Here are the latest items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on China’s “One Belt, One Road” highway project. (See the Economy and Finance section.)

Precious Metals:

Lew Rockwell: Texas Bullion Depository Open for Business; Sets the Stage to Challenge Federal Government’s Monopoly on Money

o o o

John Rubino: Inflation Is Back, Part 7: Just Check Out This Chart

Forex:

The Venezuelan Bolivar is now valued somewhere below an equal lineal measurement of New Jersey Turnpike rest stop toilet paper.

o o o

o o o

Know When to Buy or Sell a Currency Pair

Derivatives:

Cryptocurrency exchange BitMEX launches new EOS futures contract

o o o

Uses of Notional Amount in Derivatives Regulation

o o o

European Parliament adopts EMIR Refit Regulation

Economy & Finance (One Belt, One Road):

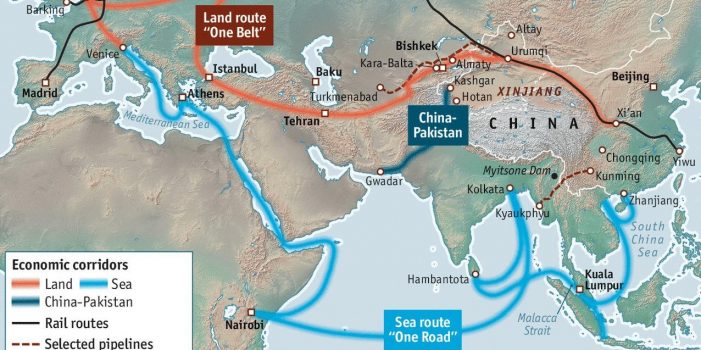

Next, an interesting Vice/HBO Video: China’s New Highway Could Make Or Break This Poor European Country. Note that the real goal of this highway system is Chinese dominance of the global economy. It might also facilitate an invasion, much later in the century. (But the globalists at Vice News would never mention those issues.)

o o o

Xi’s One Belt One Road: A Plan Too Big to Fail?

o o o

Four Strong Korean Stocks Bound To Get Stronger On A Peaceful Korean Peninsula

o o o

Italy Roils Global Capital Markets – What Next?

Tangibles Investing:

Seven Huge Mistakes Real Estate Investors Make When Running Their Numbers

o o o

Thinking about buying land offshore? Read this first: Uncertainty over land rights perceived as top investment risk in new USAID survey

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. So please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often “get the scoop” on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!