Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on Colt New Service revolvers. (See the Tangibles Investing section.)

Precious Metals:

Silver was flat this week, but gold took a jump, following the bad news on Wall Street.

o o o

Gold: Silver: The Markets: What’s Next For 2019

o o o

The Gold and Palladium ratio now shows the two metals trading at parity! This is probably a great time to buy physical palladium, if you want to diversify your precious metals portfolio.

Stocks:

This past week’s stock market slump is making headlines. As of Thursday morning (when I’m wring this), the Dow Jones Industrial Average (DJIA) is down another 648 points to 24,375. That was a 2.64% drop. And combined with Wednesdays’ losses, we’ve seen a 1,500 point drop. Ouch. And that wasn’t the first big fall. Back in October, market declines had already wiped out all of the gains for 2018.

I now fully expect this to turn into a secular bear market–especially if interest rates continue to rise and the tariff war continues. As I’ve written before: The Powers That Be would rather see a market crash than see Donald Trump re-elected.

Economy & Finance:

Morgan Stanley sees risk of US recession in 2019

o o o

Why Switzerland is worried about UK trade after Brexit

Commodities:

Oil Prices Tumble as Saudi Energy Minister Tames OPEC Production Cut Talks

o o o

I noticed that the futures market for wheat was down to $5.07 on Thursday. That was a 1.46% drop. Remember: Grain prices are in part tied to the overall economy. But it is usually weather that drives their prices. Thus, the price swings can be huge. As peppers, we should buy physical grains when prices are low! (Like now.)

Forex & Cryptos:

Pound Sentiment Erodes after Opening Debate – 05 December 2018

o o o

USD/ZAR forecast South African Rand December 6, 2018

o o o

Bitcoin Cash Drops 81% in 1 Month: Why is it Plunging So Rapidly?

Tangibles Investing (Colt New Service Revolvers):

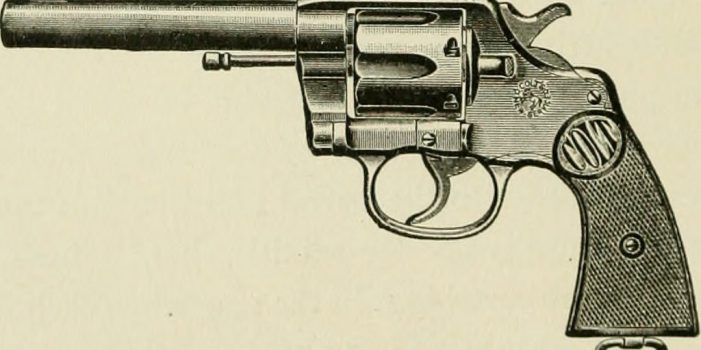

I’ve always been a fan of Colt New Service revolvers. This was Colt’s first large frame revolver with a swing-out cylinder. You’ve probably seen these in movies.

About 356,000 were made. Most of those were the M1917 .45 ACP variant, which was designed to use Half Moon clips. (Since .45 ACP is rimless, it was the only way to eject fired cartridges.) Production of the New Service began in late 1898 and continued until 1946.

Only the first 250 New Service revolvers were made before January 1, 1899, making them legally “antique” under Federal law. By happenstance, I’ve had two Federally Antique examples in my possession. One of them (serial #49) I sold a few years ago, and the other (with a serial # below 220) I plan to keep and pass down to one of my grandsons.

As with any other collectible gun, condition is very important to assigning value. Look for minty examples with most of their original bluing intact, perfect mechanical condition, and grips that are in nice condition. Back when I was in college in the 1980s, you could fine a New Service for $200 to $350. Nowadays they start at $800, for one in rough condition. Prices can range up to $3,500. Finding one that is 1898 production (serial number under 250) just about triples its value.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often get the scoop on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!

Colt New Service. Great guns I have two in 45LC, one is a target model. Great shooters if you load them with .454 bullets. I also have two in 44-40. Both the 44-40’s have tight cylinder mouths and won’t shoot worth a hoot. I need to open up the cylinder mouths a couple thousandths and I should be good to go. I have no idea how they might have loaded the 44-40’s in the old days, maybe that’s why my two in 44-40 have little sign of use, they didn’t shoot well back then either. Also, the later ones in the 20’s and 30’s have better sights, thicker blades with a wider notch. The early ones can be hard for old eyes to see, sights are pretty fine.

I have a couple S&W .44 HE’s in .44 special from the early 20’s (2nd model) that are great shooters too.

BTW, all of these guns benefit from the installation of Tyler T-Grips. They really bust my middle finger knuckle without the Tyler T-Grip. Might be because of my smallish hands, I don’t know….

All of these old pre-WWII wheel guns are rapidly going up in value.

Buy palladium? Did you mean platinum perhaps?

No, I meant what I wrote: Palladium. But only to diversify an existing portfolio which for most of us is heavy on silver.

Yeah, platinum is stupid cheap right now. Priced less than gold or palladium.

Typically gold and palladium are about at parity w/ platinum charging a significant premium.

JWR — why the emphasis on palladium?

Personally, I’d rather have a portfolio of silver and platinum at today’s prices than either gold or palladium.

One “theory” I’ve heard about bitcoin was that major financial institutions want to open trading desks in cryptos and are leveraging their prices lower before they enter the market. Has anyone else heard this?

in the permian basin drilling for oil there are 3 pipelines that were due to be finished 2020 taking the oil to the gulf. They are ahead of schedule and rumor says it will be finished between the 2nd or 3rd quarter of 2019. With all that being said, you have to wonder will that gear up the drilling only to put a glut in place? Once they start they can never pace themselves and soon there is too much on the market and then that causes other problems. Boom towns have over inflated prices on housing, real estate, fuel, groceries, child care and even overcrowded schools. The list goes on and on.