Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on ancient coins. (See the Tangibles investing section.)

Precious Metals:

We’ll start today’s column with this by Neils Christensen: Gold On The Menu Next Week If Trade Outlook Improves After G-20 – Analysts

o o o

Reader George T. tipped us to this article: Canada Outlaws Mailing Gold Coins, Gold Nuggets and Gold Dust

o o o

Gold And Silver Are Still Money Per Jp Cortez

Economy & Finance:

Here is a “must watch ” 46-minute interview about the imminent bursting of the global credit bubble: Bill Holter – Mad Max World Possible as Unpayable Debt Bubble Pops. JWR’s Comment: When a high-level financial adviser starts talking about food and fuel storage, pay attention! Also note that he concurs with my assessment of silver and the gold-to-silver ratio.

o o o

For the U.S. Economy, Storm Clouds on the Horizon

o o o

Here is an interesting book review with commentary by John Mauldin: Ray Dalio: This Debt Cycle Will End Soon

Offshore Investing:

At The Burning Platform: Is An Offshore Account Safe?

o o o

At International Man: 10 Reasons Why You Need an Offshore Bank Account Today

Derivatives:

Stuart Lewis: “Deutsche Bank has cut its exposure to derivatives” JWR’s Comment: All that this sugar-coating is really telling us is that Deutsche Bank has reduced its derivatives counterparty risk from Stupendous down to merely Gigantic. (The notional value is still measured in the tens of trillions of Euros–larger than the annual GDP of Germany.)

o o o

Role of Derivatives in Creating Mortgage Crisis. (How Derivatives Could Trigger Another Financial Crisis)

Forex:

A few brief currency exchange rate updates:

GBP/USD: The British Pound has declined to 1.27684 (At a “support” level, by the Chartists.) The big question for the value of the Pound is whether or not Brexit actually proceeds. I have my doubts about the sincerity of British politicians. Methinks that they will continue to find reasons to drag their feet on completing Brexit for another couple of years. What the “Remain” crowd really wants is another plebiscite. They somehow remind me of vote counters in Florida–never satisfied until they get things their way…

o o o

The CAD/USD rate is fairly stable at 1.3294 Canadian to buy 1 US Dollar.

o o o

And for you Swissie trade fans: The CHF/USD rate is still very close to parity. (With 1-to1 parity crossings taken place in May, July, and November of this year.) I’m glad that I bought Swiss Francs when I did!

o o o

Will interest rate increases in the US. push Forex rates significantly in 2019? Time will tell.

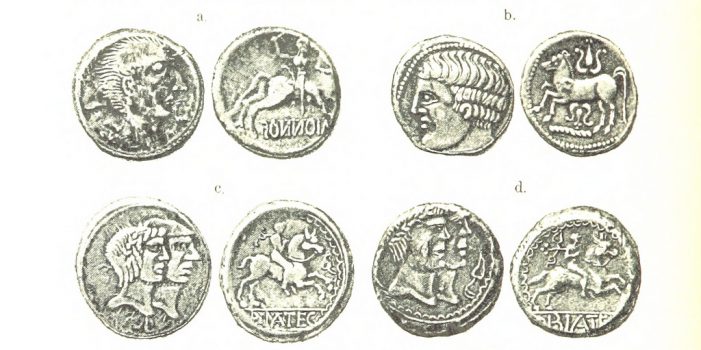

Tangibles Investing (Ancient Coins):

I’ve issued several warnings about investing in ancient coins, over the years. As I have mentioned, there are new hoards of coins being found regularly. With new metal detecting, ground penetrating radar, ultrasound, geospatial comparator software, and other technologies, I expect the rate of these new finds to increase in the next 20 years! Such will finds will likely crash the market value of ancient coins for 50 years, or more.

Here are just a few recent examples:

- Huge hoard of Roman gold coins discovered in Italian theater basement.

- Hoard of 2,000-year-old silver Roman coins unearthed by group of friends and a metal detector

- A Search for a Lost Hammer Led to the Largest Cache of Roman Treasure Ever Found in Britain

- 1,500-Year-Old Coin Stash Leaves Archaeologists with Mystery

- Mystery over tonnes of ancient coins found buried in Chinese village

- Boy unearths treasure of the Danish king Bluetooth in Germany

- Who Buried the $10 Million in Coins Found by a California Couple—and Why?

- Miners find 500-year-old shipwreck filled with gold coins in Namibian desert

- Thousands of gold coins found in Caesarea’s ancient port

o o o

If you are looking for tangibles to set aside for barter or investment, then keep a close eye on the SurvivalBlog Classifieds. And if you want to sell some of your household goods to generate cash for any purpose, our classifieds are a great place to sell them. Our text-only ads are free, while ads with photos are very reasonably priced. (Staring at just $4 per month.) Please take full advantage of this service that can put you in contact with like-minded folks, all over the country.

