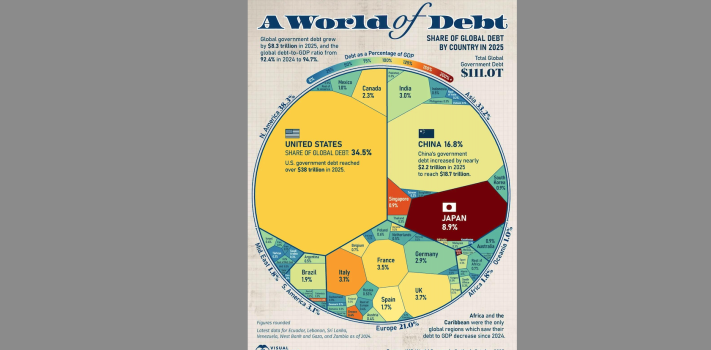

In Economics & Investing Media of the Week we feature photos, charts, graphs, maps, video links, and news items of interest to preppers. H.L. suggested a graphic derived from data from the IMF World Economic Outlook produced by Visual Capitalist that depicts aggregate world debt, by country, in 2025. The darker the color, the higher the percentage of a nation’s GDP. We are not far behind Japan! There are several sovereign debt defaults ahead. Japan will probably just be the first of many. – JWR

The thumbnail below is click-expandable.

(The graphic by Dorothy Neufeld is courtesy of Visual Capitalist.)

Economics & Investing Links of Interest

- Another bell rang this morning (12 December, 2025), when spot silver touched $64.64 per Troy ounce. The silver-to-gold ratio has plunged to 67.1-to-1. Silver Bull is charging the streets of Pamplona! – JWR

- Silver prices just smashed a new record. What does this mean for the economy? Here is a quote: “The softening of the greenback — which depreciated about 8.5 percent since the start of the year — is a big part of the story. Most of this drop occurred in the first half of the year, after the Trump administration unleashed steep tariffs on trading allies and competitors alike and reduced U.S. attractiveness as a reliable trade and investment partner. At the same time, rising U.S. debt and lingering concerns about inflation have also diminished the dollar’s value. The weakened dollar, in turn, has been driving what’s known as the “debasement trade”: Investors are looking for other assets — which include gold as well as silver — because the dollar is no longer seen as ultrasafe as it used to be…”

- SurvivalBlog’s Editor-at-Large Michael Z. Williamson had this suggestion.”I use Midwest Refineries for my scrap silver from fabricating knife guards and jewelry, for estate bits and scrap, and various other silver. They just relocated from Michigan to Florida, with the elders retiring and the next generation taking over. They are scrupulously honest, and even paid me gold price for something that I had misidentified as gold-plated. While it’s hard to sell any metals in the current market–many have huge minimum amounts and are not paying anywhere near spot, I’ve found them to offer the best available prices to individuals and small sellers, and again note: they will take unmarked scrap and pay proper value for it.”

- Too costly to mint? Germany says ‘nein’ to silver commemorative coins. (A hat tip to M.J., for the link.)

- BRICS Gold Pact Hits 33 Countries With Russia Leading Metal Exchange Push.

- Divided Fed approves third rate cut this year, sees slower pace ahead.

- North American Builder’s Supply files Chapter 11 bankruptcy.

- Reader H.B. sent this news: Multi-State Grain Merchandiser Files for Bankruptcy: What Farmers Should Know. H.B.’s Comments: “Two of the three largest Grain Elevators have filed Bankruptcy. The trickle down effect on suppliers… fuel, herbicide, fertilizer are all affected…. badly. Most will see very little compensation. Another dagger to the heart of American agriculture.”

Economics & Investing Media Tips:

Please send your economics and investing links to JWR. (Either via e-mail or via our Contact form.) Thanks!