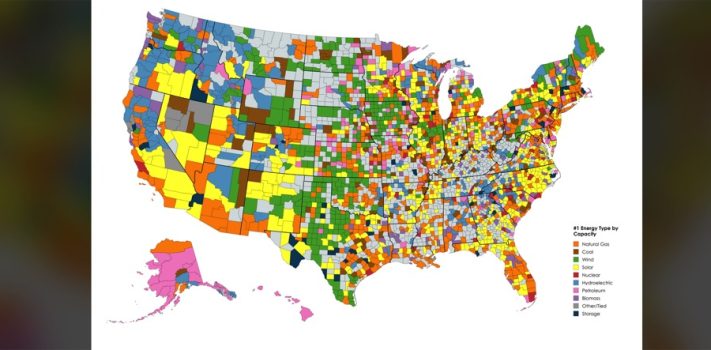

In Economics & Investing Media of the Week we feature photos, charts, graphs, maps, video links, and news items of interest to preppers. Today: A Map Showing the Largest Type of Electric Generating Capacity, By County.

The thumbnail below is click-expandable.

(Graphic courtesy of Reddit.)

Economics & Investing Links of Interest

- H.L. sent this very troubling news: The Great Taking: Global Looting of Humanity Imminent?

- Reader Tom H. mentioned this essay by Adam Sharp at The Daily Reckoning: Silver’s 27% Drop, in Context.

- Video from The Economic Ninja: Why I am pivoting from Silver investing into something else. JWR’s Comments: I’m glad to see that he agrees with my advice on recouping your original investment cost, during a rally. Rather than Bitcoin, I recommend pivoting into other tangibles, most notably, paying off your home and retreat property mortgages. Most of us have already recouped 25% or more of our silver purchase cost. When silver hits $95 per Troy ounce again, then that woudl be a good opportunity to recoup another 25%. But plan to keep at least one-third of your silver as a long-term (multigenerational) hedge on the purchasing power of the U.S. Dollar. You have fire insurance on your house. But you also need “fire insurance” on the Dollar. If you don’t already hold some silver, then the recent dip below $70/oz. might be a good opportunity. I’m confident that $85 will become the new floor for silver within a few weeks. And of course, you can also acquire still U.S. Nickels in bulk, at face value. That is a hedge with no downside risk.

- A 24-minute Matthew Piepenburg Interview: This Isn’t a Gold Bubble — It’s a Currency Breakdown.

Economics & Investing Media Tips:

Please send your economics and investing links to JWR. (Either via e-mail or via our Contact form.) Thanks!