Here are the latest items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on The Dollar Decline. (See the Forex section, below.)

Precious Metals:

First off, here is a headline at GoldSeek: Gold and Silver Market Morning: July 13 2017 – Gold and silver are rebounding!

o o o

Next, Steve St. Angelo opines: GOLD & SILVER MARKET: Four Interesting Developments

Commodities:

Reader L.B. sent us a link to this at Zero Hedge: BofA Stunned By Drop In Gasoline Demand: “Where Is Driving Season?”

Stocks:

Over at Value Line, Steve Katz posted this update: Stock Market Today: July 13, 2017

Forex (The Dollar Decline):

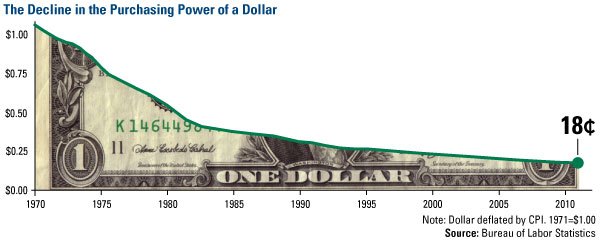

And continuing on to foreign exchange (Forex) news, take the time to read some spot-on commentary by Brandon Smith, over at Alt-Market.com. Here is an excerpt: “The U.S. dollar closed Q2 with its biggest quarterly drop in seven years, falling more than 6% during the quarter, which is a huge move for any currency let alone the world’s “reserve” currency. Compounding the bearish message of the dollar’s decline is the fact that this occurred during a period of time when the Fed is supposedly tightening money supply, which should drive the dollar higher. I would suggest that the dollar’s decline in the context of a “hawkish” Fed reflects the growing systemic dysfunction and fundamental deterioration of the economic, financial and political condition of the United States.”

o o o

I hope that some of you SurvivalBlog readers heeded my advice last fall and hedged into selected foreign currencies. I believe that the U.S. Dollar still has a lot farther to fall. So don’t feel that you’ve “missed the boat” on exercising this hedge strategy. The key issue is President DJT’s long-stated desire for the U.S. to have strong exports. Generating strong export numbers just about demands a weaker dollar! Plan on it.

Economy and Finance:

Visa Takes War on Cash to Restaurants. (Thanks to Bob R., who was the first of several readers to recommend this article.)

o o o

The Wall Street Journal reports: Fed’s Yellen Likely to Discuss Rates, Balance Sheet in Congressional Testimony

o o o

Over at Zero Hedge: Five Charts That Explain Just How Screwed Your State Is. (Note that the American Redoubt States are above average in their resiliency.

Troubling Trends:

H.L. was the first of several readers to send us the link to this video: Venezuela Goes Full Mad Max: Motorcycle Gang Overtakes and Loots a Truckload of Sugar. Note the use of Molotov cocktails to, ahem, “encourage” the driver to stop. Here is a rough translation of part of the description: “In a matter of minutes, dozens of people surrounded the truck and tearing off the canvas, began to unload the bags of refined sugar. This happened on the Zulia-Los Andes Road. The exact date is unknown, however it is presumed to have happened this month.” Wow! This is quite a case of “life imitates art.”

o o o

David Engstrom at Lear Capital warns: Bank Runs and Bail-Ins Going Global. Engstrom’s description of Warren’s Buffet’s clever maneuvering is most enlightening! (A Hat Tip to Reader D.S.V., for sending the link.)

Tangibles Investing:

At Bigger Pockets: The 4 Pros (& 6 Cons) of Investing in Vacant Land

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. So please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often “gets the scoop” on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!

Visa war on Cash. ” THIS NOTE IS LEGAL TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE” When a company sets out to destroy a countries currency I believe there are a number of laws as well as conspiracy laws that they could be prosecuted under. But the will has to be there. Write your Congress people and demand a new law that strictly prohibits actions of this sort with real jail time penalties for the perpetrators. If this goes into effect we can vote with our wallets and not patronize participating merchants. A side bar, I refuse to use automatic check out at stores as these machines are taking peoples jobs away. You can bet that they were not installed for your convenience.

1) The Redoubt glass is half full and half empty. On the one hand, it is an area that has above average income:

https://upload.wikimedia.org/wikipedia/commons/9/9f/United_States_Counties_Per_Capita_Income.png

2) On the other hand, much of the Redoubt income comes from spending by a federal government that is $20 Trillion in debt — with $8 Trillion (over 40% of US GDP) now being owned to foreigners. So what happens if the spigot gets turned off by the Chinese and Japanese?

http://www.supportingevidence.com/images/GovtSpendPerCapitaByCounty.png

VISA……and what else do they expect to be re-paid with, after they “loan” you credit? Wampum? BitCoin? NO! They want CASH! Be it a check, or transfer from a bank account, it’s CASH!

hypocrites.