Annual Financial/Investing Disclosures:

By Federal law, I am obliged to make periodic public disclosures.

For the record: I am presently the sole author of SurvivalBlog’s thrice-weekly posted Economics & Investing For Preppers column. I am not a paid investment counselor or adviser. My paid consulting is on preparedness, relocation, and related topics–not on investing, per se.

I am not a board member of any corporation. I hold no stocks, bonds, options, registered securities, or ETFs whatsoever. I am not paid or otherwise compensated by any company to promote any investment vehicle or currency.

I do not recommend or endorse any financial particular investment advisor, firm, blog, or web site, although I do quote various advisors and make links to their web sites. Such mentions and links are my own choices, and are never compensated.

While I personally hold precious metals, firearms, ammuntion, and other tangibles as a large portion of my portfolio, I have no connection or financial arrangement with any firm, other than that some such firms do buy advertising space in SurvivalBlog, and that we have affiliate advertising contracts in place with others. I do on occasion personally make purchases from these companies. However, I receive no special discounts or other consideration from them. Such advertising relationships have no bearing on the investing news that I report and the recommendations that I make. I personally hold some foreign currencies, but I have never held Forex options. I have never held any Comex options.

We maintain walls of separation between advertising, consulting, and editorial realms. No editorial space or content in this column is ever promised to any advertiser or consulting client. A few article links have been suggested by our advertisers, but we have never been compensated or felt obliged to post them. We universally reject the dozens paid editorial, infographic, product review, and link placement requests that we receive every week via e-mail from spammers, scammers, SEO wonks, and manipulators.

I am not now, nor have I ever been an agent of any foreign nation. After being de-briefed from Special Access Programs (SAPs), I resigned my commission as a U.S. Army Intelligence Corps officer on January 20, 1993. (The day that Bill Clinton first took office.) I have had no tasking or relationship whatsoever with the U.S. government, the U.S. Army, or any government agencies, other than as a normal taxpaying citizen. I did however, work as defense contractor in a technical writing and proposal writing capacity for various defense-related companies up until July, 2006. I no longer hold an active security clearance. I am a past-member of the Association of Former Intelligence Officers (AFIO), but have had no contact with that organization since the mid-1990s.

In sum, we do our very best to operate SurvivalBlog.com as ethically as possible. Our editorial integrity is very important to us. We will never betray the trust of our readers. In an age where journalistic prostitution has become the norm in the blogging world, we forthrightly reject even the slightest hint of editorial compromise. – JWR

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often get the scoop on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!

Offshore Accounts: I am working on suitable preps, storing some silver and gold coins, while working on a moving to a more suitable location. Due to this, my savings account is usually between $10K-$20K. I don’t see the lure for folks in my situation. If there money was there after the above, I would look at it.

Re: Economy and Finance

Bill Holter is a frequent guest on usawatchdog.com. In my opinion Bill Holter is a very savvy guy; one that I would trust. I’ve love to see Greg Hunter interview Mr. Rawles.

: Canada Outlaws Mailing Gold Coins, Gold Nuggets and Gold Dust

An un-enforceable law (except for those idiots that advertise that they’re breaking the law).

How is the Canuck Postal service going to know that I’m mailing gold or silver coins? Metal scanner? Open each and every package? I could always hide a few at a time in an otherwise innocent box of Other Stuff that I’m mailing to Someone Else.

More Gubberment Overreach.

Canada Outlaws Mailing Gold

I disagree with the article when it suggests it is because then Canada will know who has gold. Banning “future” mailings doesn’t achieve that purpose because you can’t see in the package. Neither does it tell you who has gold NOW.

What it does, sadly, is make it harder to GET gold. Something of real value which might be worth something when any future draconian measures taken by the government to prevent you from getting to your money in the bank goes into effect.

Unfortunately, we had something similar in principle to us in California. I used to order ammunition on the internet because even with freight it was still cheaper in bulk. As of last year I can still do so but I would have to do so through an FFL dealer and my cost savings is gone. Guess what? I don’t do that anymore and have dropped off my purchases 100%. But, luckily, I had a good amount anyway.

Just like us on this site, Canadians should try to get gold coins close to them when they can and squirrel away small bills on a consistent basis and secure them both safely. Unfortunately, I think Canadians are far more trusting of their government than we are of ours. But they’re very friendly folks I’ve found.

Why would Canada want to stop the mailing of gold ? It sounds to me that Canada is getting scared that their fiat money will soon fail and that Canada will be trying to go CASHLESS in order to totally control and tax all transactions, OR to go with negative interest rates. Negative interest rates means that the government takes a percentage of all bank accounts. Using gold or silver eliminates the ability of the government to do these.