Here are the latest items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on condition grading antiques. (See the Tangibles Investing section.)

Commodities:

$90 Oil Is A Very Real Possibility

o o o

Cobalt demand still there, says BMI’s Rawles. (Clarification Note from JWR: Although he is probably a distant relative, I don”t know Caspar Rawles. We’ve never met or corresponded.)

Cryptos:

The Crypto Market Just Hit a New Low for 2018

o o o

Bitcoin the ‘Best House in a Tough Neighborhood’: Wall Street Strategist

o o o

U.S. Judge Slaps Bitcoin Fraudster with $1.9 Million in Penalties

Economy & Finance:

Here is an important piece to read at Zero Hedge: 8 Measures Say A Crash Is Coming, Here’s How To Time It

o o o

Next, at Wolf Street: Cyclical Heavy-Truck Industry Soars to Cloud 9

o o o

Long-time blog reader H.L suggested this: Welcome to the ‘Man Camps’ of West Texas

Forex:

Turkish Banks Scramble to Stave Off Debt Crisis, as Lira Plummets

o o o

Forex Currency Pairs: The Ultimate Guide and Cheat Sheet

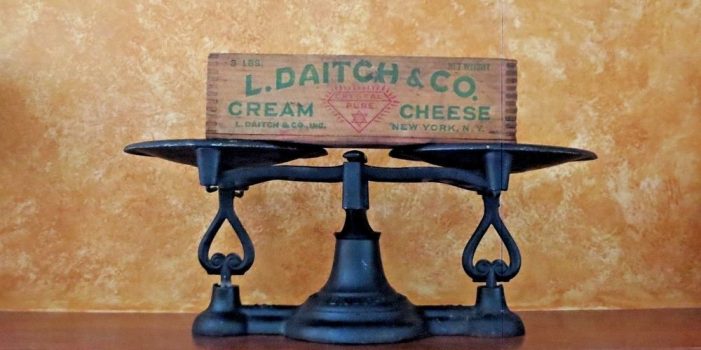

Tangibles Investing (Condition Grading Antiques):

This week, I’m focusing on useful references on condition grading antiques and collectibles. The following web references should prove helpful.

o o o

GRADING ANTIQUE AND VINTAGE CHINAWARE

o o o

How to Grade Baseball Cards Like a Pro

o o o

CONDITION STANDARDS FOR RATING FIREARMS

o o o

o o o

o o o

o o o

Tips for Pricing Used Furniture

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often get the scoop on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!