down 2% to $1868.60. So this might be a good juncture to buy some physical gold or silver. And, for the record, I’m still leaning toward silver. The silver-to-gold spot price ratio is presently 68.67-to-1. In my estimation, a ratio anywhere above 45-to-1 makes silver a buy.

o o o

US Mint Delays Silver Shipments Due To “Global Silver Shortage”. Note: The U.S. Mint later posted this follow-up: “In a message released Friday, May 28, we made reference to a global shortage of silver. In more precise terms, the silver shortage being experienced by the United States Mint pertains only to the supply of silver blanks among suppliers to the U.S. Mint.”

o o o

How Governments Killed the Gold Standard

o o o

Arkadiusz Sieroń: Biden Proposes $6 Trillion Budget. Will Money Flow Into Gold?

Economy & Finance:

Over at Fox Business: US durable goods orders drop 1.3% in April

o o o

At Zero Hedge: California’s Massive Container-Ship Traffic Jam Is Still Really Jammed

o o o

At Wolf Street: Fed Drains $485 Billion in Liquidity from Market via Reverse Repos, Undoing 4 Months of QE, Even as QE Continues, Total Assets Near $8 Trillion

Commodities:

JBS Says “Significant Progress” After Ransomware Attack, Sets To Reopen Meat Plants Wednesday.

o o o

Copper prices: fundamentally justified or fundamentally flawed?

o o o

OilPrice News reports: Oil Prices Hit 2-Year High.

o o o

Inflation Watch:

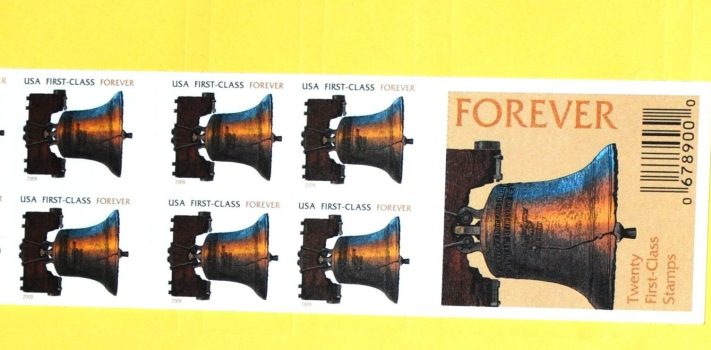

H.L. sent this: U.S. Postal Service looks to raise first-class stamp to 58 cents. JWR’s Comments: “Forever” stamps are a good hedge on inflation. Just be advised that due to their hygiene regulations, USPS postal clerks are not allowed to buy back postage stamps, even if they are in sealed packages. So never buy more Forever stamps than you believe that you will eventually use personally, or be able to barter with neighbors and friends. And, of course, there is no point in stocking up on stamps printed with a dollar amount. Only “Forever” stamps will be your inflation hedge.

o o o

Fortune reports: Lumber prices are up 232% and ‘could spiral out of control in the next few months’

o o o

The Worst-Kept Secret in America: High Inflation Is Back.

o o o

The Tax That Nobody Voted For, and Everyone Pays.

o o o

Gas Is Going To $5 Per Gallon: First In California, Then Across The Country

Forex & Cryptos:

Good Day for the Dollar and a Bad One for the Turkish Lira

o o o

Going to six Real to the Dollar? Shift in Brazilian Real Forecast

o o o

Reserve Bank of Australia Maintaining Monetary Accommodation

o o o

A JPMorgan Icon Quits, And Has Some Parting Words About Cryptocurrencies. (A hat tip to H.L. for the link.)

o o o

Crypto Analyst: Bitcoin Is On The Cusp Of A Potential Death Cross

Tangibles Investing:

Modular Construction: “Not there yet”

o o o

It is Hard to Resist the Dopamine of Collective Euphoria in the Housing Market. JWR’s Comment: Only rising interest rates will kill this market boom.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. And it need not be only about commodities and precious metals. Thanks!